NH

nusrat haque

Answers (6)

NH

Answered

Ramkissoon Midwifery's cost formula for its wages and salaries is $2,060 per month plus $442 per birth. For the month of July, the company planned for activity of 117 births, but the actual level of activity was 114 births. The actual wages and salaries for the month was $54,500. The spending variance for wages and salaries in July would be closest to:

A) $726 U

B) $2,052 F

C) $2,052 U

D) $726 F

A) $726 U

B) $2,052 F

C) $2,052 U

D) $726 F

On Jul 18, 2024

C

NH

Answered

Which of the following represented a far-reaching change to organizational control and accounting systems, making securities fraud a criminal offense?

A) Foreign Corrupt Practices Act

B) Sarbanes-Oxley Act

C) Consumer Protection Act

D) Defense Industry Initiative on Business Ethics and Conduct

E) Dodd-Frank Wall Street Reform and Consumer Protection Act

A) Foreign Corrupt Practices Act

B) Sarbanes-Oxley Act

C) Consumer Protection Act

D) Defense Industry Initiative on Business Ethics and Conduct

E) Dodd-Frank Wall Street Reform and Consumer Protection Act

On Jul 16, 2024

B

NH

Answered

Describe the differences in how the direct write-off method and the allowance method are applied in accounting for uncollectible accounts receivables.

On Jun 17, 2024

The direct write-off method records the loss from an uncollectible account receivable when a specific individual account is determined to be uncollectible.Under the allowance method,estimated bad debt expense is recorded at the end of each accounting period by debiting Bad Debts Expense and crediting Allowance for Doubtful Accounts.The amount of bad debts expense is determined by applying one of several estimation methods.Individual uncollectible accounts are later written off with a debit to the Allowance for Doubtful Accounts and a credit to the specific account receivable.

NH

Answered

Which statement is true?

A) Vault cash is considered a secondary reserve.

B) The larger the reserve requirement,the smaller the deposit expansion multiplier.

C) Open market operations are borrowing by banks from the Fed.

D) The comptroller of the currency does check clearing.

A) Vault cash is considered a secondary reserve.

B) The larger the reserve requirement,the smaller the deposit expansion multiplier.

C) Open market operations are borrowing by banks from the Fed.

D) The comptroller of the currency does check clearing.

On Jun 15, 2024

B

NH

Answered

Sirignano Corporation produces and sells one product. The budgeted selling price per unit is $84. Budgeted unit sales for October, November, December, and January are 8,400, 12,000, 13,800, and 14,300 units, respectively. All sales are on credit with 40% collected in the month of the sale and 60% in the following month. The expected cash collections for November is closest to:

A) $826,560

B) $705,600

C) $423,360

D) $403,200

A) $826,560

B) $705,600

C) $423,360

D) $403,200

On May 18, 2024

A

NH

Answered

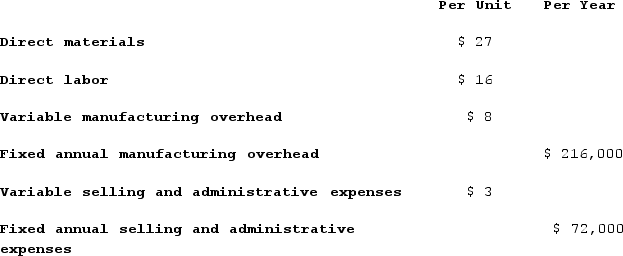

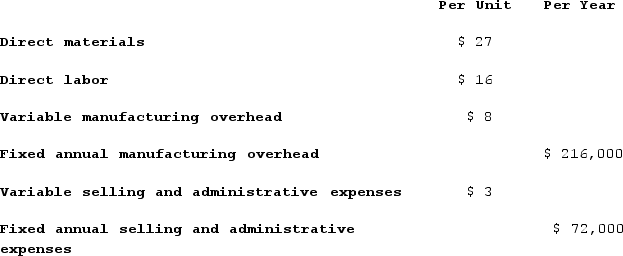

The management of Musselman Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:  Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.The markup percentage on absorption cost is closest to:

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.The markup percentage on absorption cost is closest to:

A) 25%

B) 34%

C) 15%

D) 10%

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.The markup percentage on absorption cost is closest to:

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.The markup percentage on absorption cost is closest to:A) 25%

B) 34%

C) 15%

D) 10%

On May 16, 2024

B