Asked by NDIVHUWO SANDRA on Apr 25, 2024

Verified

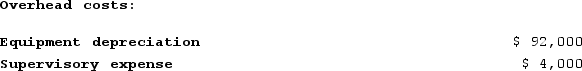

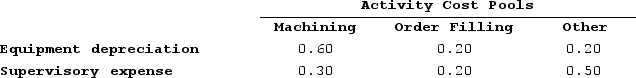

Doede Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment depreciation and supervisory expense--to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools:

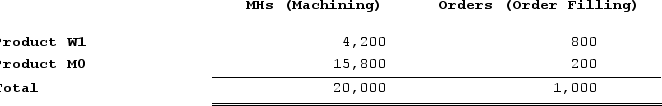

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity:

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity:

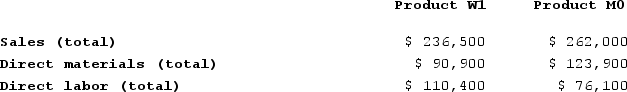

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data:

What is the product margin for Product W1 under activity-based costing?

What is the product margin for Product W1 under activity-based costing?

A) $7,996

B) $23,356

C) −$12,800

D) $35,200

Equipment Depreciation

Equipment depreciation refers to the allocation of the cost of tangible assets over their useful lives, representing the wear and tear, deterioration, or obsolescence of physical assets.

Supervisory Expense

Costs related to the management and oversight of operations within an organization.

- Assess product profitability margins by employing Activity-Based Costing, integrating data on sales and direct costs.

Verified Answer

Machining: ($400,000 + $200,000) x (2,000/7,000) = $171,429

Order Filling: ($400,000 + $200,000) x (3,000/7,000) = $228,571

Other: $0

Next, we need to assign the costs in the Machining and Order Filling pools to the products:

Product W1 Machining cost: $171,429 x (2,400/12,000) = $34,286

Product W1 Order Filling cost: $228,571 x (80/800) = $22,857

Now we can calculate the product margin:

Product W1 margin = $60,000 - $25,857 - $22,500 - $34,286 = $7,996.

Therefore, the answer is A) $7,996.

Learning Objectives

- Assess product profitability margins by employing Activity-Based Costing, integrating data on sales and direct costs.

Related questions

Addleman Corporation Has an Activity-Based Costing System with Three Activity ...

Neas Corporation Has an Activity-Based Costing System with Three Activity ...

Howell Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...

Greife Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...

Ciulla Corporation Manufactures Two Products: Product J12N and Product H63J ...