TJ

Trevon Johnson

Answers (6)

TJ

Answered

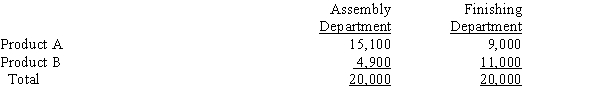

Condoleezza Co. manufactures two products, A and B, in two production departments, Assembly and Finishing. Condoleezza Co. expects to produce 10,000 units of Product A and 20,000 units of Product B in the coming year. Budgeted factory overhead costs for the coming year are:  The machine hours expected to be used in the coming year are as follows:

The machine hours expected to be used in the coming year are as follows:

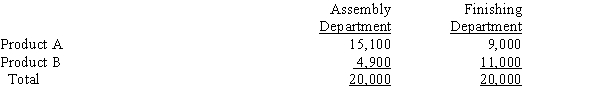

a.Compute the plantwide factory overhead rate, assuming the single plantwide factory overhead rate method is used.

b.Compute the production department factory overhead rates, assuming the multiple production department factory overhead rate method is used.

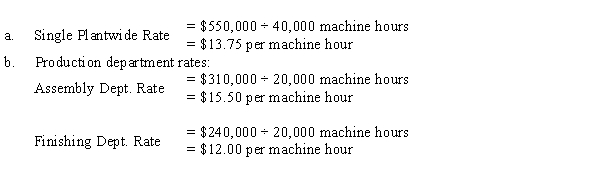

c.Compute the factory overhead allocated per unit for each product using (1) the single plantwide rate and (2) production department factory overhead rates.

d.Which method is better (single or multiple)? Why?

The machine hours expected to be used in the coming year are as follows:

The machine hours expected to be used in the coming year are as follows:

a.Compute the plantwide factory overhead rate, assuming the single plantwide factory overhead rate method is used.

b.Compute the production department factory overhead rates, assuming the multiple production department factory overhead rate method is used.

c.Compute the factory overhead allocated per unit for each product using (1) the single plantwide rate and (2) production department factory overhead rates.

d.Which method is better (single or multiple)? Why?

On Jul 21, 2024

d.The multiple production department factory overhead rate method is better. This method is more accurate. Using the single plantwide factory overhead rate method undercosts each unit of A and overcosts each unit of B.

d.The multiple production department factory overhead rate method is better. This method is more accurate. Using the single plantwide factory overhead rate method undercosts each unit of A and overcosts each unit of B.TJ

Answered

A(n) ________ groups workers, their equipment, and spaces/offices to provide for comfort, safety, and movement of information.

On Jul 20, 2024

office layout

TJ

Answered

Gloria is the manager of a plant in Iowa that manufactures baby furniture. She wants workers to be more productive so the plant can avoid being closed down and the work being shifted overseas. Which one of the following approaches or techniques should Gloria emphasize?

A) Theory X

B) Unionization threat

C) Hawthorne effect

D) Scientific management

A) Theory X

B) Unionization threat

C) Hawthorne effect

D) Scientific management

On Jun 21, 2024

D

TJ

Answered

The balance sheet provides information on all of the following except

A) how management invested its money.

B) where the money came from.

C) assessing rates of return.

D) the market price of the company's stock.

A) how management invested its money.

B) where the money came from.

C) assessing rates of return.

D) the market price of the company's stock.

On Jun 20, 2024

D

TJ

Answered

Henderson Farms reports the following results for the month of November: Sales (10,000 units) $600,000 Variable costs 420,000 Contribution margin 180,000 Fixed costs 110,000 Net income $70,000\begin{array} { l r } \text { Sales (10,000 units) } & \$ 600,000 \\\text { Variable costs } & 420,000 \\\text { Contribution margin } & 180,000 \\\text { Fixed costs } & 110,000 \\\text { Net income } & \$ 70,000\end{array} Sales (10,000 units) Variable costs Contribution margin Fixed costs Net income $600,000420,000180,000110,000$70,000 Management is considering the following independent courses of action to increase net income.

1. Increase selling price by 5% with no change in total variable costs.

2. Reduce variable costs to 66 % of sales.

% of sales.

3. Reduce fixed costs by $10000.

Instructions

If maximizing net income is the objective which is the best course of action?

1. Increase selling price by 5% with no change in total variable costs.

2. Reduce variable costs to 66

% of sales.

