SW

shantay white

Answers (6)

SW

Answered

Mookie, a professional baseball player, negotiated with the Soxville Eagles for a one-year contract. He was given one week to consider the offer and was to sign it by the opening day of the season, one week away. Mookie, in the meantime, was offered a better contract with the Baxton Bulldogs, which he accepted. On opening day, Mookie walked onto the field in the uniform of Baxton. Soxville can sue Mookie for a breach of contract.

On Jul 16, 2024

False

SW

Answered

When using the allowance method of accounting for uncollectible accounts,the recovery of a bad debt would be recorded as a debit to Cash and a credit to Bad Debts Expense.

On Jul 13, 2024

False

SW

Answered

The trial balances of Ash Inc. and its subsidiary Cinder Corp. on December 31, 2020 are shown below:

Ash Cinder Inventory $160,000$100,000 Plant and Equipment (net) $2,700,000$700,000 Dividends Declared $200,000$100,000 Investment in Cinder $700,000 Cost of Goods Sold $650,000$90,000 Other Expenses $50,000$10,000 Total Assets $4,460,000$1,000,000 Liabilities $1,000,000$150,000 Common Shares $1,660,000$600,000 Retained Earnings $600,000$100,000 Sales and Other Revenue $1,200,000$150,000 Total Liabilities and Equity $4,460,000$1,000,000\begin{array}{|l|r|r|}\hline & \text { Ash } & \text { Cinder } \\\hline \text { Inventory } & \$ 160,000 & \$ 100,000 \\\hline \text { Plant and Equipment (net) } & \$ 2,700,000 & \$ 700,000 \\\hline \text { Dividends Declared } & \$ 200,000 & \$ 100,000 \\\hline \text { Investment in Cinder } & \$ 700,000 & \\\hline \text { Cost of Goods Sold } & \$ 650,000 & \$ 90,000 \\\hline \text { Other Expenses } & \$ 50,000 & \$ 10,000 \\\hline \text { Total Assets } & \$ 4,460,000 & \$ 1,000,000 \\\hline \text { Liabilities } & \$ 1,000,000 & \$ 150,000 \\\hline \text { Common Shares } & \$ 1,660,000 & \$ 600,000 \\\hline \text { Retained Earnings } & \$ 600,000 & \$ 100,000 \\\hline \text { Sales and Other Revenue } & \$ 1,200,000 & \$ 150,000 \\\hline \text { Total Liabilities and Equity } & \$ 4,460,000 & \$ 1,000,000\\\hline\end{array} Inventory Plant and Equipment (net) Dividends Declared Investment in Cinder Cost of Goods Sold Other Expenses Total Assets Liabilities Common Shares Retained Earnings Sales and Other Revenue Total Liabilities and Equity Ash $160,000$2,700,000$200,000$700,000$650,000$50,000$4,460,000$1,000,000$1,660,000$600,000$1,200,000$4,460,000 Cinder $100,000$700,000$100,000$90,000$10,000$1,000,000$150,000$600,000$100,000$150,000$1,000,000 Other Information:

Ash acquired Cinder in three stages:

january 1, 2017: Ash purchased 10,000 shares for $100,000. Cinder’s Retained Earnings were $40,000 on that date. The investment is classified as fair value through profit or loss (FVTPL). january 1, 2019: Ash purchased 30,000 shares for $450,000. Cinder’s Retained Earnings were $80,000 on that date. Ash has obtained significant influence in the key decisions for Cinder. December 31,2020: Ash purchased 20,000 shares for $150,000. Cinder’s Retained Earnings were $100,000 on that date. Ash now owns 60% and has control over Cinder.\begin{array} { |l|l| }\hline \text { january 1, 2017:}& \begin{array} { l } \text { Ash purchased 10,000 shares for \( \$ 100,000 \). Cinder's } \\ \text { Retained Earnings were \( \$ 40,000 \) on that date. The } \\ \text {investment is classified as fair value through profit or loss } \\ \text {(FVTPL). } \\\end{array}\\\hline \text {january 1, 2019: } &\begin{array} { l } \text { Ash purchased 30,000 shares for \( \$ 450,000 \). Cinder's } \\ \text {Retained Earnings were \( \$ 80,000 \) on that date. Ash } \\ \text {has obtained significant influence in the key decisions for } \\ \text {Cinder. } \\\end{array}\\\hline \text {December 31,2020: } &\begin{array} { l } \text {Ash purchased 20,000 shares for \( \$ 150,000 \). Cinder's } \\ \text { Retained Earnings were \( \$ 100,000 \) on that date. Ash } \\ \text { now owns \( 60 \% \) and has control over Cinder.} \\\end{array}\\\hline \end{array} january 1, 2017:january 1, 2019: December 31,2020: Ash purchased 10,000 shares for $100,000. Cinder’s Retained Earnings were $40,000 on that date. The investment is classified as fair value through profit or loss (FVTPL). Ash purchased 30,000 shares for $450,000. Cinder’s Retained Earnings were $80,000 on that date. Ash has obtained significant influence in the key decisions for Cinder. Ash purchased 20,000 shares for $150,000. Cinder’s Retained Earnings were $100,000 on that date. Ash now owns 60% and has control over Cinder.

