ZK

Zybrea Knight

Answers (7)

ZK

Answered

(Table: Market for Apartments) Use Table: Market for Apartments.If a price ceiling of $700 is imposed on this market,the result will be an inefficiency in the form of a _____ million apartments.

A) surplus of 0.6

B) shortage of 0.6

C) surplus of 0.2

D) shortage of 0.2

A) surplus of 0.6

B) shortage of 0.6

C) surplus of 0.2

D) shortage of 0.2

On Aug 03, 2024

B

ZK

Answered

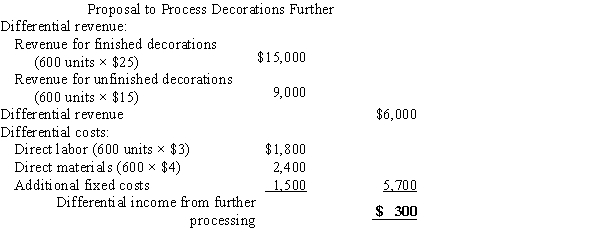

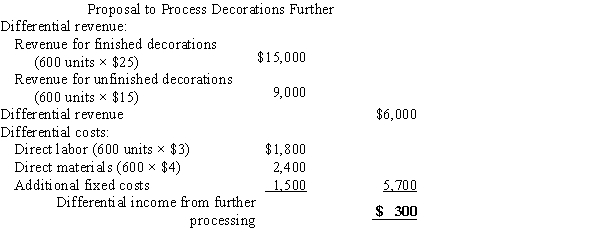

Lark Art Company sells unfinished wooden decorations at a price of $15. The current profit margin is $5 per decoration. The company is considering taking individual orders and customizing them for customers. To finish the decoration, the company would have to pay additional labor of $3 per unit, additional materials costing an average of $4 per unit, and fixed costs would increase by $1,500. If the company estimates that it can sell 600 units for $25 per unit each month, should it start taking the orders?

On Jul 07, 2024

Yes, the company should take additional orders.

ZK

Answered

The Wagner Act allowed an individual employee in a unionized business to negotiate his or her own employment contract.

On Jul 04, 2024

False

ZK

Answered

According to the BCG growth-market share matrix,________ are strategic business units with products that have low market shares in fast-growth markets.

A) question marks

B) cash cows

C) dogs

D) stars

A) question marks

B) cash cows

C) dogs

D) stars

On Jun 06, 2024

A

ZK

Answered

A sunk cost should be ignored in decisions about future actions.

On Jun 04, 2024

True

ZK

Answered

How are cash balance plans different from defined-benefit and defined-contribution plans?

On May 07, 2024

A defined-benefit plan guarantees a specified level of retirement income based on the employee's years of service, age, and earnings level. A defined-contribution plan does not promise a specific benefit level for employees upon retirement. Rather, an individual account is set up for each employee with a guaranteed size of contribution. An increasingly popular way to combine the advantages of defined-benefit plans and defined-contribution plans is to use a cash balance plan. This type of retirement plan consists of individual accounts, as in a 401(k) plan. But in contrast to a 401(k), all the contributions come from the employer. Usually, the employer contributes a percentage of the employee's salary, say, 4 or 5 percent. The money in the cash balance plan earns interest according to a predetermined rate, such as the rate paid on U.S. Treasury bills. This arrangement helps employers plan their contributions and helps employees predict their retirement benefits. If employees change jobs, they generally can roll over the balance into an individual retirement account. Defined-benefit plans are most generous to older employees with many years of service, while cash balance plans are most generous to young employees who will have many years ahead in which to earn interest. For an organization with many experienced employees, switching from a defined-benefit plan can produce great savings in pension benefits. In that case, the older workers are the greatest losers, unless the organization adjusts the program to retain their benefits.

ZK

Answered

The wage bracket withholding table is used to:

A) Compute social security withholding.

B) Compute Medicare withholding.

C) Compute federal income tax withholding.

D) Prepare the W-4.

E) Compute unemployment taxes.

A) Compute social security withholding.

B) Compute Medicare withholding.

C) Compute federal income tax withholding.

D) Prepare the W-4.

E) Compute unemployment taxes.

On May 04, 2024

C