LB

latara barnes

Answers (2)

LB

Answered

To keep employees from shirking,invest in greater monitoring

A) when monitoring is expensive relative to its benefits

B) especially when monitoring is not very efficient

C) when employees respond well to incentive contracts

D) when incentives fail to solve either moral hazard and adverse selection problems with employees

A) when monitoring is expensive relative to its benefits

B) especially when monitoring is not very efficient

C) when employees respond well to incentive contracts

D) when incentives fail to solve either moral hazard and adverse selection problems with employees

On Sep 28, 2024

D

LB

Answered

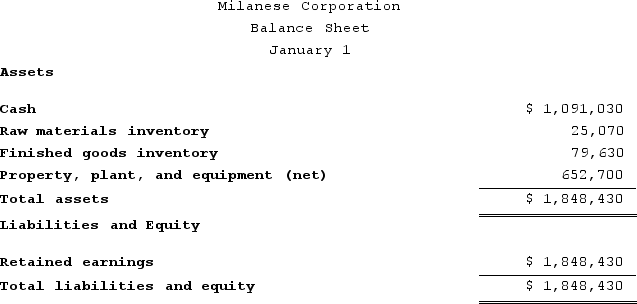

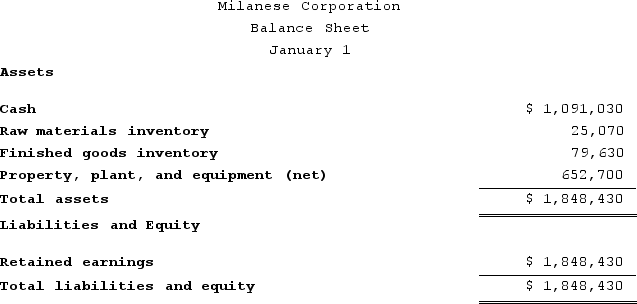

Milanese Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The company's balance sheet at the beginning of the year was as follows:

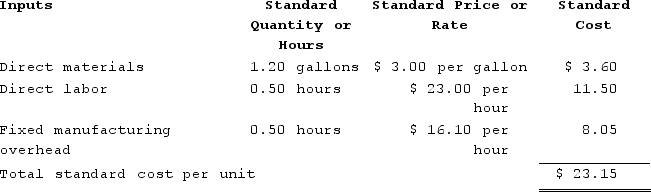

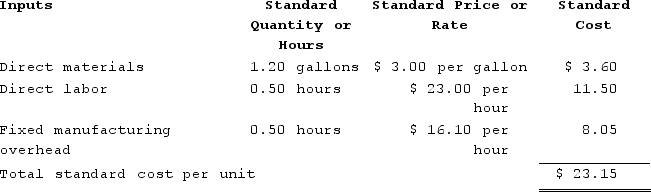

The standard cost card for the company's only product is as follows:

The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $161,000 and budgeted activity of 10,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $161,000 and budgeted activity of 10,000 hours.

