Asked by Angela Trevino on Apr 24, 2024

Verified

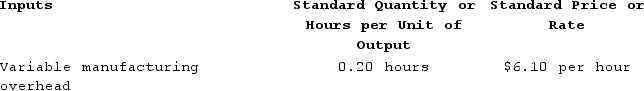

Descamps Incorporated has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.  The company has reported the following actual results for the product for July:

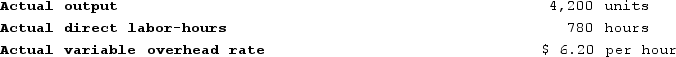

The company has reported the following actual results for the product for July:

The variable overhead rate variance for the month is closest to:

The variable overhead rate variance for the month is closest to:

A) $78 Favorable

B) $84 Favorable

C) $78 Unfavorable

D) $84 Unfavorable

Variable Overhead Rate Variance

The difference between the actual variable overhead incurred and the expected (or standard) variable overhead based on a standard rate.

Variable Manufacturing Overhead

Costs that vary with the level of production output, such as utilities or raw materials.

Direct Labor-hours

The total time workers spend working directly on manufacturing goods, often used as a basis for allocating manufacturing overhead.

- Appraise variable overhead rate variances to measure the oversight of overhead expenditures.

Verified Answer

Actual variable overhead cost = $18,540

Actual direct labor hours = 2,100

Actual variable overhead rate = Actual variable overhead cost / Actual direct labor hours

Actual variable overhead rate = $18,540 / 2,100 = $8.82 per direct labor hour

Next, calculate the expected variable overhead rate per direct labor hour:

Standard variable overhead rate per direct labor hour = $8.50 per direct labor hour

Finally, calculate the variable overhead rate variance:

Variable overhead rate variance = Actual variable overhead rate - Standard variable overhead rate

Variable overhead rate variance = $8.82 - $8.50 = $0.32 unfavorable per direct labor hour

To find the total variance, multiply the variable overhead rate variance by the actual direct labor hours:

Total variable overhead rate variance = Variable overhead rate variance x Actual direct labor hours

Total variable overhead rate variance = $0.32 x 2,100 = $672 unfavorable

Since the variance is unfavorable, the answer is either C or D. C is the best choice because it is the closest answer to $672.

Learning Objectives

- Appraise variable overhead rate variances to measure the oversight of overhead expenditures.

Related questions

Irving Corporation Makes a Product with the Following Standards for ...

The Following Standards for Variable Manufacturing Overhead Have Been Established ...

The Following Data Have Been Provided by Furr Corporation ...

Fluegge Incorporated Has Provided the Following Data Concerning One of ...

Miguez Corporation Makes a Product with the Following Standard Costs ...