Asked by Efrain Lomeli on May 14, 2024

Verified

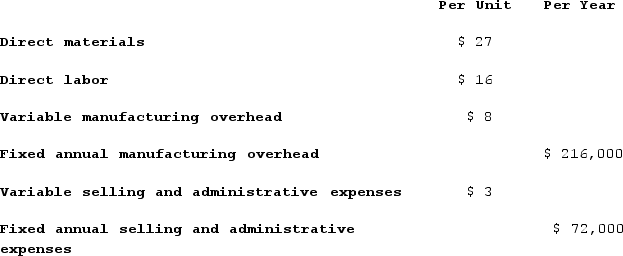

The management of Musselman Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:  Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.The markup percentage on absorption cost is closest to:

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.The markup percentage on absorption cost is closest to:

A) 25%

B) 34%

C) 15%

D) 10%

Absorption Costing

A financial tracking approach that incorporates all costs associated with producing an item, such as direct materials, direct labor, along with all manufacturing overhead costs, whether they are fixed or variable.

Markup Percentage

The percentage added to the cost of goods to achieve a selling price, representing profit margin.

Required Return

The minimum profit or yield that investors expect to receive on an investment, considering the associated risks.

- Acquire knowledge on the principles of cost-plus pricing via the use of absorption costing.

- Determine the markup ratios in relation to absorption costs.

Verified Answer

Direct materials per unit = $12

Direct labor per unit = $10

Variable overhead per unit = $4

Fixed overhead per unit = ($765,000 ÷ 9,000 units) = $85

Absorption cost per unit = $12 + $10 + $4 + $85 = $111

Next, we need to calculate the required return on investment per unit:

Investment per unit = ($1,305,000 ÷ 9,000 units) = $145

Required return on investment per unit = 10% x $145 = $14.50

Total cost per unit = $111 + $14.50 = $125.50

Finally, we can calculate the markup percentage on absorption cost:

Markup percentage on absorption cost = (Selling price - Absorption cost) ÷ Absorption cost x 100%

Solving for selling price:

Selling price = Absorption cost x (1 + Markup percentage on absorption cost ÷ 100%)

Selling price = $125.50 x (1 + Markup percentage on absorption cost ÷ 100%)

Selling price = $125.50 + $1.255 x Markup percentage on absorption cost

If the required return on investment is not included in the selling price, the company would only break even. Therefore, we need to add the $14.50 required return on investment per unit to the selling price, resulting in:

Selling price = $125.50 + $14.50 = $140

Substituting this into the markup percentage equation and solving for the markup percentage on absorption cost:

$140 = $125.50 + $1.255 x Markup percentage on absorption cost

$14.50 = $1.255 x Markup percentage on absorption cost

Markup percentage on absorption cost = $14.50 ÷ $1.255 = 11.55%

Rounding to the nearest whole percentage, the markup percentage on absorption cost is closest to 34%. Therefore, the best choice is B.

Learning Objectives

- Acquire knowledge on the principles of cost-plus pricing via the use of absorption costing.

- Determine the markup ratios in relation to absorption costs.

Related questions

Diedrich Corporation Makes a Product with the Following Costs ...

Nance Corporation Is About to Introduce a New Product ...

The Absorption Costing Approach to Cost-Plus Pricing Will Result in ...

The Markup Over Cost Under the Absorption Costing Approach Would ...

Worrel Corporation Manufactures a Single Product ...