AR

aneesa rahim

Answers (6)

AR

Answered

Why do critics argue that high compensation for boards of directors is a bad thing?

A) It is too expensive for the organization.

B) It could cause conflicts of interest between the directors and the organization.

C) It is not fair to poorly compensated employees.

D) High pay will render the board less complacent.

E) Board of director compensation is negatively related to corporate growth.

A) It is too expensive for the organization.

B) It could cause conflicts of interest between the directors and the organization.

C) It is not fair to poorly compensated employees.

D) High pay will render the board less complacent.

E) Board of director compensation is negatively related to corporate growth.

On Jul 19, 2024

B

AR

Answered

What's the first step in the three-step approach in deciding on team incentives?

A) Performance measures are decided.

B) The size of the incentive is decided.

C) A payout formula is determined.

D) A survey is conducted.

A) Performance measures are decided.

B) The size of the incentive is decided.

C) A payout formula is determined.

D) A survey is conducted.

On Jul 18, 2024

A

AR

Answered

When units produced equal units sold,reported income is identical under absorption costing and variable costing.

On Jun 19, 2024

True

AR

Answered

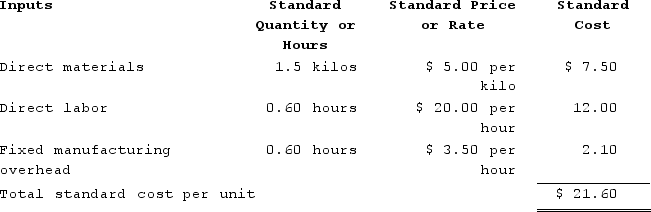

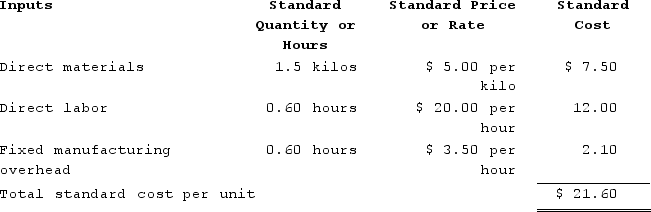

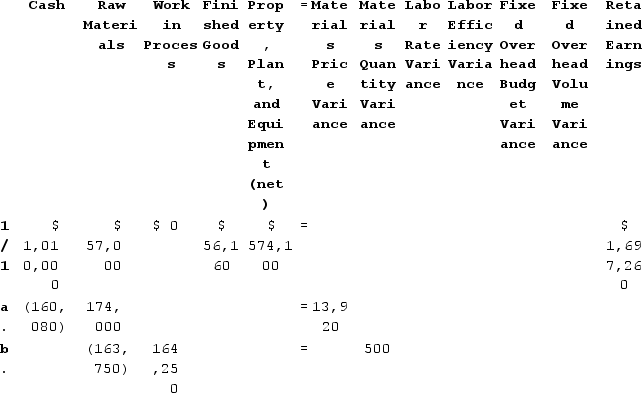

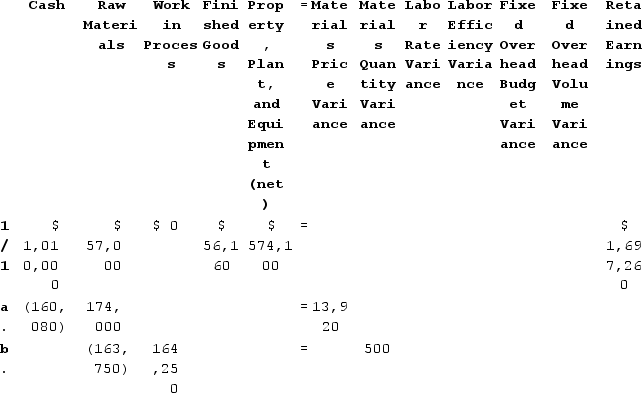

Siciliano Corporation manufactures one product. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

During the year, the company completed the following transactions concerning raw materials:a. Purchased 34,800 kilos of raw material at a price of $4.60 per kilo.b. Used 32,750 kilos of the raw material to produce 21,900 units of work in process.

During the year, the company completed the following transactions concerning raw materials:a. Purchased 34,800 kilos of raw material at a price of $4.60 per kilo.b. Used 32,750 kilos of the raw material to produce 21,900 units of work in process.