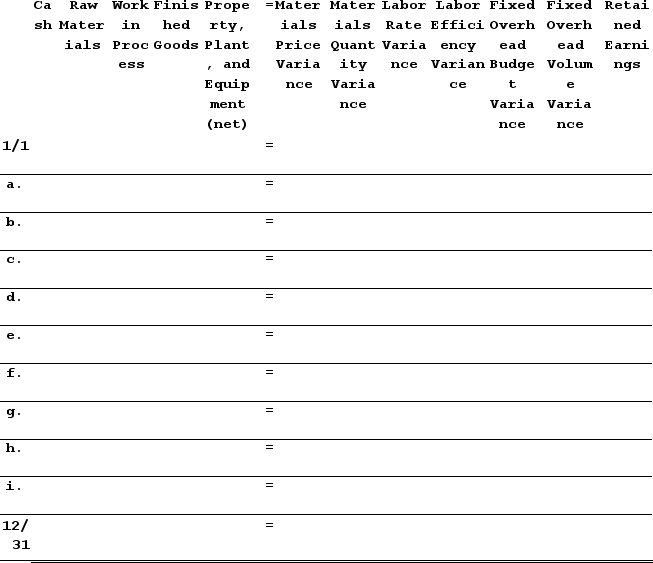

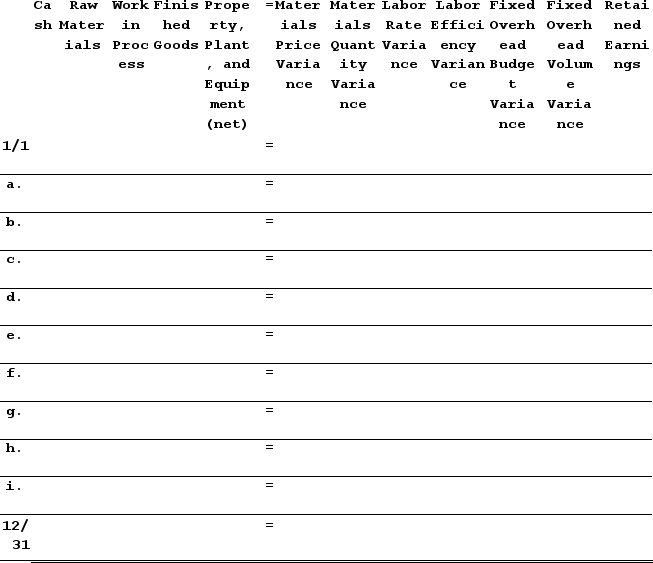

During the year, the company completed the following transactions:Purchased 24,400 gallons of raw material at a price of $3.90 per gallon.Used 21,460 gallons of the raw material to produce 17,800 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 9,300 hours at an average cost of $23.40 per hour.Applied fixed overhead to the 17,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $170,800. Of this total, $122,790 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $48,010 related to depreciation of manufacturing equipment.Transferred 17,800 units from work in process to finished goods.Sold for cash 17,700 units to customers at a price of $46.60 per unit.Completed and transferred the standard cost associated with the 17,700 units sold from finished goods to cost of goods sold.Paid $53,390 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Compute all direct materials, direct labor, and fixed overhead variances for the year.2. Enter the beginning balances and record the above transactions in the worksheet that appears below.

3. Determine the ending balance (e.g., 12/31 balance) in each account.

3. Determine the ending balance (e.g., 12/31 balance) in each account.

The standard cost card for the company's only product is as follows:

The standard cost card for the company's only product is as follows: The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $161,000 and budgeted activity of 10,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $161,000 and budgeted activity of 10,000 hours.During the year, the company completed the following transactions:Purchased 24,400 gallons of raw material at a price of $3.90 per gallon.Used 21,460 gallons of the raw material to produce 17,800 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 9,300 hours at an average cost of $23.40 per hour.Applied fixed overhead to the 17,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $170,800. Of this total, $122,790 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $48,010 related to depreciation of manufacturing equipment.Transferred 17,800 units from work in process to finished goods.Sold for cash 17,700 units to customers at a price of $46.60 per unit.Completed and transferred the standard cost associated with the 17,700 units sold from finished goods to cost of goods sold.Paid $53,390 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Compute all direct materials, direct labor, and fixed overhead variances for the year.2. Enter the beginning balances and record the above transactions in the worksheet that appears below.