Cinder was incorporated on January 1, 2015. On that date, Cinder issued 100,000 voting shares.

Any difference between the cost and book value is attributable entirely to trademarks, which are to be amortized over 5 years. The company has neither issued nor retired shares since the date of its incorporation.

Ash sold depreciable assets to Cinder at a loss of $20,000 on January 1, 2019. These assets had a 10 year remaining life.

Intercompany sales of inventory during 2020 amounted to $250,000. Unrealized inventory profits for each company are shown below for 2020. The amounts indicate the amount of profit in each company's inventory.

Ash January 1,2020:$10,000 December 31,2020:$20,000 Cinder January 1,2020:$20,000 December 31,2020:$40,000\begin{array}{|c|c|}\hline \text { Ash } & \\\hline \text { January } 1,2020: & \$ 10,000 \\\hline \text { December } 31,2020: & \$ 20,000 \\\hline \text { Cinder } & \\\hline \text { January } 1,2020: & \$ 20,000 \\\hline \text { December } 31,2020: & \$ 40,000 \\\hline\end{array} Ash January 1,2020: December 31,2020: Cinder January 1,2020: December 31,2020:$10,000$20,000$20,000$40,000 All inventories on hand at the start of 2020 were sold to outsiders during the year. The net incomes of both companies are evenly earned throughout the year. Both companies are subject to an effective corporate tax rate of 20%.

Compute consolidated inventory for Ash as at December 31, 2020.

Ash Cinder Inventory $160,000$100,000 Plant and Equipment (net) $2,700,000$700,000 Dividends Declared $200,000$100,000 Investment in Cinder $700,000 Cost of Goods Sold $650,000$90,000 Other Expenses $50,000$10,000 Total Assets $4,460,000$1,000,000 Liabilities $1,000,000$150,000 Common Shares $1,660,000$600,000 Retained Earnings $600,000$100,000 Sales and Other Revenue $1,200,000$150,000 Total Liabilities and Equity $4,460,000$1,000,000\begin{array}{|l|r|r|}\hline & \text { Ash } & \text { Cinder } \\\hline \text { Inventory } & \$ 160,000 & \$ 100,000 \\\hline \text { Plant and Equipment (net) } & \$ 2,700,000 & \$ 700,000 \\\hline \text { Dividends Declared } & \$ 200,000 & \$ 100,000 \\\hline \text { Investment in Cinder } & \$ 700,000 & \\\hline \text { Cost of Goods Sold } & \$ 650,000 & \$ 90,000 \\\hline \text { Other Expenses } & \$ 50,000 & \$ 10,000 \\\hline \text { Total Assets } & \$ 4,460,000 & \$ 1,000,000 \\\hline \text { Liabilities } & \$ 1,000,000 & \$ 150,000 \\\hline \text { Common Shares } & \$ 1,660,000 & \$ 600,000 \\\hline \text { Retained Earnings } & \$ 600,000 & \$ 100,000 \\\hline \text { Sales and Other Revenue } & \$ 1,200,000 & \$ 150,000 \\\hline \text { Total Liabilities and Equity } & \$ 4,460,000 & \$ 1,000,000\\\hline\end{array} Inventory Plant and Equipment (net) Dividends Declared Investment in Cinder Cost of Goods Sold Other Expenses Total Assets Liabilities Common Shares Retained Earnings Sales and Other Revenue Total Liabilities and Equity Ash $160,000$2,700,000$200,000$700,000$650,000$50,000$4,460,000$1,000,000$1,660,000$600,000$1,200,000$4,460,000 Cinder $100,000$700,000$100,000$90,000$10,000$1,000,000$150,000$600,000$100,000$150,000$1,000,000 Other Information:

