ZK

Zybrea Knight

Answers (6)

ZK

Answered

One example of labor-market discrimination is that a firm may be less likely to interview a job candidate whose resume clearly indicates he is not a good fit for the job.

On Jul 08, 2024

False

ZK

Answered

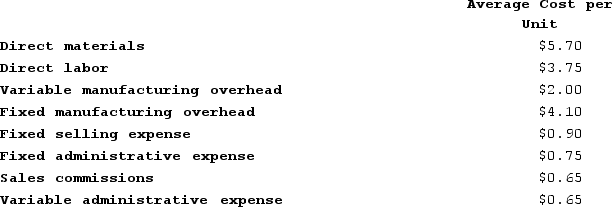

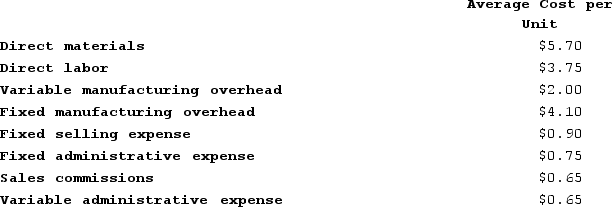

Saxbury Corporation's relevant range of activity is 3,000 units to 7,000 units. When it produces and sells 5,800 units, its average costs per unit are as follows:

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 5,800 units?b. For financial reporting purposes, what is the total amount of period costs incurred to sell 5,800 units?c. If 6,800 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)d. If 6,800 units are sold, what is the total amount of variable costs related to the units sold?e. If 6,800 units are produced, what is the average fixed manufacturing cost per unit produced? (Round "Per unit" answer to 2 decimal places.)f. If 6,800 units are produced, what is the total amount of fixed manufacturing cost incurred?g. If 6,800 units are produced, what is the total amount of manufacturing overhead cost incurred? What is this total amount expressed on a per unit basis? (Round "Per unit" answer to 2 decimal places.)h. If the selling price is $23.20 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)i. If 4,800 units are produced, what is the total amount of direct manufacturing cost incurred?j. If 4,800 units are produced, what is the total amount of indirect manufacturing cost incurred?k. What incremental manufacturing cost will the company incur if it increases production from 5,800 to 5,801 units? (Round "Per unit" answer to 2 decimal places.)

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 5,800 units?b. For financial reporting purposes, what is the total amount of period costs incurred to sell 5,800 units?c. If 6,800 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)d. If 6,800 units are sold, what is the total amount of variable costs related to the units sold?e. If 6,800 units are produced, what is the average fixed manufacturing cost per unit produced? (Round "Per unit" answer to 2 decimal places.)f. If 6,800 units are produced, what is the total amount of fixed manufacturing cost incurred?g. If 6,800 units are produced, what is the total amount of manufacturing overhead cost incurred? What is this total amount expressed on a per unit basis? (Round "Per unit" answer to 2 decimal places.)h. If the selling price is $23.20 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)i. If 4,800 units are produced, what is the total amount of direct manufacturing cost incurred?j. If 4,800 units are produced, what is the total amount of indirect manufacturing cost incurred?k. What incremental manufacturing cost will the company incur if it increases production from 5,800 to 5,801 units? (Round "Per unit" answer to 2 decimal places.)

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 5,800 units?b. For financial reporting purposes, what is the total amount of period costs incurred to sell 5,800 units?c. If 6,800 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)d. If 6,800 units are sold, what is the total amount of variable costs related to the units sold?e. If 6,800 units are produced, what is the average fixed manufacturing cost per unit produced? (Round "Per unit" answer to 2 decimal places.)f. If 6,800 units are produced, what is the total amount of fixed manufacturing cost incurred?g. If 6,800 units are produced, what is the total amount of manufacturing overhead cost incurred? What is this total amount expressed on a per unit basis? (Round "Per unit" answer to 2 decimal places.)h. If the selling price is $23.20 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)i. If 4,800 units are produced, what is the total amount of direct manufacturing cost incurred?j. If 4,800 units are produced, what is the total amount of indirect manufacturing cost incurred?k. What incremental manufacturing cost will the company incur if it increases production from 5,800 to 5,801 units? (Round "Per unit" answer to 2 decimal places.)

