Asked by Taira DeSutter on May 06, 2024

Verified

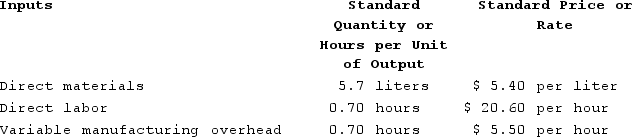

Fluegge Incorporated has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.  The company has reported the following actual results for the product for December:

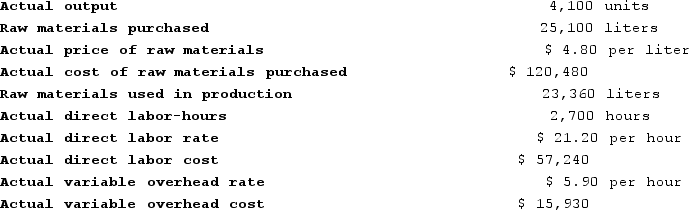

The company has reported the following actual results for the product for December:

The variable overhead rate variance for the month is closest to:

The variable overhead rate variance for the month is closest to:

A) $1,080 Unfavorable

B) $1,080 Favorable

C) $1,148 Unfavorable

D) $1,148 Favorable

Variable Overhead Rate Variance

The difference between the actual variable overhead incurred and the expected variable overhead based on standard cost accounting.

- Determine the variances in efficiency and rate for variable overhead to evaluate the management of overhead expenses.

Verified Answer

AA

Armando AraujoMay 09, 2024

Final Answer :

A

Explanation :

The variable overhead rate variance measures the difference between the actual variable overhead rate and the standard variable overhead rate, multiplied by the actual hours worked.

The actual variable overhead rate is $13,200 ÷ 1,100 hours = $12 per hour.

The standard variable overhead rate is $11 per hour.

The variable overhead rate variance is calculated as follows:

Variance = (Actual rate - Standard rate) x Actual hours

Variance = ($12 - $11) x 1,100

Variance = $1,100

Since the actual rate is higher than the standard rate, the variance is unfavorable. Therefore, the closest option is A) $1,080 unfavorable.

The actual variable overhead rate is $13,200 ÷ 1,100 hours = $12 per hour.

The standard variable overhead rate is $11 per hour.

The variable overhead rate variance is calculated as follows:

Variance = (Actual rate - Standard rate) x Actual hours

Variance = ($12 - $11) x 1,100

Variance = $1,100

Since the actual rate is higher than the standard rate, the variance is unfavorable. Therefore, the closest option is A) $1,080 unfavorable.

Learning Objectives

- Determine the variances in efficiency and rate for variable overhead to evaluate the management of overhead expenses.

Related questions

Miguez Corporation Makes a Product with the Following Standard Costs ...

Miguez Corporation Makes a Product with the Following Standard Costs ...

Kartman Corporation Makes a Product with the Following Standard Costs ...

Irving Corporation Makes a Product with the Following Standards for ...

Descamps Incorporated Has Provided the Following Data Concerning One of ...