TR

Thomas Ruggio

Answers (6)

TR

Answered

Elkins and Landry are partners who share income and losses in the ratio of 3:2 respectively. On August 31 their capital balances were: Elkins $140000 and Landry $120000. On that date they agree to admit Neumark as a partner with a one-third capital interest. If Neumark invests $160000 in the partnership what is Landry's capital balance after Neumark's admittance?

A) $140000

B) $128000

C) $126000

D) $120000

A) $140000

B) $128000

C) $126000

D) $120000

On Jul 25, 2024

B

TR

Answered

Most professionals are members of professional associations that are responsible for the establishment of

A) training and education.

B) standards of performance of the members.

C) enforcement of the standards by an accredited or licensing process.

D) training and education and standards of performance of the members.

E) training and education, standards of performance of the members and enforcement of the standards by an accredited or licensing process.

A) training and education.

B) standards of performance of the members.

C) enforcement of the standards by an accredited or licensing process.

D) training and education and standards of performance of the members.

E) training and education, standards of performance of the members and enforcement of the standards by an accredited or licensing process.

On Jul 21, 2024

E

TR

Answered

(Scenario: Alexander and Vanessa) Use Scenario: Alexander and Vanessa.What is the socially optimal amount of scientific research for this economy? Scenario: Alexander and Vanessa

Alexander and Vanessa benefit from scientific research.Alexander's marginal private benefit from such research is given by the equation MPB = 200 - Q,where Q refers to the amount of research undertaken and MPB captures the marginal private benefit Alexander gets from different marginal quantities.Meanwhile,Vanessa's marginal private benefit from such research is given by the equation MPB = 100 - Q.The marginal social cost of such research is constant at $100.

A) 60 units

B) 300 units

C) 100 units

D) 200 units

Alexander and Vanessa benefit from scientific research.Alexander's marginal private benefit from such research is given by the equation MPB = 200 - Q,where Q refers to the amount of research undertaken and MPB captures the marginal private benefit Alexander gets from different marginal quantities.Meanwhile,Vanessa's marginal private benefit from such research is given by the equation MPB = 100 - Q.The marginal social cost of such research is constant at $100.

A) 60 units

B) 300 units

C) 100 units

D) 200 units

On Jun 25, 2024

C

TR

Answered

A promissory note is an instrument that involves three parties in three capacities.

On Jun 21, 2024

False

TR

Answered

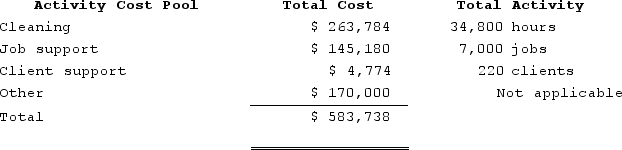

Dane Housecleaning provides housecleaning services to its clients. The company uses an activity-based costing system for its overhead costs. The company has provided the following data from its activity-based costing system.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. One particular client, the Hoium family, requested 45 jobs during the year that required a total of 90 hours of housecleaning. For this service, the client was charged $2,000.Required:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. One particular client, the Hoium family, requested 45 jobs during the year that required a total of 90 hours of housecleaning. For this service, the client was charged $2,000.Required:

a. Compute the activity rates (i.e., cost per unit of activity) for the activity cost pools. Round off all calculations to the nearest whole cent.b. Using the activity-based costing system, compute the customer margin for the Hoium family. Round off all calculations to the nearest whole cent.c. Assume the company decides instead to use a traditional costing system in which ALL costs are allocated to customers on the basis of cleaning hours. Compute the margin for the Hoium family. (Round off all calculations to the nearest whole cent.)

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. One particular client, the Hoium family, requested 45 jobs during the year that required a total of 90 hours of housecleaning. For this service, the client was charged $2,000.Required:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. One particular client, the Hoium family, requested 45 jobs during the year that required a total of 90 hours of housecleaning. For this service, the client was charged $2,000.Required:a. Compute the activity rates (i.e., cost per unit of activity) for the activity cost pools. Round off all calculations to the nearest whole cent.b. Using the activity-based costing system, compute the customer margin for the Hoium family. Round off all calculations to the nearest whole cent.c. Assume the company decides instead to use a traditional costing system in which ALL costs are allocated to customers on the basis of cleaning hours. Compute the margin for the Hoium family. (Round off all calculations to the nearest whole cent.)

