Asked by Jocelyn 30545 Leon on Jul 21, 2024

Verified

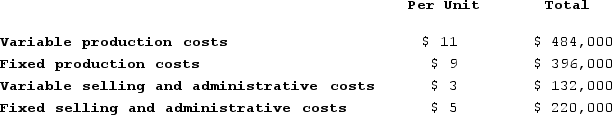

Nance Corporation is about to introduce a new product. The following costs would be incurred if 44,000 units are produced and sold each year:  Nance Corporation uses the absorption costing approach to cost-plus pricing as described in the text.Assume that the company has not yet determined a markup to use on the new product. The new product would require an investment of $1,480,000. The company requires a 30% rate of return on investment in all new products. The markup under the absorption costing approach would be closest to:

Nance Corporation uses the absorption costing approach to cost-plus pricing as described in the text.Assume that the company has not yet determined a markup to use on the new product. The new product would require an investment of $1,480,000. The company requires a 30% rate of return on investment in all new products. The markup under the absorption costing approach would be closest to:

A) 109.1%

B) 50.5%

C) 90.5%

D) 63.2%

Absorption Costing

A costing method that integrates all expenses related to the manufacturing process, including direct materials, direct labor, and overhead costs, both variable and fixed, into the final product cost.

Required Rate

Often refers to the minimum expected rate of return on an investment, taking into account the risk level.

Markup

The amount added to the cost of a product to cover expenses and profit, resulting in the selling price.

- Digest the key principles of cost-plus pricing by utilizing absorption costing.

- Establish the percentages reflecting markup over absorbed costs.

Verified Answer

Unit cost = Total cost / Number of units produced and sold

Total cost = Direct Materials cost + Direct Labor cost + Variable overhead cost + Fixed overhead cost

Total cost = $264,000 + $528,000 + $352,000 + $1,176,000

Total cost = $2,320,000

Unit cost = $2,320,000 / 44,000

Unit cost = $52.73

Now, to calculate the markup, we need to use the following formula:

Markup percentage = (Desired ROI / Total cost) + 1

Desired ROI = Investment * Rate of return

Desired ROI = $1,480,000 * 0.30

Desired ROI = $444,000

Markup percentage = ($444,000 / $2,320,000) + 1

Markup percentage = 1.191

Markup percentage = 119.1%

However, since it is asking for the markup closest to, we need to round the answer.

The closest markup would be 90.5%.

Learning Objectives

- Digest the key principles of cost-plus pricing by utilizing absorption costing.

- Establish the percentages reflecting markup over absorbed costs.

Related questions

Diedrich Corporation Makes a Product with the Following Costs ...

The Management of Musselman Corporation Would Like to Set the ...

The Absorption Costing Approach to Cost-Plus Pricing Will Result in ...

The Markup Over Cost Under the Absorption Costing Approach Would ...

Worrel Corporation Manufactures a Single Product ...