3. Determine the ending balance (e.g., 12/31 balance) in each account.

3. Determine the ending balance (e.g., 12/31 balance) in each account.On Sep 23, 2024

1. Materials price variance = Actual quantity × (Average price − Standard price)= {{[a(19)]:#,###}} gallons × (${{[a(20)]:#,###.00}} per gallon − ${{[a(4)]:#,###.00}} per gallon)= {{[a(19)]:#,###}} gallons × ($0.90 per gallon)= ${{[a(41)]:#,###}} UnfavorableMaterials quantity variance:Standard quantity = Actual output × Standard quantity = {{[a(22)]:#,###}} units × {{[a(1)]:#,###.00}} gallons per unit = {{[a(44)]:#,###}} gallonsMaterials quantity variance = (Actual quantity − Standard quantity) × Standard price= ({{[a(21)]:#,###}} gallons − {{[a(44)]:#,###}} gallons) × ${{[a(4)]:#,###.00}} per gallon= (100 gallons) × ${{[a(4)]:#,###.00}} per gallon= ${{[a(46)]:#,###}} UnfavorableLabor rate variance = Actual hours × (Actual rate − Standard rate)= {{[a(23)]:#,###}} hours × (${{[a(24)]:#,###0.00}} per hour − ${{[a(5)]:#,###.00}} per hour)= {{[a(23)]:#,###}} hours × ($0.40 per hour)= ${{[a(13)]:#,###}} UnfavorableLabor efficiency variance:Standard hours = Actual output × Standard quantity = {{[a(22)]:#,###}} units × {{[a(2)]:#,##0.00}} hours per unit = {{[a(48)]:#,###}} hoursLabor efficiency variance = (Actual hours − Standard hours) × Standard rate= ({{[a(48)]:#,###}} hours − {{[a(48)]:#,###}} hours) × ${{[a(5)]:#,###.00}} per hour= (400 hours) × ${{[a(5)]:#,###.00}} per hour= ${{[a(14)]:#,###}} UnfavorableBudget variance = Actual fixed overhead − Budgeted fixed overhead= ${{[a(26)]:#,###}} − ${{[a(17)]:#,###}}= ${{[a(15)]:#,###}} UnfavorableVolume variance = Budgeted fixed overhead − Fixed overhead applied to work in process= ${{[a(17)]:#,###}} − ({{[a(48)]:#,###}} hours × ${{[a(6)]:#,###.00}} per hour)= ${{[a(17)]:#,###}} − (${{[a(54)]:#,###}})= ${{[a(16)]:#,###}} Unfavorable2. and 3.

