Asked by Wrayon Primo on May 01, 2024

Verified

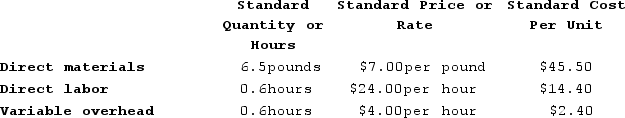

Kartman Corporation makes a product with the following standard costs:  In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The labor rate variance for June is:

In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.The labor rate variance for June is:

A) $1,890 Favorable

B) $2,061 Unfavorable

C) $2,061 Favorable

D) $1,890 Unfavorable

Labor Rate Variance

The difference between the expected cost of labor per unit of production and the actual cost, often used to identify efficiency and wage rate changes.

- Assess the variances in labor effectiveness and pay rates to evaluate the utilization of workforce and management of wage levels.

Verified Answer

SG

Stephanie GarciaMay 06, 2024

Final Answer :

B

Explanation :

To calculate the labor rate variance, we need to first calculate the actual labor rate per hour:

Actual labor rate per hour = Actual direct labor cost / Actual direct labor-hours

Actual labor rate per hour = $57,021 / 2,290 = $24.90 per hour

Next, we need to calculate the standard labor rate per hour:

Standard labor rate per hour = Standard labor cost / Standard direct labor-hours

Standard labor rate per hour = $36,400 / 2,000 = $18.20 per hour

Finally, we can calculate the labor rate variance:

Labor rate variance = (Actual labor rate per hour - Standard labor rate per hour) x Actual direct labor-hours

Labor rate variance = ($24.90 - $18.20) x 2,290

Labor rate variance = $2,061 Unfavorable

Therefore, the best choice is B.

Actual labor rate per hour = Actual direct labor cost / Actual direct labor-hours

Actual labor rate per hour = $57,021 / 2,290 = $24.90 per hour

Next, we need to calculate the standard labor rate per hour:

Standard labor rate per hour = Standard labor cost / Standard direct labor-hours

Standard labor rate per hour = $36,400 / 2,000 = $18.20 per hour

Finally, we can calculate the labor rate variance:

Labor rate variance = (Actual labor rate per hour - Standard labor rate per hour) x Actual direct labor-hours

Labor rate variance = ($24.90 - $18.20) x 2,290

Labor rate variance = $2,061 Unfavorable

Therefore, the best choice is B.

Learning Objectives

- Assess the variances in labor effectiveness and pay rates to evaluate the utilization of workforce and management of wage levels.

Related questions

Kartman Corporation Makes a Product with the Following Standard Costs ...

Boldrin Incorporated Has a Standard Cost System ...

Fortes Incorporated Has Provided the Following Data Concerning One of ...

Motts Incorporated Has a Standard Cost System in Which the ...

Reagen Corporation Makes a Product with the Following Standard Costs ...