Ash acquired Cinder in three stages:

january 1, 2017: Ash purchased 10,000 shares for $100,000. Cinder’s Retained Earnings were $40,000 on that date. The investment is classified as fair value through profit or loss (FVTPL). january 1, 2019: Ash purchased 30,000 shares for $450,000. Cinder’s Retained Earnings were $80,000 on that date. Ash has obtained significant influence in the key decisions for Cinder. December 31,2020: Ash purchased 20,000 shares for $150,000. Cinder’s Retained Earnings were $100,000 on that date. Ash now owns 60% and has control over Cinder.\begin{array} { |l|l| }\hline \text { january 1, 2017:}& \begin{array} { l } \text { Ash purchased 10,000 shares for \( \$ 100,000 \). Cinder's } \\ \text { Retained Earnings were \( \$ 40,000 \) on that date. The } \\ \text {investment is classified as fair value through profit or loss } \\ \text {(FVTPL). } \\\end{array}\\\hline \text {january 1, 2019: } &\begin{array} { l } \text { Ash purchased 30,000 shares for \( \$ 450,000 \). Cinder's } \\ \text {Retained Earnings were \( \$ 80,000 \) on that date. Ash } \\ \text {has obtained significant influence in the key decisions for } \\ \text {Cinder. } \\\end{array}\\\hline \text {December 31,2020: } &\begin{array} { l } \text {Ash purchased 20,000 shares for \( \$ 150,000 \). Cinder's } \\ \text { Retained Earnings were \( \$ 100,000 \) on that date. Ash } \\ \text { now owns \( 60 \% \) and has control over Cinder.} \\\end{array}\\\hline \end{array} january 1, 2017:january 1, 2019: December 31,2020: Ash purchased 10,000 shares for $100,000. Cinder’s Retained Earnings were $40,000 on that date. The investment is classified as fair value through profit or loss (FVTPL). Ash purchased 30,000 shares for $450,000. Cinder’s Retained Earnings were $80,000 on that date. Ash has obtained significant influence in the key decisions for Cinder. Ash purchased 20,000 shares for $150,000. Cinder’s Retained Earnings were $100,000 on that date. Ash now owns 60% and has control over Cinder.

Cinder was incorporated on January 1, 2015. On that date, Cinder issued 100,000 voting shares.

Any difference between the cost and book value is attributable entirely to trademarks, which are to be amortized over 5 years. The company has neither issued nor retired shares since the date of its incorporation.

Ash sold depreciable assets to Cinder at a loss of $20,000 on January 1, 2019. These assets had a 10 year remaining life.

Intercompany sales of inventory during 2020 amounted to $250,000. Unrealized inventory profits for each company are shown below for 2020. The amounts indicate the amount of profit in each company's inventory.

Ash January 1,2020:$10,000 December 31,2020:$20,000 Cinder January 1,2020:$20,000 December 31,2020:$40,000\begin{array}{|c|c|}\hline \text { Ash } & \\\hline \text { January } 1,2020: & \$ 10,000 \\\hline \text { December } 31,2020: & \$ 20,000 \\\hline \text { Cinder } & \\\hline \text { January } 1,2020: & \$ 20,000 \\\hline \text { December } 31,2020: & \$ 40,000 \\\hline\end{array} Ash January 1,2020: December 31,2020: Cinder January 1,2020: December 31,2020:$10,000$20,000$20,000$40,000 All inventories on hand at the start of 2020 were sold to outsiders during the year. The net incomes of both companies are evenly earned throughout the year. Both companies are subject to an effective corporate tax rate of 20%.

Compute consolidated inventory for Ash as at December 31, 2020.

On Jun 16, 2024

Book value of inventory $260,000 less: Unrealized Profits ($20,000+$40,000)($60,000)$200,000\begin{array} { | l | c | } \hline \text { Book value of inventory } & \$ 260,000 \\\hline \text { less: } & \\\hline \text { Unrealized Profits } ( \$ 20,000 + \$ 40,000 ) & (\$ 60,000 ) \\\hline & \$ 200,000 \\\hline\end{array} Book value of inventory less: Unrealized Profits ($20,000+$40,000)$260,000($60,000)$200,000

SW

Answered

An assignment of book debts is a common corporate financing method. Describe such an assignment, the two ways debts may be collected and why each may be preferred by the assignor. Further, describe the notion of crystallization as it would apply in this context.

On Jun 13, 2024

An assignment of book debts is very similar to any other assignment of a contractual right, in this case being a right to collect a debt. Title to the accounts passes immediately in return for the financing advanced on the basis of that security.

The two options for collection are either collection by assignor or collection by assignee. The former may be preferred by the assignor as informing clients to make their payments to ostensibly a third party may have overtones of the assignor being in financial trouble. The latter may however be preferable where this appearance is irrelevant, and having the assignee collect the accounts means that the assignor need not worry about bad debts, nor incur the expense of maintaining a large Accounts Receivable department. The notion of crystallization would only occur in the instance of the assignor collecting the accounts. Here, if the assignor defaulted on its payments to the assignee, the assignee would step in, notify those with accounts payable of the assignment, and begin collecting the accounts itself. In the first situation there is no crystallization as the assignee is collecting the accounts from the beginning.