![1. Materials price variance = Actual quantity × (Average price − Standard price)= {{[a(19)]:#,###}} gallons × (${{[a(20)]:#,###.00}} per gallon − ${{[a(4)]:#,###.00}} per gallon)= {{[a(19)]:#,###}} gallons × ($0.90 per gallon)= ${{[a(41)]:#,###}} UnfavorableMaterials quantity variance:Standard quantity = Actual output × Standard quantity = {{[a(22)]:#,###}} units × {{[a(1)]:#,###.00}} gallons per unit = {{[a(44)]:#,###}} gallonsMaterials quantity variance = (Actual quantity − Standard quantity) × Standard price= ({{[a(21)]:#,###}} gallons − {{[a(44)]:#,###}} gallons) × ${{[a(4)]:#,###.00}} per gallon= (100 gallons) × ${{[a(4)]:#,###.00}} per gallon= ${{[a(46)]:#,###}} UnfavorableLabor rate variance = Actual hours × (Actual rate − Standard rate)= {{[a(23)]:#,###}} hours × (${{[a(24)]:#,###0.00}} per hour − ${{[a(5)]:#,###.00}} per hour)= {{[a(23)]:#,###}} hours × ($0.40 per hour)= ${{[a(13)]:#,###}} UnfavorableLabor efficiency variance:Standard hours = Actual output × Standard quantity = {{[a(22)]:#,###}} units × {{[a(2)]:#,##0.00}} hours per unit = {{[a(48)]:#,###}} hoursLabor efficiency variance = (Actual hours − Standard hours) × Standard rate= ({{[a(48)]:#,###}} hours − {{[a(48)]:#,###}} hours) × ${{[a(5)]:#,###.00}} per hour= (400 hours) × ${{[a(5)]:#,###.00}} per hour= ${{[a(14)]:#,###}} UnfavorableBudget variance = Actual fixed overhead − Budgeted fixed overhead= ${{[a(26)]:#,###}} − ${{[a(17)]:#,###}}= ${{[a(15)]:#,###}} UnfavorableVolume variance = Budgeted fixed overhead − Fixed overhead applied to work in process= ${{[a(17)]:#,###}} − ({{[a(48)]:#,###}} hours × ${{[a(6)]:#,###.00}} per hour)= ${{[a(17)]:#,###}} − (${{[a(54)]:#,###}})= ${{[a(16)]:#,###}} Unfavorable2. and 3. The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = {{[a(17)]:#,###}} gallons × ${{[a(24)]:#,###.00}} per gallon = ${{[a(39)]:#,###}}. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = {{[a(19)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(40)]:#,###}}. The materials price variance is ${{[a(41)]:#,###}} Unfavorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = {{[a(21)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(43)]:#,###}}. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = ({{[a(22)]:#,###}} units × {{[a(1)]:#,###.00}} gallons per unit) × ${{[a(4)]:#,###.00}} per gallon = {{[a(44)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(45)]:#,###}}. The difference is the Materials Quantity Variance which is ${{[a(46)]:#,###}} Unfavorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = {{[a(23)]:#,###}} hours × ${{[a(24)]:#,###.00}} per hour = ${{[a(47)]:#,###}}. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = ({{[a(22)]:#,###}} units × {{[a(3)]:#,##0.00}} hours per unit) × ${{[a(5)]:#,###.00}} per hour = {{[a(48)]:#,###}} hours × ${{[a(5)]:#,###.00}} per hour = ${{[a(49)]:#,###}}. The difference consists of the Labor Rate Variance which is ${{[a(13)]:#,###}} U and the Labor Efficiency Variance which is ${{[a(14)]:#,###}} Unfavorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is ${{[a(27)]:#,###}}. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is ({{[a(29)]:#,###}} units × {{[a(3)]:#,##.00}} hours per unit) × ${{[a(6)]:#,###.00}} per hour = {{[a(48)]:#,###}} hours × ${{[a(6)]:#,###.00}} per hour = ${{[a(54)]:#,###}}. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is ${{[a(28)]:#,###}}. The difference is the Fixed Overhead (FOH) Budget Variance which is ${{[a(15)]:#,###}} U and the Fixed Overhead (FOH) Volume Variance which is ${{[a(16)]:#,###}} Unfavorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = {{[a(22)]:#,###}} units × $41.20 per unit = ${{[a(55)]:#,###}}. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is {{[a(30)]:#,###}} units × $41.20 per unit = ${{[a(56)]:#,###}}. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is {{[a(30)]:#,###}} units × $41.20 per unit = ${{[a(57)]:#,###}}. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by ${{[a(32)]:#,###}} to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_63b5_188c_bf83_a356260dc54d_TB8314_00.jpg) The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = {{[a(17)]:#,###}} gallons × ${{[a(24)]:#,###.00}} per gallon = ${{[a(39)]:#,###}}. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = {{[a(19)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(40)]:#,###}}. The materials price variance is ${{[a(41)]:#,###}} Unfavorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = {{[a(21)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(43)]:#,###}}. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = ({{[a(22)]:#,###}} units × {{[a(1)]:#,###.00}} gallons per unit) × ${{[a(4)]:#,###.00}} per gallon = {{[a(44)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(45)]:#,###}}. The difference is the Materials Quantity Variance which is ${{[a(46)]:#,###}} Unfavorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = {{[a(23)]:#,###}} hours × ${{[a(24)]:#,###.00}} per hour = ${{[a(47)]:#,###}}. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = ({{[a(22)]:#,###}} units × {{[a(3)]:#,##0.00}} hours per unit) × ${{[a(5)]:#,###.00}} per hour = {{[a(48)]:#,###}} hours × ${{[a(5)]:#,###.00}} per hour = ${{[a(49)]:#,###}}. The difference consists of the Labor Rate Variance which is ${{[a(13)]:#,###}} U and the Labor Efficiency Variance which is ${{[a(14)]:#,###}} Unfavorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is ${{[a(27)]:#,###}}. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is ({{[a(29)]:#,###}} units × {{[a(3)]:#,##.00}} hours per unit) × ${{[a(6)]:#,###.00}} per hour = {{[a(48)]:#,###}} hours × ${{[a(6)]:#,###.00}} per hour = ${{[a(54)]:#,###}}. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is ${{[a(28)]:#,###}}. The difference is the Fixed Overhead (FOH) Budget Variance which is ${{[a(15)]:#,###}} U and the Fixed Overhead (FOH) Volume Variance which is ${{[a(16)]:#,###}} Unfavorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = {{[a(22)]:#,###}} units × $41.20 per unit = ${{[a(55)]:#,###}}. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is {{[a(30)]:#,###}} units × $41.20 per unit = ${{[a(56)]:#,###}}. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is {{[a(30)]:#,###}} units × $41.20 per unit = ${{[a(57)]:#,###}}. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by ${{[a(32)]:#,###}} to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).

