AC

arlene calcena

Answers (6)

AC

Answered

A profit center is responsible for generating revenue, but it is not responsible for controlling costs.

On Jul 28, 2024

False

AC

Answered

Refer to Table 17-7. Which of the following statements is correct?

A) Wonka can potentially earn its highest possible profit if it produces a good quality product, and for that reason it is a dominant strategy for Wonka to produce a good quality product.

B) The highest possible combined profit for the two firms occurs when both produce a poor quality product, and for that reason producing a poor quality product is a dominant strategy for both firms.

C) Regardless of the strategy pursued by Wonka, Gekko's best strategy is to produce a good quality product, and for that reason producing a good quality product is a dominant strategy for Gekko.

D) Our knowledge of game theory suggests that the most likely outcome of the game, if it is played only once, is for one firm to produce a poor quality product and for the other firm to produce a good quality product.

A) Wonka can potentially earn its highest possible profit if it produces a good quality product, and for that reason it is a dominant strategy for Wonka to produce a good quality product.

B) The highest possible combined profit for the two firms occurs when both produce a poor quality product, and for that reason producing a poor quality product is a dominant strategy for both firms.

C) Regardless of the strategy pursued by Wonka, Gekko's best strategy is to produce a good quality product, and for that reason producing a good quality product is a dominant strategy for Gekko.

D) Our knowledge of game theory suggests that the most likely outcome of the game, if it is played only once, is for one firm to produce a poor quality product and for the other firm to produce a good quality product.

On Jul 26, 2024

C

AC

Answered

What is the goal of A/B testing?

A) To determine what design choices trigger the best performance on the KPIs.

B) To compare the cost of different tactics.

C) To determine the time value of performing one action vs.another action.

D) To determine how well the brand addressed customer needs.

E) To gauge the successfulness of risk mitigation efforts.

A) To determine what design choices trigger the best performance on the KPIs.

B) To compare the cost of different tactics.

C) To determine the time value of performing one action vs.another action.

D) To determine how well the brand addressed customer needs.

E) To gauge the successfulness of risk mitigation efforts.

On Jun 27, 2024

A

AC

Answered

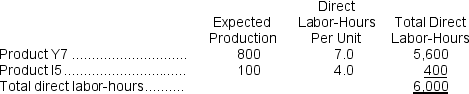

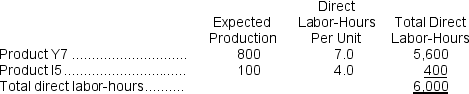

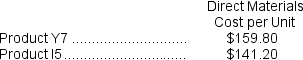

Dooms, Inc., manufactures and sells two products: Product Y7 and Product I5.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $27.50 per DLH.The direct materials cost per unit for each product is given below:

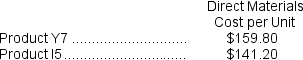

The direct labor rate is $27.50 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

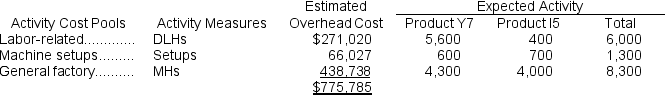

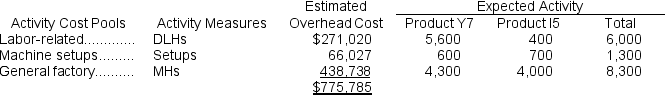

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

In all computations involving dollars in the following requirements, round off your answer to the nearest whole cent.

a.Determine the unit product cost of each product under the company's traditional costing method.

b.Determine the unit product cost of each product under the activity-based costing method.

The direct labor rate is $27.50 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $27.50 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:In all computations involving dollars in the following requirements, round off your answer to the nearest whole cent.

a.Determine the unit product cost of each product under the company's traditional costing method.

b.Determine the unit product cost of each product under the activity-based costing method.

