AI

abdullah idrees

Answers (2)

AI

Answered

Roland had $10,500 in medical expenses last year and has no medical insurance.The IRS allows medical expense deductions for the amount that exceeds 7.5% of a taxpayer's adjusted gross income.If Roland's adjusted gross income is $31,000,how much can he claim as a medical deduction?

A) $10,500

B) $8,175

C) $7,500

D) $750

A) $10,500

B) $8,175

C) $7,500

D) $750

On Sep 25, 2024

B

AI

Answered

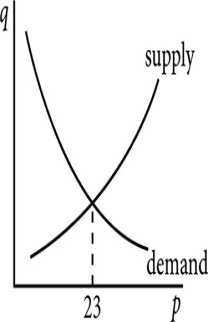

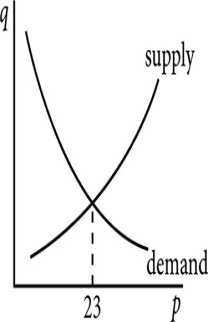

The graph shows the supply and demand for a widget.What happens if the price is set at $25?

On Sep 22, 2024

Because the price is more than the equilibrium price,supply will exceed demand and suppliers will try to sell their excess supply at a lower price.