The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = {{[a(17)]:#,###}} gallons × ${{[a(24)]:#,###.00}} per gallon = ${{[a(39)]:#,###}}. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = {{[a(19)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(40)]:#,###}}. The materials price variance is ${{[a(41)]:#,###}} Unfavorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = {{[a(21)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(43)]:#,###}}. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = ({{[a(22)]:#,###}} units × {{[a(1)]:#,###.00}} gallons per unit) × ${{[a(4)]:#,###.00}} per gallon = {{[a(44)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(45)]:#,###}}. The difference is the Materials Quantity Variance which is ${{[a(46)]:#,###}} Unfavorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = {{[a(23)]:#,###}} hours × ${{[a(24)]:#,###.00}} per hour = ${{[a(47)]:#,###}}. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = ({{[a(22)]:#,###}} units × {{[a(3)]:#,##0.00}} hours per unit) × ${{[a(5)]:#,###.00}} per hour = {{[a(48)]:#,###}} hours × ${{[a(5)]:#,###.00}} per hour = ${{[a(49)]:#,###}}. The difference consists of the Labor Rate Variance which is ${{[a(13)]:#,###}} U and the Labor Efficiency Variance which is ${{[a(14)]:#,###}} Unfavorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is ${{[a(27)]:#,###}}. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is ({{[a(29)]:#,###}} units × {{[a(3)]:#,##.00}} hours per unit) × ${{[a(6)]:#,###.00}} per hour = {{[a(48)]:#,###}} hours × ${{[a(6)]:#,###.00}} per hour = ${{[a(54)]:#,###}}. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is ${{[a(28)]:#,###}}. The difference is the Fixed Overhead (FOH) Budget Variance which is ${{[a(15)]:#,###}} U and the Fixed Overhead (FOH) Volume Variance which is ${{[a(16)]:#,###}} Unfavorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = {{[a(22)]:#,###}} units × $41.20 per unit = ${{[a(55)]:#,###}}. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is {{[a(30)]:#,###}} units × $41.20 per unit = ${{[a(56)]:#,###}}. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is {{[a(30)]:#,###}} units × $41.20 per unit = ${{[a(57)]:#,###}}. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by ${{[a(32)]:#,###}} to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).

