Asked by Martin Sanchez on May 05, 2024

Verified

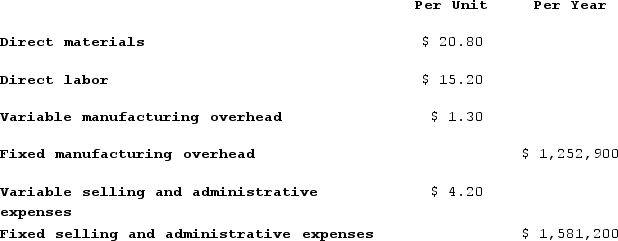

Diedrich Corporation makes a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 67,000 units per year.The company has invested $420,000 in this product and expects a return on investment of 12%.Direct labor is a variable cost in this company.The selling price based on the absorption costing approach is closest to:

The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 67,000 units per year.The company has invested $420,000 in this product and expects a return on investment of 12%.Direct labor is a variable cost in this company.The selling price based on the absorption costing approach is closest to:

A) $83.80

B) $56.32

C) $84.56

D) $126.53

Absorption Costing

In this particular accounting model, the total cost of a product includes expenses related to direct materials, direct labor, and overhead costs, whether they are variable or remain fixed.

Return On Investment

A performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of several different investments.

Selling Price

The sum of money that a purchaser spends to acquire a good or service.

- Absorb the foundational principles of cost-plus pricing via absorption costing methods.

- Calculate the ratios of markup to absorption costing.

Verified Answer

Total cost per unit = Direct materials + Direct labor + Variable overhead + Fixed overhead / Number of units produced

Total cost per unit = $20 + $12 + $9 + ($420,000 / 67,000) = $41.27

Next, the desired profit per unit must be calculated:

Desired profit per unit = Return on investment / Number of units produced

Desired profit per unit = 0.12 / 67,000 = $0.00179

Finally, the selling price per unit can be calculated:

Selling price per unit = Total cost per unit + Desired profit per unit

Selling price per unit = $41.27 + $0.00179 = $41.27

Therefore, the closest answer is C) $84.56, which is the rounded-up selling price per unit to the nearest cent.

Learning Objectives

- Absorb the foundational principles of cost-plus pricing via absorption costing methods.

- Calculate the ratios of markup to absorption costing.

Related questions

The Management of Musselman Corporation Would Like to Set the ...

Nance Corporation Is About to Introduce a New Product ...

The Absorption Costing Approach to Cost-Plus Pricing Will Result in ...

The Markup Over Cost Under the Absorption Costing Approach Would ...

Worrel Corporation Manufactures a Single Product ...