TS

Tiphany santander

Answers (6)

TS

Answered

Is social media a science or an art? Discuss your rationale for each and tie in current case studies discussed in the textbook.

On Jul 25, 2024

Social media is both an art and science, integrating both principles together. Without research, social media strategists will not be able to understand the insights gathered to help them determine what is working and why it may not be working. Data and understanding the insights are the first part of what sparks creativity, which is the heart of the social media campaign. Creativity, when done with research, can provide more substantial results and ideas. In addition, without insights to have for a campaign, ideas may fall flat, and time and resources may be wasted.

TS

Answered

The variable overhead rate variance for July is:

A) $191 U

B) $210 U

C) $210 F

D) $191 F

A) $191 U

B) $210 U

C) $210 F

D) $191 F

On Jul 21, 2024

A

TS

Answered

The behavioral approach is being applied when a corporate trainer ______.

A) administers an Emotional Intelligence test to match leaders and followers

B) gives a motivational speech to the executive team to boost morale

C) uses assessments to help leaders discover their relative focus on goals vs. people

D) offers employees an in-depth look at their personality traits for behavioral improvement

A) administers an Emotional Intelligence test to match leaders and followers

B) gives a motivational speech to the executive team to boost morale

C) uses assessments to help leaders discover their relative focus on goals vs. people

D) offers employees an in-depth look at their personality traits for behavioral improvement

On Jun 25, 2024

C

TS

Answered

This group has been said to be the overlooked generation.

A) Generation X

B) Generation Y

C) Generation Z

D) Tweens

A) Generation X

B) Generation Y

C) Generation Z

D) Tweens

On Jun 21, 2024

A

TS

Answered

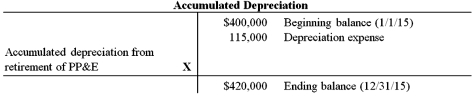

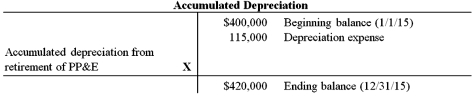

Rick Company uses straight-line depreciation for its property,plant,and equipment which-stated at cost-consisted of the following:

20152014 Land $25,000$25,000 Buildings 195,000195,000 Machinery and equipment 795,000750,0001,015,000970,000 - Accumulated depreciation (420,000)‾(400,000)‾ Net book value 5595,000$570,000\begin{array}{lcc} & \mathbf{2 0 1 5} & \mathbf{2 0 1 4} \\\text { Land } & \$ 25,000 & \$ 25,000 \\\text { Buildings } & 195,000 & 195,000 \\\text { Machinery and equipment } & 795,000 & 750,000 \\& 1,015,000 & 970,000 \\\text { - Accumulated depreciation } & \underline{(420,000)} & \underline{(400,000)} \\ \text { Net book value } &5595,000 & \$ 570,000\end{array} Land Buildings Machinery and equipment - Accumulated depreciation Net book value 2015$25,000195,000795,0001,015,000(420,000)5595,0002014$25,000195,000750,000970,000(400,000)$570,000

Rick's depreciation expense for 2015 and 2014 was $115,000 and $110,000 respectively.

Required:

What amount was debited to accumulated depreciation during 2015 because of property,plant,and equipment retirements?

20152014 Land $25,000$25,000 Buildings 195,000195,000 Machinery and equipment 795,000750,0001,015,000970,000 - Accumulated depreciation (420,000)‾(400,000)‾ Net book value 5595,000$570,000\begin{array}{lcc} & \mathbf{2 0 1 5} & \mathbf{2 0 1 4} \\\text { Land } & \$ 25,000 & \$ 25,000 \\\text { Buildings } & 195,000 & 195,000 \\\text { Machinery and equipment } & 795,000 & 750,000 \\& 1,015,000 & 970,000 \\\text { - Accumulated depreciation } & \underline{(420,000)} & \underline{(400,000)} \\ \text { Net book value } &5595,000 & \$ 570,000\end{array} Land Buildings Machinery and equipment - Accumulated depreciation Net book value 2015$25,000195,000795,0001,015,000(420,000)5595,0002014$25,000195,000750,000970,000(400,000)$570,000

Rick's depreciation expense for 2015 and 2014 was $115,000 and $110,000 respectively.

Required:

What amount was debited to accumulated depreciation during 2015 because of property,plant,and equipment retirements?

On May 26, 2024

To determine the amount debited in 2015,reconstruct the accumulated depreciation T-account:

$400,000 + $115,000 - X = $420,000

X = $95,000

Feedback:Rick Company must have debited accumulated depreciation $95,000 during 2015 because of property,plant,and equipment retirements.

$400,000 + $115,000 - X = $420,000

X = $95,000

Feedback:Rick Company must have debited accumulated depreciation $95,000 during 2015 because of property,plant,and equipment retirements.

TS

Answered

If a drawee refuses to pay an unaccepted draft,the draft is dishonored,and the drawee becomes liable for refusing to pay it.

On May 22, 2024

False