On May 25, 2024

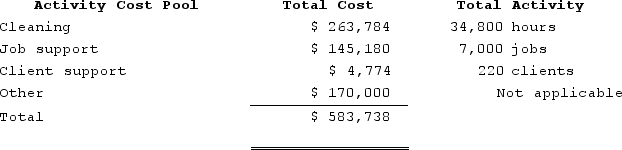

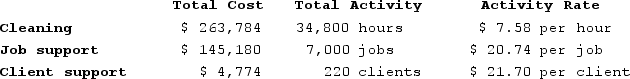

a.The computation of the activity rates follow:

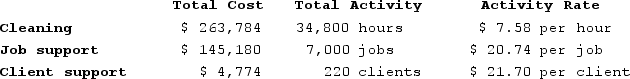

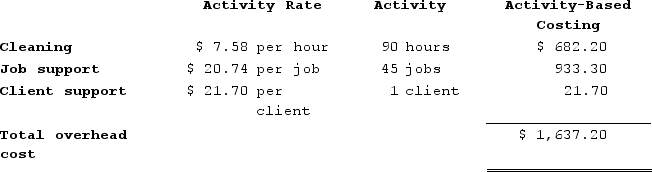

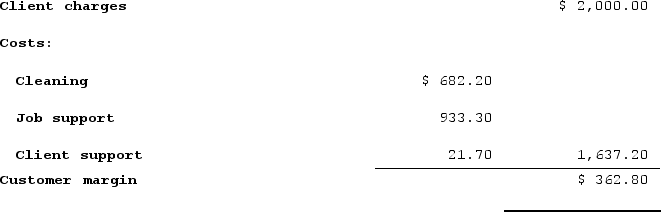

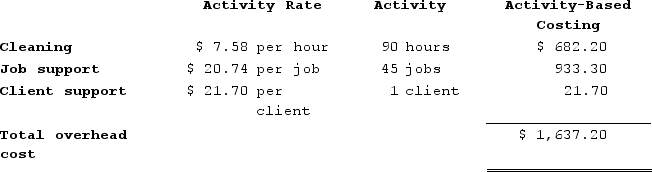

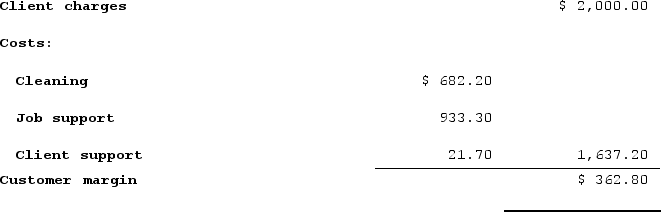

b.The customer margin for the family is computed as follows:

b.The customer margin for the family is computed as follows:

The customer margin for the family is computed as follows:

The customer margin for the family is computed as follows:

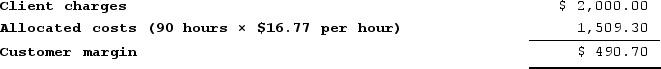

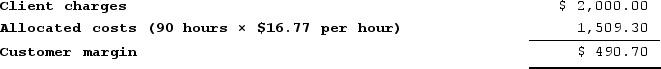

c.The margin if all costs are allocated on the basis of cleaning hours:Predetermined overhead rate = Estimated total overhead cost ÷ Estimated total amount of the allocation base = $583,738 ÷ 34,800 hours= $16.77 per hour

c.The margin if all costs are allocated on the basis of cleaning hours:Predetermined overhead rate = Estimated total overhead cost ÷ Estimated total amount of the allocation base = $583,738 ÷ 34,800 hours= $16.77 per hour

b.The customer margin for the family is computed as follows:

b.The customer margin for the family is computed as follows: The customer margin for the family is computed as follows:

The customer margin for the family is computed as follows: c.The margin if all costs are allocated on the basis of cleaning hours:Predetermined overhead rate = Estimated total overhead cost ÷ Estimated total amount of the allocation base = $583,738 ÷ 34,800 hours= $16.77 per hour

c.The margin if all costs are allocated on the basis of cleaning hours:Predetermined overhead rate = Estimated total overhead cost ÷ Estimated total amount of the allocation base = $583,738 ÷ 34,800 hours= $16.77 per hour

TR

Answered

A merchandising business buys products from other businesses to sell to customers.

On May 22, 2024

True