RT

radhika tangri

Answers (6)

RT

Answered

Which of the following is the true function of the résumé?

A) To compel employers to hire you

B) To compel employers to set up an interview with you

C) To highlight skills and abilities needed to progress on the career ladder

D) To impress the employer with industry specific buzzwords and jargon

E) To list all your skills and abilities

A) To compel employers to hire you

B) To compel employers to set up an interview with you

C) To highlight skills and abilities needed to progress on the career ladder

D) To impress the employer with industry specific buzzwords and jargon

E) To list all your skills and abilities

On Jul 04, 2024

B

RT

Answered

According to the Diversity competency: Managing across Generations,____ and ____ would be more likely than ____ to recognize a manager's authority.

A) Gen X'ers;baby boomers;Gen Y'ers

B) baby boomers;Gen Y'ers;Gen X'ers

C) Gen X'ers;Gen Y'ers;baby boomers

D) Gen Y'ers;Gen X'ers;baby boomers

A) Gen X'ers;baby boomers;Gen Y'ers

B) baby boomers;Gen Y'ers;Gen X'ers

C) Gen X'ers;Gen Y'ers;baby boomers

D) Gen Y'ers;Gen X'ers;baby boomers

On Jul 01, 2024

A

RT

Answered

Interest must be imputed whenever the stated rate is not the same as the prime rate of interest at the time of the transaction.

On Jun 04, 2024

False

RT

Answered

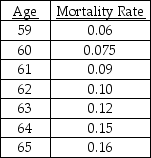

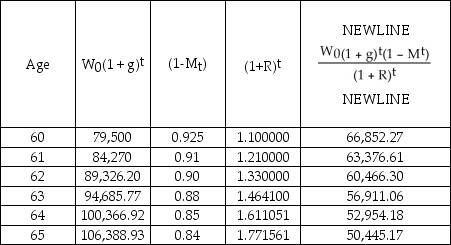

You have been hired by an attorney to perform an economic analysis of lost wages in a wrongful death suit. The case involves an insurance agent, John Doe, who was killed in an auto accident a few days after his 59th birthday. Mr. Doe could have expected to earn $75,000 this year. Data suggest that the income of insurance agents has risen an average of 6% over the past 20 years. Mr. Doe's expected retirement age was 65, i.e., on his 65th birthday. Available data provide the mortality rates given below for individuals of Mr. Doe's sex and occupation at various ages. Ten percent appears to be the appropriate discount rate.

a. Calculate the present discounted value of Mr. Doe's expected earnings stream. (For simplicity, assume he receives all of his earnings for the preceding year on his birthday.)

a. Calculate the present discounted value of Mr. Doe's expected earnings stream. (For simplicity, assume he receives all of his earnings for the preceding year on his birthday.)

b. The attorney has asked your advice regarding a minimum figure that should be accepted as an out-of-court settlement. What guidance can you give the attorney? Would additional information allow you to give the attorney a more precise estimate of the figure that should be accepted? Give an example of how more information would help.

c. You must be prepared for cross-examination by the defendant's attorney. Where would you expect the opposing attorney to attack your testimony?

a. Calculate the present discounted value of Mr. Doe's expected earnings stream. (For simplicity, assume he receives all of his earnings for the preceding year on his birthday.)

a. Calculate the present discounted value of Mr. Doe's expected earnings stream. (For simplicity, assume he receives all of his earnings for the preceding year on his birthday.)b. The attorney has asked your advice regarding a minimum figure that should be accepted as an out-of-court settlement. What guidance can you give the attorney? Would additional information allow you to give the attorney a more precise estimate of the figure that should be accepted? Give an example of how more information would help.

c. You must be prepared for cross-examination by the defendant's attorney. Where would you expect the opposing attorney to attack your testimony?

On Jun 01, 2024

a.  b.The attorney would be foolish to insist upon $350,985.59, since there is some uncertainty regarding the outcome of the case. Clearly, it is appropriate to accept a somewhat smaller settlement. How much smaller would depend upon the probability of winning the case. If the attorney assigned a 0.9 probability of winning the case with the full settlement, the appropriate offer would be 0.9 times the estimated loss.

b.The attorney would be foolish to insist upon $350,985.59, since there is some uncertainty regarding the outcome of the case. Clearly, it is appropriate to accept a somewhat smaller settlement. How much smaller would depend upon the probability of winning the case. If the attorney assigned a 0.9 probability of winning the case with the full settlement, the appropriate offer would be 0.9 times the estimated loss.

0.9 × 350,985.59 = 315,887.03

Obviously, as the probability of winning falls, the out-of-court settlement falls with it.

c.The defendant's attorney could be expected to attack the validity of the assumptions that have been made in preparing the estimated lost income. Assuming that the mortality figures come from an objective source, there are two main assumptions contained in the report. We must make an assumption regarding growth in Mr. Doe's earnings, and we must also make an assumption for the interest rate. The defendant's attorney could be expected to argue for a lower growth in earnings and a higher discount rate.

b.The attorney would be foolish to insist upon $350,985.59, since there is some uncertainty regarding the outcome of the case. Clearly, it is appropriate to accept a somewhat smaller settlement. How much smaller would depend upon the probability of winning the case. If the attorney assigned a 0.9 probability of winning the case with the full settlement, the appropriate offer would be 0.9 times the estimated loss.

b.The attorney would be foolish to insist upon $350,985.59, since there is some uncertainty regarding the outcome of the case. Clearly, it is appropriate to accept a somewhat smaller settlement. How much smaller would depend upon the probability of winning the case. If the attorney assigned a 0.9 probability of winning the case with the full settlement, the appropriate offer would be 0.9 times the estimated loss.0.9 × 350,985.59 = 315,887.03

Obviously, as the probability of winning falls, the out-of-court settlement falls with it.

c.The defendant's attorney could be expected to attack the validity of the assumptions that have been made in preparing the estimated lost income. Assuming that the mortality figures come from an objective source, there are two main assumptions contained in the report. We must make an assumption regarding growth in Mr. Doe's earnings, and we must also make an assumption for the interest rate. The defendant's attorney could be expected to argue for a lower growth in earnings and a higher discount rate.

RT

Answered

Back in the Middle Ages,the only safe place to put your money was

A) in Treasury bills.

B) in goldsmiths' safes.

C) in real estate.

D) in commodity futures.

A) in Treasury bills.

B) in goldsmiths' safes.

C) in real estate.

D) in commodity futures.

On May 05, 2024

B

RT

Answered

Federally-sponsored agency debt

A) is legally insured by the U.S. Treasury.

B) would probably be backed by the U.S. Treasury in the event of a near-default.

C) has a small positive yield spread relative to U.S. Treasuries.

D) would probably be backed by the U.S. Treasury in the event of a near-default and has a small positive yield spread relative to U.S. Treasuries.

E) is legally insured by the U.S. Treasury and has a small positive yield spread relative to U.S. Treasuries.

A) is legally insured by the U.S. Treasury.

B) would probably be backed by the U.S. Treasury in the event of a near-default.

C) has a small positive yield spread relative to U.S. Treasuries.

D) would probably be backed by the U.S. Treasury in the event of a near-default and has a small positive yield spread relative to U.S. Treasuries.

E) is legally insured by the U.S. Treasury and has a small positive yield spread relative to U.S. Treasuries.

On May 02, 2024

D