![1. Materials price variance = Actual quantity × (Average price − Standard price)= {{[a(19)]:#,###}} gallons × (${{[a(20)]:#,###.00}} per gallon − ${{[a(4)]:#,###.00}} per gallon)= {{[a(19)]:#,###}} gallons × ($0.90 per gallon)= ${{[a(41)]:#,###}} UnfavorableMaterials quantity variance:Standard quantity = Actual output × Standard quantity = {{[a(22)]:#,###}} units × {{[a(1)]:#,###.00}} gallons per unit = {{[a(44)]:#,###}} gallonsMaterials quantity variance = (Actual quantity − Standard quantity) × Standard price= ({{[a(21)]:#,###}} gallons − {{[a(44)]:#,###}} gallons) × ${{[a(4)]:#,###.00}} per gallon= (100 gallons) × ${{[a(4)]:#,###.00}} per gallon= ${{[a(46)]:#,###}} UnfavorableLabor rate variance = Actual hours × (Actual rate − Standard rate)= {{[a(23)]:#,###}} hours × (${{[a(24)]:#,###0.00}} per hour − ${{[a(5)]:#,###.00}} per hour)= {{[a(23)]:#,###}} hours × ($0.40 per hour)= ${{[a(13)]:#,###}} UnfavorableLabor efficiency variance:Standard hours = Actual output × Standard quantity = {{[a(22)]:#,###}} units × {{[a(2)]:#,##0.00}} hours per unit = {{[a(48)]:#,###}} hoursLabor efficiency variance = (Actual hours − Standard hours) × Standard rate= ({{[a(48)]:#,###}} hours − {{[a(48)]:#,###}} hours) × ${{[a(5)]:#,###.00}} per hour= (400 hours) × ${{[a(5)]:#,###.00}} per hour= ${{[a(14)]:#,###}} UnfavorableBudget variance = Actual fixed overhead − Budgeted fixed overhead= ${{[a(26)]:#,###}} − ${{[a(17)]:#,###}}= ${{[a(15)]:#,###}} UnfavorableVolume variance = Budgeted fixed overhead − Fixed overhead applied to work in process= ${{[a(17)]:#,###}} − ({{[a(48)]:#,###}} hours × ${{[a(6)]:#,###.00}} per hour)= ${{[a(17)]:#,###}} − (${{[a(54)]:#,###}})= ${{[a(16)]:#,###}} Unfavorable2. and 3. The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = {{[a(17)]:#,###}} gallons × ${{[a(24)]:#,###.00}} per gallon = ${{[a(39)]:#,###}}. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = {{[a(19)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(40)]:#,###}}. The materials price variance is ${{[a(41)]:#,###}} Unfavorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = {{[a(21)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(43)]:#,###}}. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = ({{[a(22)]:#,###}} units × {{[a(1)]:#,###.00}} gallons per unit) × ${{[a(4)]:#,###.00}} per gallon = {{[a(44)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(45)]:#,###}}. The difference is the Materials Quantity Variance which is ${{[a(46)]:#,###}} Unfavorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = {{[a(23)]:#,###}} hours × ${{[a(24)]:#,###.00}} per hour = ${{[a(47)]:#,###}}. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = ({{[a(22)]:#,###}} units × {{[a(3)]:#,##0.00}} hours per unit) × ${{[a(5)]:#,###.00}} per hour = {{[a(48)]:#,###}} hours × ${{[a(5)]:#,###.00}} per hour = ${{[a(49)]:#,###}}. The difference consists of the Labor Rate Variance which is ${{[a(13)]:#,###}} U and the Labor Efficiency Variance which is ${{[a(14)]:#,###}} Unfavorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is ${{[a(27)]:#,###}}. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is ({{[a(29)]:#,###}} units × {{[a(3)]:#,##.00}} hours per unit) × ${{[a(6)]:#,###.00}} per hour = {{[a(48)]:#,###}} hours × ${{[a(6)]:#,###.00}} per hour = ${{[a(54)]:#,###}}. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is ${{[a(28)]:#,###}}. The difference is the Fixed Overhead (FOH) Budget Variance which is ${{[a(15)]:#,###}} U and the Fixed Overhead (FOH) Volume Variance which is ${{[a(16)]:#,###}} Unfavorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = {{[a(22)]:#,###}} units × $41.20 per unit = ${{[a(55)]:#,###}}. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is {{[a(30)]:#,###}} units × $41.20 per unit = ${{[a(56)]:#,###}}. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is {{[a(30)]:#,###}} units × $41.20 per unit = ${{[a(57)]:#,###}}. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by ${{[a(32)]:#,###}} to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_63b5_188c_bf83_a356260dc54d_TB8314_00.jpg) The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = {{[a(17)]:#,###}} gallons × ${{[a(24)]:#,###.00}} per gallon = ${{[a(39)]:#,###}}. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = {{[a(19)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(40)]:#,###}}. The materials price variance is ${{[a(41)]:#,###}} Unfavorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = {{[a(21)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(43)]:#,###}}. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = ({{[a(22)]:#,###}} units × {{[a(1)]:#,###.00}} gallons per unit) × ${{[a(4)]:#,###.00}} per gallon = {{[a(44)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(45)]:#,###}}. The difference is the Materials Quantity Variance which is ${{[a(46)]:#,###}} Unfavorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = {{[a(23)]:#,###}} hours × ${{[a(24)]:#,###.00}} per hour = ${{[a(47)]:#,###}}. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = ({{[a(22)]:#,###}} units × {{[a(3)]:#,##0.00}} hours per unit) × ${{[a(5)]:#,###.00}} per hour = {{[a(48)]:#,###}} hours × ${{[a(5)]:#,###.00}} per hour = ${{[a(49)]:#,###}}. The difference consists of the Labor Rate Variance which is ${{[a(13)]:#,###}} U and the Labor Efficiency Variance which is ${{[a(14)]:#,###}} Unfavorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is ${{[a(27)]:#,###}}. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is ({{[a(29)]:#,###}} units × {{[a(3)]:#,##.00}} hours per unit) × ${{[a(6)]:#,###.00}} per hour = {{[a(48)]:#,###}} hours × ${{[a(6)]:#,###.00}} per hour = ${{[a(54)]:#,###}}. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is ${{[a(28)]:#,###}}. The difference is the Fixed Overhead (FOH) Budget Variance which is ${{[a(15)]:#,###}} U and the Fixed Overhead (FOH) Volume Variance which is ${{[a(16)]:#,###}} Unfavorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = {{[a(22)]:#,###}} units × $41.20 per unit = ${{[a(55)]:#,###}}. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is {{[a(30)]:#,###}} units × $41.20 per unit = ${{[a(56)]:#,###}}. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is {{[a(30)]:#,###}} units × $41.20 per unit = ${{[a(57)]:#,###}}. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by ${{[a(32)]:#,###}} to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).

