TB

Tommy Barron

Answers (6)

TB

Answered

Which of the following may be considered a commercially reasonable manner by which notice of dishonor can be given to a secondarily liable party?

A) Orally

B) In writing

C) Electronically

D) Orally,in writing,or electronically

E) By certified letter,return receipt requested only

A) Orally

B) In writing

C) Electronically

D) Orally,in writing,or electronically

E) By certified letter,return receipt requested only

On Jun 21, 2024

D

TB

Answered

Fritz is having his will prepared and also wants to prepare other advance directives.Discuss the typical advance directives and why they are prepared.

On Jun 15, 2024

The living will and health care proxy are typical advance directives used by people to give instructions for their future medical care if they become unable to do so themselves.A living will expresses a wish to die a natural death and not to be kept alive by artificial means.A health care proxy authorizes someone to make medical decisions in the event of incapacity.

TB

Answered

When creating content for social media, you should think of it as ________.

A) an information session

B) a lecture

C) a sales pitch

D) a conversation

A) an information session

B) a lecture

C) a sales pitch

D) a conversation

On Jun 14, 2024

D

TB

Answered

The lower the price, the lower the producer surplus, all else equal.

On May 16, 2024

True

TB

Answered

A voucher system is a set of procedures and approvals designed to control cash payments and the acceptance of liabilities.

On May 15, 2024

True

TB

Answered

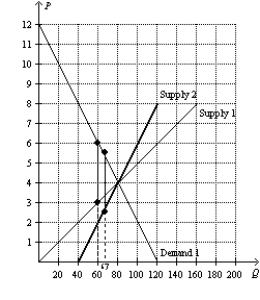

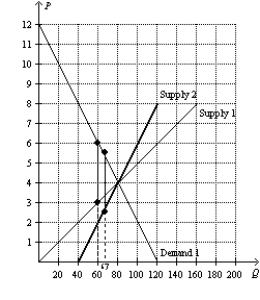

Refer to Figure 8-12. Suppose that Market A is characterized by Demand 1 and Supply 1, and Market B is characterized by Demand 1 and Supply 2. If an identical tax is imposed on each market, the tax will create a larger deadweight loss in which market? Explain.

On May 13, 2024

The deadweight loss will be larger in Market A than Market B because the supply curve is more elastic in Market A than in Market B. The more elastic (inelastic) the supply, the more (less) that quantity decreases when the tax increases the price. The amount by which quantity decreases is the key factor for measuring deadweight loss. The decrease in quantity is the "base" of the deadweight loss triangle. Recall that we measure the area of a triangle as 0.5 x base x height. The height is the amount of the tax, which remains constant in this comparison. The more (less) that quantity responds to a change in price, the larger (smaller) the area of deadweight loss.

The figure below illustrates the area of deadweight loss using a $3 tax in each market.

The figure below illustrates the area of deadweight loss using a $3 tax in each market.