YS

Yashpal singh

Answers (6)

YS

Answered

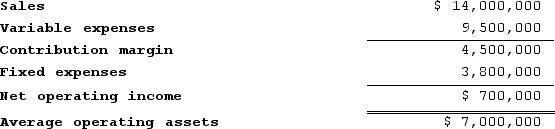

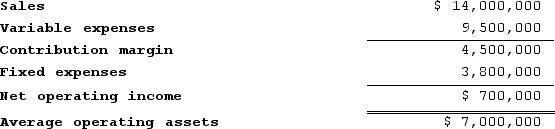

Parsa Incorporated reported the following results from last year's operations:  At the beginning of this year, the company has a $1,100,000 investment opportunity with the following characteristics:

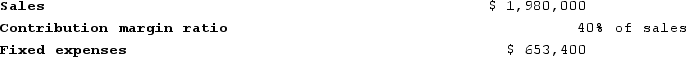

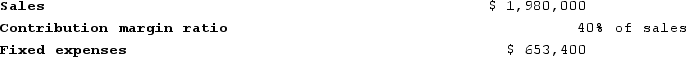

At the beginning of this year, the company has a $1,100,000 investment opportunity with the following characteristics:

The Return on investment for this year's investment opportunity considered alone is closest to:

The Return on investment for this year's investment opportunity considered alone is closest to:

A) 7.0%

B) 21.2%

C) 12.6%

D) 72.0%

At the beginning of this year, the company has a $1,100,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,100,000 investment opportunity with the following characteristics: The Return on investment for this year's investment opportunity considered alone is closest to:

The Return on investment for this year's investment opportunity considered alone is closest to:A) 7.0%

B) 21.2%

C) 12.6%

D) 72.0%

On Jul 25, 2024

C

YS

Answered

A sense of making progress is important for intrinsic motivation.

On Jul 24, 2024

True

YS

Answered

The Change to Win coalition recently mounted a national recruiting drive,primarily targeting _______.

A) janitors

B) dishwashers

C) cashiers

D) security guards

E) All of these jobs were targeted.

A) janitors

B) dishwashers

C) cashiers

D) security guards

E) All of these jobs were targeted.

On Jun 25, 2024

E

YS

Answered

If you receive a gift whose market price is $20,but you consider it to be worth only $10,then:

A) there is a $10 or 50 percent value gain.

B) there may or may not be a value loss.

C) there is a $10 or 50 percent value loss.

D) you can be relatively certain the giver was a sibling or other close relative.

A) there is a $10 or 50 percent value gain.

B) there may or may not be a value loss.

C) there is a $10 or 50 percent value loss.

D) you can be relatively certain the giver was a sibling or other close relative.

On Jun 24, 2024

C

YS

Answered

Double taxation of earnings is the primary financial disadvantage of the corporate form of business organization.

On May 26, 2024

True

YS

Answered

Mariella's purchase of a ticket to the ballet grants her a license to use the theater's premises during the performance, but it does not give her an interest in the real property.

On May 25, 2024

True