ZK

Zybrea Knight

Answers (8)

ZK

Answered

If a U.S. importer can purchase 10,000 British pounds for $30,000, the rate of exchange is

A) $3 = 1 British pound in the United States.

B) $1 = 3 British pounds in the United States.

C) $0.33 = 1 British pound in Great Britain.

D) $1 = 0.33 British pound in Great Britain.

A) $3 = 1 British pound in the United States.

B) $1 = 3 British pounds in the United States.

C) $0.33 = 1 British pound in Great Britain.

D) $1 = 0.33 British pound in Great Britain.

On Jul 21, 2024

A

ZK

Answered

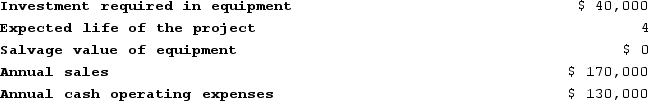

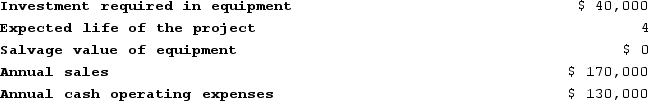

Morefield Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation. The depreciation expense will be $10,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 12%.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

The company uses straight-line depreciation. The depreciation expense will be $10,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 12%.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

The company uses straight-line depreciation. The depreciation expense will be $10,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 12%.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!

The company uses straight-line depreciation. The depreciation expense will be $10,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 12%.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the table provided.Required:Determine the net present value of the project. Show your work!On Jul 14, 2024

ZK

Answered

In the United States the CEOs of our largest companies earn over _____ times the earnings of their average employee.

On Jun 21, 2024

300 (or 300 - 400)

ZK

Answered

A corporation is required to reimburse a promoter for her reasonable expenses incurred on behalf of the corporation prior to incorporation.

On Jun 14, 2024

False

ZK

Answered

Common law exists only at the state level and only state courts can apply it.

On Jun 04, 2024

False

ZK

Answered

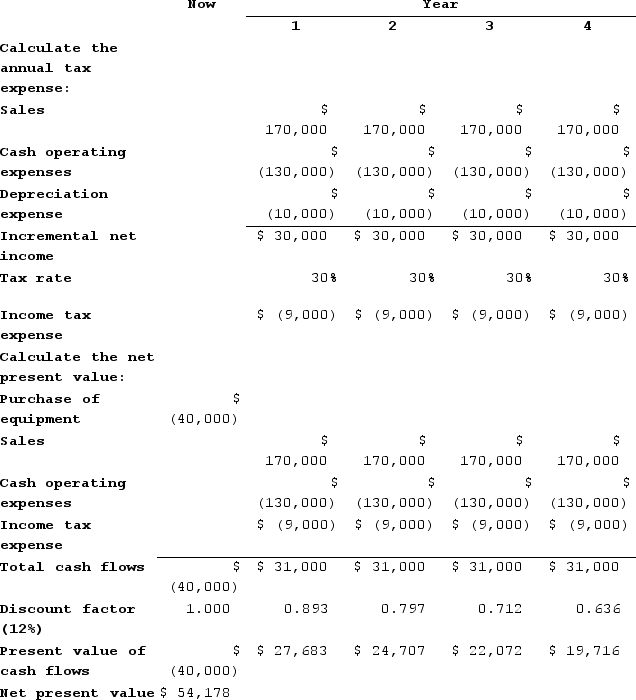

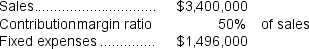

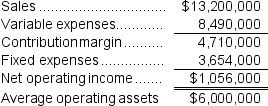

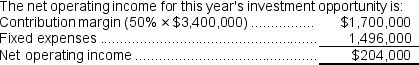

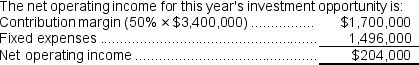

Worley Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:  The company's minimum required rate of return is 17%.

The company's minimum required rate of return is 17%.

Required:

1.What was last year's residual income?

2.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall residual income this year?

3.If Westerville's CEO earns a bonus only if residual income for this year exceeds residual income for last year, would the CEO pursue the investment opportunity?

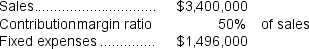

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:  The company's minimum required rate of return is 17%.

The company's minimum required rate of return is 17%.Required:

1.What was last year's residual income?

2.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall residual income this year?

3.If Westerville's CEO earns a bonus only if residual income for this year exceeds residual income for last year, would the CEO pursue the investment opportunity?

On May 16, 2024

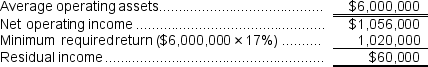

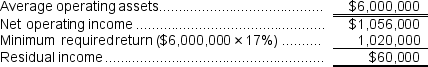

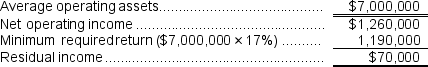

1.Last year's residual income was:

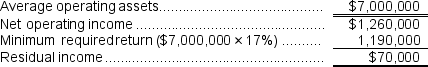

2.If the company pursues the investment opportunity, this year's residual income will be: Average operating assets = $6,000,000 + $1,000,000 = $7,000,000

Average operating assets = $6,000,000 + $1,000,000 = $7,000,000

Net operating income = $1,056,000 + $204,000 = $1,260,000

3.The CEO would pursue the investment opportunity because residual income would increase by $34,000.

2.If the company pursues the investment opportunity, this year's residual income will be:

Average operating assets = $6,000,000 + $1,000,000 = $7,000,000

Average operating assets = $6,000,000 + $1,000,000 = $7,000,000Net operating income = $1,056,000 + $204,000 = $1,260,000

3.The CEO would pursue the investment opportunity because residual income would increase by $34,000.

ZK

Answered

Formal leadership is exerted by persons who become influential due to special skills or their ability to meet the needs of others.

On May 05, 2024

False

ZK

Answered

You find that the confidence index is down, the market breadth is up, and the trin ratio is down. In total, how many bullish signs do you have?

A) 0

B) 1

C) 2

D) 3

A) 0

B) 1

C) 2

D) 3

On May 02, 2024

C