The two options for collection are either collection by assignor or collection by assignee. The former may be preferred by the assignor as informing clients to make their payments to ostensibly a third party may have overtones of the assignor being in financial trouble. The latter may however be preferable where this appearance is irrelevant, and having the assignee collect the accounts means that the assignor need not worry about bad debts, nor incur the expense of maintaining a large Accounts Receivable department. The notion of crystallization would only occur in the instance of the assignor collecting the accounts. Here, if the assignor defaulted on its payments to the assignee, the assignee would step in, notify those with accounts payable of the assignment, and begin collecting the accounts itself. In the first situation there is no crystallization as the assignee is collecting the accounts from the beginning.

SW

Answered

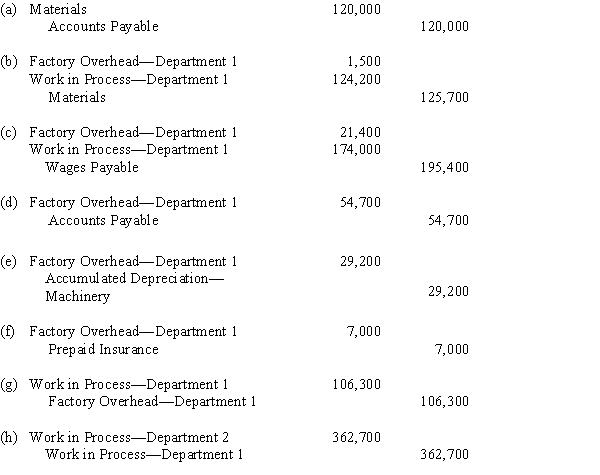

A firm produces its products by a continuous process involving three production departments, 1 through 3. Prepare journal entries to record the following selected transactions related to production during August:

(a)Materials purchased on account, $120,000.

(b)Material requisitioned for use in Department 1, $125,700, of which $124,200 entered directly into the product.

(c)Labor cost incurred in Department 1, $195,400, of which $174,000 was used directly in the manufacture of the product.

(d)Factory overhead costs for Department 1 incurred on account, $54,700.

(e)Depreciation on machinery in Department 1, $29,200.

(f)Expiration of prepaid insurance chargeable to Department 1, $7,000.

(g)Factory overhead applied to production in Department 1, $106,300.

(h)Output of Department 1 transferred to Department 2, $362,700.

(a)Materials purchased on account, $120,000.

(b)Material requisitioned for use in Department 1, $125,700, of which $124,200 entered directly into the product.

(c)Labor cost incurred in Department 1, $195,400, of which $174,000 was used directly in the manufacture of the product.

(d)Factory overhead costs for Department 1 incurred on account, $54,700.

(e)Depreciation on machinery in Department 1, $29,200.

(f)Expiration of prepaid insurance chargeable to Department 1, $7,000.

(g)Factory overhead applied to production in Department 1, $106,300.

(h)Output of Department 1 transferred to Department 2, $362,700.

On May 17, 2024

SW

Answered

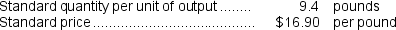

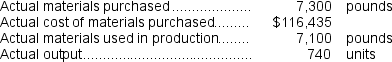

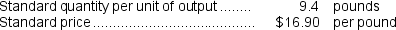

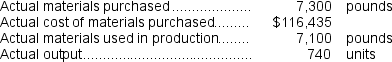

The following materials standards have been established for a particular product:  The following data pertain to operations concerning the product for the last month:

The following data pertain to operations concerning the product for the last month:  The direct materials purchases variance is computed when the materials are purchased.

The direct materials purchases variance is computed when the materials are purchased.

Required:

a.What is the materials price variance for the month?

b.What is the materials quantity variance for the month?

The following data pertain to operations concerning the product for the last month:

The following data pertain to operations concerning the product for the last month:  The direct materials purchases variance is computed when the materials are purchased.

The direct materials purchases variance is computed when the materials are purchased.Required:

a.What is the materials price variance for the month?

b.What is the materials quantity variance for the month?

On May 14, 2024

a.Materials price variance = (AQ × AP)− (AQ × SP)

= $116,435 - (7,300 pounds × $16.90 per pound)

= $116,435 - $123,370

= $6,935 F

b.SQ = Standard quantity per unit × Actual output = 9.4 pounds per unit × 740 units = 6,956 pounds

Materials quantity variance = (AQ − SQ)× SP

= (7,100 pounds - 6,956 pounds)× $16.90 per pound

= (144 pounds)× $16.90 per pound

= $2,433.60 U

= $116,435 - (7,300 pounds × $16.90 per pound)

= $116,435 - $123,370

= $6,935 F

b.SQ = Standard quantity per unit × Actual output = 9.4 pounds per unit × 740 units = 6,956 pounds

Materials quantity variance = (AQ − SQ)× SP

= (7,100 pounds - 6,956 pounds)× $16.90 per pound

= (144 pounds)× $16.90 per pound

= $2,433.60 U