The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = {{[a(17)]:#,###}} gallons × ${{[a(24)]:#,###.00}} per gallon = ${{[a(39)]:#,###}}. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = {{[a(19)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(40)]:#,###}}. The materials price variance is ${{[a(41)]:#,###}} Unfavorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = {{[a(21)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(43)]:#,###}}. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = ({{[a(22)]:#,###}} units × {{[a(1)]:#,###.00}} gallons per unit) × ${{[a(4)]:#,###.00}} per gallon = {{[a(44)]:#,###}} gallons × ${{[a(4)]:#,###.00}} per gallon = ${{[a(45)]:#,###}}. The difference is the Materials Quantity Variance which is ${{[a(46)]:#,###}} Unfavorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = {{[a(23)]:#,###}} hours × ${{[a(24)]:#,###.00}} per hour = ${{[a(47)]:#,###}}. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = ({{[a(22)]:#,###}} units × {{[a(3)]:#,##0.00}} hours per unit) × ${{[a(5)]:#,###.00}} per hour = {{[a(48)]:#,###}} hours × ${{[a(5)]:#,###.00}} per hour = ${{[a(49)]:#,###}}. The difference consists of the Labor Rate Variance which is ${{[a(13)]:#,###}} U and the Labor Efficiency Variance which is ${{[a(14)]:#,###}} Unfavorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is ${{[a(27)]:#,###}}. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is ({{[a(29)]:#,###}} units × {{[a(3)]:#,##.00}} hours per unit) × ${{[a(6)]:#,###.00}} per hour = {{[a(48)]:#,###}} hours × ${{[a(6)]:#,###.00}} per hour = ${{[a(54)]:#,###}}. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is ${{[a(28)]:#,###}}. The difference is the Fixed Overhead (FOH) Budget Variance which is ${{[a(15)]:#,###}} U and the Fixed Overhead (FOH) Volume Variance which is ${{[a(16)]:#,###}} Unfavorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = {{[a(22)]:#,###}} units × $41.20 per unit = ${{[a(55)]:#,###}}. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is {{[a(30)]:#,###}} units × $41.20 per unit = ${{[a(56)]:#,###}}. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is {{[a(30)]:#,###}} units × $41.20 per unit = ${{[a(57)]:#,###}}. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by ${{[a(32)]:#,###}} to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).