Required:a. For financial reporting purposes, what is the total amount of product costs incurred to make 5,800 units?b. For financial reporting purposes, what is the total amount of period costs incurred to sell 5,800 units?c. If 6,800 units are sold, what is the variable cost per unit sold? (Round "Per unit" answer to 2 decimal places.)d. If 6,800 units are sold, what is the total amount of variable costs related to the units sold?e. If 6,800 units are produced, what is the average fixed manufacturing cost per unit produced? (Round "Per unit" answer to 2 decimal places.)f. If 6,800 units are produced, what is the total amount of fixed manufacturing cost incurred?g. If 6,800 units are produced, what is the total amount of manufacturing overhead cost incurred? What is this total amount expressed on a per unit basis? (Round "Per unit" answer to 2 decimal places.)h. If the selling price is $23.20 per unit, what is the contribution margin per unit sold? (Round "Per unit" answer to 2 decimal places.)i. If 4,800 units are produced, what is the total amount of direct manufacturing cost incurred?j. If 4,800 units are produced, what is the total amount of indirect manufacturing cost incurred?k. What incremental manufacturing cost will the company incur if it increases production from 5,800 to 5,801 units? (Round "Per unit" answer to 2 decimal places.)On Jul 04, 2024

a.

![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_c4f6_bf83_e57aef14ede6_TB8314_00.jpg) b.

b.

![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_ec07_bf83_d5505c458578_TB8314_00.jpg) c.

c.

![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_ec08_bf83_2d72a604b789_TB8314_00.jpg) d.

d.

![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_ec09_bf83_affcee274f20_TB8314_00.jpg) e.

e.

![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_ec0a_bf83_e1bd2fc0c6c3_TB8314_00.jpg) *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f.

![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_ec0b_bf83_75ff7f44946d_TB8314_00.jpg) g.

g.

![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624c_131c_bf83_9f52f9904586_TB8314_00.jpg) *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h.

![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624c_131d_bf83_75e46727c741_TB8314_00.jpg) i.

i.

![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624c_131e_bf83_81bd1190b6a6_TB8314_00.jpg) j.

j.

![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624c_131f_bf83_c3e4e1aa147a_TB8314_00.jpg) *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.

![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624c_1320_bf83_fd93a5044427_TB8314_00.jpg)

![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_c4f6_bf83_e57aef14ede6_TB8314_00.jpg) b.

b.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_ec07_bf83_d5505c458578_TB8314_00.jpg) c.

c.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_ec08_bf83_2d72a604b789_TB8314_00.jpg) d.

d.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_ec09_bf83_affcee274f20_TB8314_00.jpg) e.

e.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_ec0a_bf83_e1bd2fc0c6c3_TB8314_00.jpg) *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624b_ec0b_bf83_75ff7f44946d_TB8314_00.jpg) g.

g.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624c_131c_bf83_9f52f9904586_TB8314_00.jpg) *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624c_131d_bf83_75e46727c741_TB8314_00.jpg) i.

i.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624c_131e_bf83_81bd1190b6a6_TB8314_00.jpg) j.

j.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624c_131f_bf83_c3e4e1aa147a_TB8314_00.jpg) *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.

*The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.![a. b. c. d. e. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.f. g. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.h. i. j. *The average fixed manufacturing overhead cost per unit was determined by dividing the total fixed manufacturing overhead cost by {{[a(9)]:#,###}} units.k.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_624c_1320_bf83_fd93a5044427_TB8314_00.jpg)

ZK

Answered

When member satisfaction is your top priority,which of the following leadership styles should you select?

A) Authoritarian leadership style

B) Democratic leadership style

C) Laissez-faire leadership style

D) Leadership style has no impact on group satisfaction

A) Authoritarian leadership style

B) Democratic leadership style

C) Laissez-faire leadership style

D) Leadership style has no impact on group satisfaction

On Jun 07, 2024

B

ZK

Answered

In a partnership,some classes of partners may have greater voting rights than others.

On Jun 04, 2024

True

ZK

Answered

As the number of order cycles per season increases,

A) the leftover inventory increases,but at a decreasing marginal rate.

B) the leftover inventory increases and at an increasing marginal rate.

C) the leftover inventory decreases,and at an increasing marginal rate.

D) the leftover inventory decreases,but at a decreasing marginal rate.

A) the leftover inventory increases,but at a decreasing marginal rate.

B) the leftover inventory increases and at an increasing marginal rate.

C) the leftover inventory decreases,and at an increasing marginal rate.

D) the leftover inventory decreases,but at a decreasing marginal rate.

On May 07, 2024

D

ZK

Answered

Unfortunately, in most workplaces, there is too much feedback rather than too little.

On May 04, 2024

False