On Jun 26, 2024

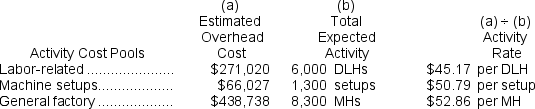

a.Predetermined overhead rate = Estimated total overhead ÷ Total direct labor-hours

= $775,785 ÷ 6,000 DLHs = $129.30 per DLH (rounded)

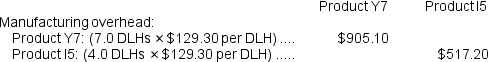

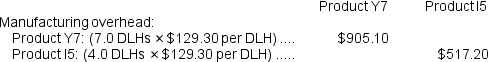

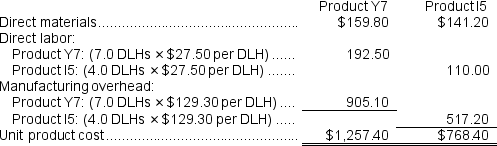

Computation of overhead applied to each product: Computation of traditional unit product costs:

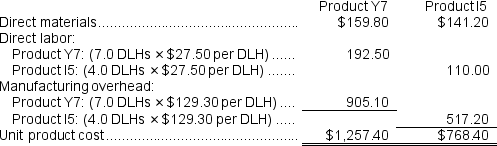

Computation of traditional unit product costs:  b.Computation of activity rates:

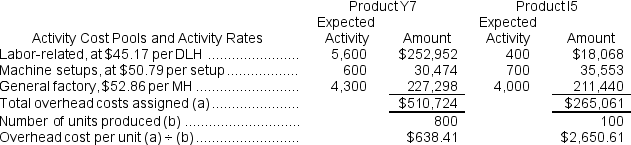

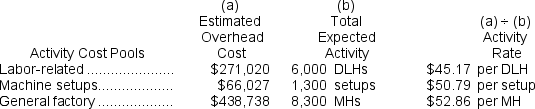

b.Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

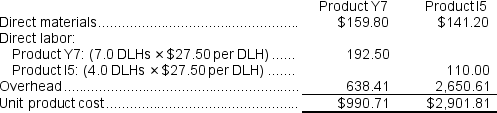

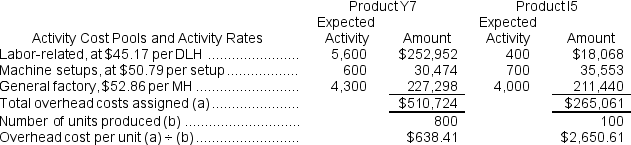

Computation of the overhead cost per unit under activity-based costing.  Computation of unit product costs under activity-based costing.

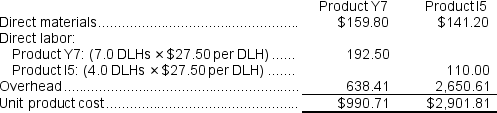

Computation of unit product costs under activity-based costing.

= $775,785 ÷ 6,000 DLHs = $129.30 per DLH (rounded)

Computation of overhead applied to each product:

Computation of traditional unit product costs:

Computation of traditional unit product costs:  b.Computation of activity rates:

b.Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.  Computation of unit product costs under activity-based costing.

Computation of unit product costs under activity-based costing.

AC

Answered

Investment analysts often compare cash flows from operations across two or more companies.

On May 28, 2024

True

AC

Answered

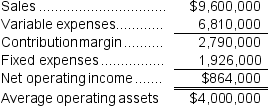

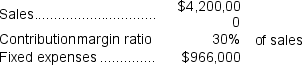

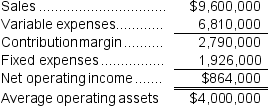

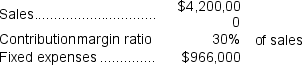

Cirone Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:  If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

A) 3.1%

B) 8.4%

C) 6.3%

D) 12.1%

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:  If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:A) 3.1%

B) 8.4%

C) 6.3%

D) 12.1%

On May 27, 2024

B