% of sales.3. Reduce fixed costs by $10000.

Instructions

If maximizing net income is the objective which is the best course of action?

On May 22, 2024

1. Current selling price is: $600000 ÷ 10000 units = $60

Increase $60 by 5%: $60 × 1.05 = $63 Revised sales $630,000 Variable costs 420,000 Contribution margin 210,000 Fixed costs 110,000 Net income $100,000\begin{array}{lr}\text { Revised sales } & \$ 630,000 \\\text { Variable costs } & 420,000 \\\text { Contribution margin } & 210,000 \\\text { Fixed costs } & 110,000 \\\text { Net income } & \$ 100,000\end{array} Revised sales Variable costs Contribution margin Fixed costs Net income $630,000420,000210,000110,000$100,000

2. Sales $600,000 Variable costs (reduce variable costs to 66%% of sales) 400,000 Contribution margin 200,000 Fixed costs 110,000 Net income $90,000\begin{array}{ll}\text { Sales } & \$ 600,000 \\\text { Variable costs (reduce variable costs to } 66 \% \% \text { of sales) } & 400,000 \\\text { Contribution margin } & 200,000 \\\text { Fixed costs } & 110,000 \\\text { Net income } & \$ 90,000\end{array} Sales Variable costs (reduce variable costs to 66%% of sales) Contribution margin Fixed costs Net income $600,000400,000200,000110,000$90,000

3.

Sales $600,000 Variable costs 420,000 Contribution margin 180,000 Fixed costs (reduce fixed costs by $10,000)100,000 Net income $80,000\begin{array}{lr}\text { Sales } & \$ 600,000 \\\text { Variable costs } & 420,000 \\\text { Contribution margin } & 180,000 \\\text { Fixed costs (reduce fixed costs by } \$ 10,000) & 100,000 \\\text { Net income } & \$ 80,000\end{array} Sales Variable costs Contribution margin Fixed costs (reduce fixed costs by $10,000) Net income $600,000420,000180,000100,000$80,000 Increasing the price will increase net income from $70000 to $100000. Option (2) will increase net income to only $90000 and Option (3) will increase net income to only $80000.

Increase $60 by 5%: $60 × 1.05 = $63 Revised sales $630,000 Variable costs 420,000 Contribution margin 210,000 Fixed costs 110,000 Net income $100,000\begin{array}{lr}\text { Revised sales } & \$ 630,000 \\\text { Variable costs } & 420,000 \\\text { Contribution margin } & 210,000 \\\text { Fixed costs } & 110,000 \\\text { Net income } & \$ 100,000\end{array} Revised sales Variable costs Contribution margin Fixed costs Net income $630,000420,000210,000110,000$100,000

2. Sales $600,000 Variable costs (reduce variable costs to 66%% of sales) 400,000 Contribution margin 200,000 Fixed costs 110,000 Net income $90,000\begin{array}{ll}\text { Sales } & \$ 600,000 \\\text { Variable costs (reduce variable costs to } 66 \% \% \text { of sales) } & 400,000 \\\text { Contribution margin } & 200,000 \\\text { Fixed costs } & 110,000 \\\text { Net income } & \$ 90,000\end{array} Sales Variable costs (reduce variable costs to 66%% of sales) Contribution margin Fixed costs Net income $600,000400,000200,000110,000$90,000

3.

Sales $600,000 Variable costs 420,000 Contribution margin 180,000 Fixed costs (reduce fixed costs by $10,000)100,000 Net income $80,000\begin{array}{lr}\text { Sales } & \$ 600,000 \\\text { Variable costs } & 420,000 \\\text { Contribution margin } & 180,000 \\\text { Fixed costs (reduce fixed costs by } \$ 10,000) & 100,000 \\\text { Net income } & \$ 80,000\end{array} Sales Variable costs Contribution margin Fixed costs (reduce fixed costs by $10,000) Net income $600,000420,000180,000100,000$80,000 Increasing the price will increase net income from $70000 to $100000. Option (2) will increase net income to only $90000 and Option (3) will increase net income to only $80000.

TJ

Answered

List six determinants of market supply.

On May 20, 2024

The six determinants of supply are: (1)a change in resource prices; (2)a change in technology; (3)a change in taxes and subsidies; (4)a change in prices of other goods; (5)a change in producer expectations; (6)a change in the number of sellers.