ZK

Zybrea Knight

Answers (2)

ZK

Answered

Russ has been on time for work all year, consistently going above and beyond his duties. However, in the month before his performance appraisal, he had the flu and his whole family became sick, causing him to frequently be absent and exhibit lower-than-normal performance. As a result, his annual performance appraisal was somewhat negative. It is likely that Russ's boss committed which of the following perceptual errors?

A) impression management

B) self-fulfilling prophecy

C) recency effect

D) primacy effect

A) impression management

B) self-fulfilling prophecy

C) recency effect

D) primacy effect

On May 05, 2024

C

ZK

Answered

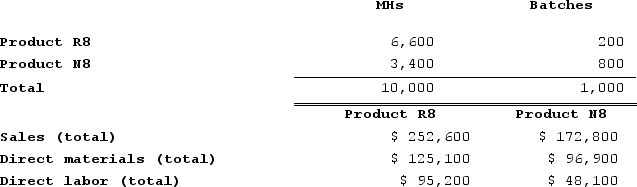

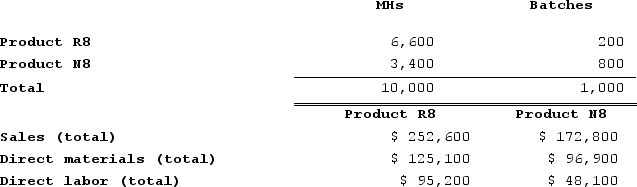

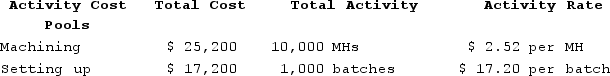

Neas Corporation has an activity-based costing system with three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs have already been allocated to the cost pools and total $25,200 for the Machining cost pool, $17,200 for the Setting Up cost pool, and $41,600 for the Other cost pool.Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Required:a. Calculate activity rates for each activity cost pool using activity-based costing.b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.c. Determine the product margins for each product using activity-based costing.

Required:a. Calculate activity rates for each activity cost pool using activity-based costing.b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.c. Determine the product margins for each product using activity-based costing.

Required:a. Calculate activity rates for each activity cost pool using activity-based costing.b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.c. Determine the product margins for each product using activity-based costing.

Required:a. Calculate activity rates for each activity cost pool using activity-based costing.b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.c. Determine the product margins for each product using activity-based costing.On May 02, 2024

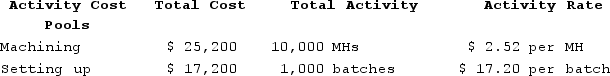

a.Computation of activity rates:

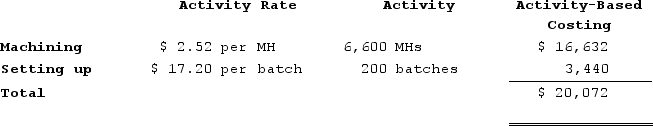

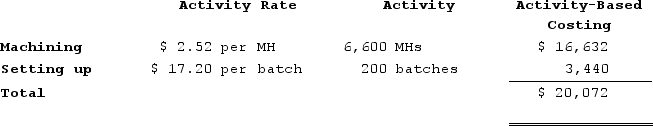

b.Assign overhead costs to products:Overhead cost for Product R8:

b.Assign overhead costs to products:Overhead cost for Product R8:

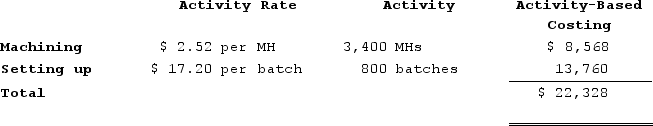

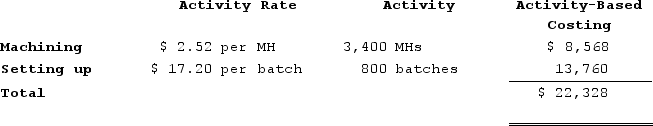

Overhead cost for Product N8:

Overhead cost for Product N8:

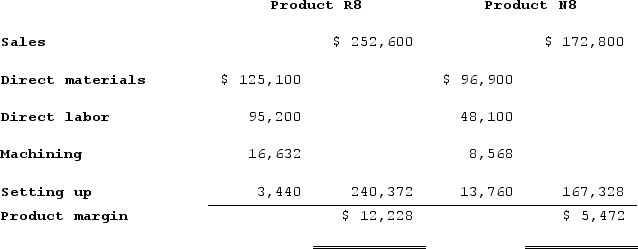

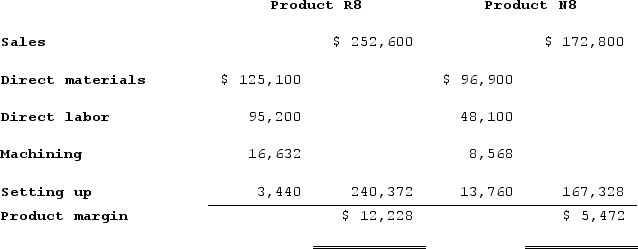

c.Determine product margins:

c.Determine product margins:

b.Assign overhead costs to products:Overhead cost for Product R8:

b.Assign overhead costs to products:Overhead cost for Product R8: Overhead cost for Product N8:

Overhead cost for Product N8: c.Determine product margins:

c.Determine product margins: