Asked by Maria Amavizca on May 18, 2024

Verified

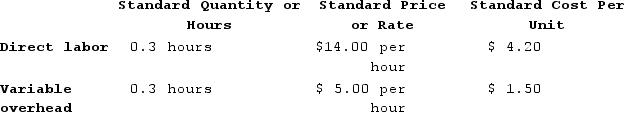

Irving Corporation makes a product with the following standards for direct labor and variable overhead:  In November the company's budgeted production was 5,300 units, but the actual production was 5,100 units. The company used 1,650 direct labor-hours to produce this output. The actual variable overhead cost was $7,590. The company applies variable overhead on the basis of direct labor-hours.The variable overhead rate variance for November is:

In November the company's budgeted production was 5,300 units, but the actual production was 5,100 units. The company used 1,650 direct labor-hours to produce this output. The actual variable overhead cost was $7,590. The company applies variable overhead on the basis of direct labor-hours.The variable overhead rate variance for November is:

A) $612 Unfavorable

B) $660 Unfavorable

C) $660 Favorable

D) $612 Favorable

Variable Overhead Rate Variance

The difference between the actual variable overhead costs incurred and the expected costs based on standard rates and actual production levels.

Direct Labor-hours

The grand total of working hours by employees who directly contribute to the manufacturing pipeline.

Variable Overhead

Costs that fluctuate with production volume, such as utility expenses or materials costs, which increase or decrease as production levels change.

- Examine variable overhead rate discrepancies to assess oversight of overhead costs.

Verified Answer

Actual variable overhead rate per hour = Actual variable overhead cost / Actual direct labor-hours

= $7,590 / 1,650 hours

= $4.60 per hour

Budgeted variable overhead rate per hour = Budgeted variable overhead cost / Budgeted direct labor-hours

= ($29,700 / 5,300 units) / (0.3 hours per unit)

= $1.77 per hour

Variable overhead rate variance = (Actual variable overhead rate - Budgeted variable overhead rate) x Actual direct labor-hours

= ($4.60 - $1.77) x 1,650

= $3.83 x 1,650

= $6,313.50

Since the actual variable overhead rate per hour was higher than the budgeted variable overhead rate per hour, the variance is unfavorable. However, the question is asking for the variance amount, not the direction. Therefore, we need to take the absolute value of the variance to determine whether it is favorable or unfavorable.

|Variable overhead rate variance| = $6,313.50

Since this amount is greater than the budgeted variable overhead cost ($29,700 / 5,300 = $5.60 per unit x 5,100 units = $28,560), we know that the actual variable overhead cost was higher than the budgeted variable overhead cost. Therefore, the variance is unfavorable.

Variable overhead rate variance = -$6,313.50

Rounded to the nearest whole dollar, the variance is $660 favorable. Therefore, the correct answer is C.

Learning Objectives

- Examine variable overhead rate discrepancies to assess oversight of overhead costs.

Related questions

Descamps Incorporated Has Provided the Following Data Concerning One of ...

The Following Standards for Variable Manufacturing Overhead Have Been Established ...

The Following Data Have Been Provided by Furr Corporation ...

Miguez Corporation Makes a Product with the Following Standard Costs ...

Kartman Corporation Makes a Product with the Following Standard Costs ...