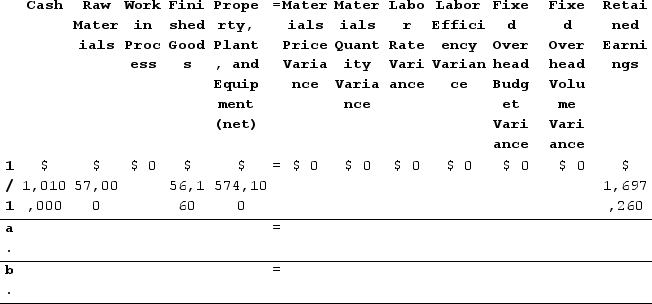

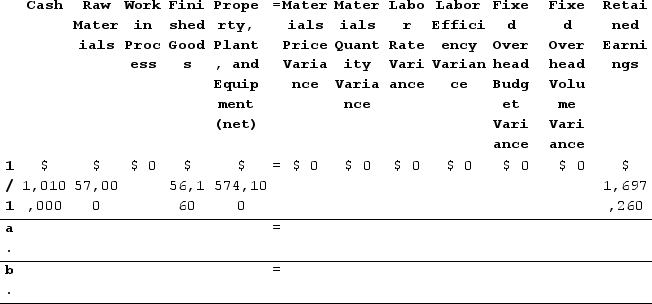

Required:Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

During the year, the company completed the following transactions concerning raw materials:a. Purchased 34,800 kilos of raw material at a price of $4.60 per kilo.b. Used 32,750 kilos of the raw material to produce 21,900 units of work in process.

During the year, the company completed the following transactions concerning raw materials:a. Purchased 34,800 kilos of raw material at a price of $4.60 per kilo.b. Used 32,750 kilos of the raw material to produce 21,900 units of work in process.Required:Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

On Jun 18, 2024

Materials price variance = Actual quantity × (Average price − Standard price)= 34,800 kilos × ($4.60 per kilo − $5.00 per kilo)= 34,800 kilos × (−$0.40 per kilo)= $13,920 FavorableMaterials quantity variance:Standard quantity = Actual output × Standard quantity = 21,900 units × 1.5 kilos per unit = 32,850 kilosMaterials quantity variance = (Actual quantity − Standard quantity) × Standard price= (32,750 kilos − 32,850 kilos) × $5.00 per kilo= (−100 kilos) × $5.00 per kilo= $500 Favorable

The explanations are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 34,800 kilos × $4.60 per kilo = $160,080. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 34,800 kilos × $5.00 per kilo = $174,000. The materials price variance is $13,920 Favorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 32,750 kilos × $5.00 per kilo = $163,750. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (21,900 units × 1.5 kilos per unit) × $5.00 per kilo = 32,850 kilos × $5.00 per kilo = $164,250. The difference is the Materials Quantity Variance which is $500 Favorable.

The explanations are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 34,800 kilos × $4.60 per kilo = $160,080. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 34,800 kilos × $5.00 per kilo = $174,000. The materials price variance is $13,920 Favorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 32,750 kilos × $5.00 per kilo = $163,750. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (21,900 units × 1.5 kilos per unit) × $5.00 per kilo = 32,850 kilos × $5.00 per kilo = $164,250. The difference is the Materials Quantity Variance which is $500 Favorable.

The explanations are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 34,800 kilos × $4.60 per kilo = $160,080. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 34,800 kilos × $5.00 per kilo = $174,000. The materials price variance is $13,920 Favorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 32,750 kilos × $5.00 per kilo = $163,750. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (21,900 units × 1.5 kilos per unit) × $5.00 per kilo = 32,850 kilos × $5.00 per kilo = $164,250. The difference is the Materials Quantity Variance which is $500 Favorable.

The explanations are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 34,800 kilos × $4.60 per kilo = $160,080. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 34,800 kilos × $5.00 per kilo = $174,000. The materials price variance is $13,920 Favorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 32,750 kilos × $5.00 per kilo = $163,750. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (21,900 units × 1.5 kilos per unit) × $5.00 per kilo = 32,850 kilos × $5.00 per kilo = $164,250. The difference is the Materials Quantity Variance which is $500 Favorable.AR

Answered

What management approaches might be used to overcome the problem of poorly structured production processes?

i. Value analysis to identify and remove non-value-added activities.

ii. Implement continuous improvement processes.

iii. Process re-engineering.

A) i

B) i and iii

C) iii

D) All of the given answers

i. Value analysis to identify and remove non-value-added activities.

ii. Implement continuous improvement processes.

iii. Process re-engineering.

A) i

B) i and iii

C) iii

D) All of the given answers

On May 20, 2024

D

AR

Answered

Using our model of consumer choice, is it possible for a consumer to buy less of a particular good when his income rises? Briefly explain.

On May 19, 2024

Yes, an increase in income will lead a consumer to buy less of a good when it is an inferior good.