Asked by Srishti Sharma on May 18, 2024

Verified

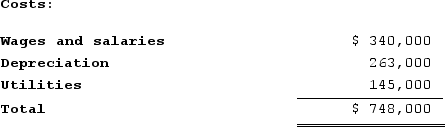

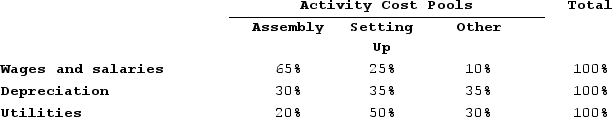

Eccles Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system:  Distribution of resource consumption:

Distribution of resource consumption:

How much cost, in total, would be allocated in the first-stage allocation to the Assembly activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Assembly activity cost pool?

A) $316,233

B) $328,900

C) $486,200

D) $149,600

Activity-based Costing

A costing method that assigns costs to products or services based on the activities they require.

First-stage Allocation

The initial process of assigning overhead costs to different departments or cost centers in a business based on relevant criteria.

- Comprehend the initial and subsequent allocations in Activity-Based Costing.

- Understand the significance of cost pools in Activity-Based Costing and their influence on the distribution of costs.

Verified Answer

XF

Xavian FairleyMay 24, 2024

Final Answer :

B

Explanation :

To calculate the cost allocated to the Assembly activity cost pool, we need to multiply the cost driver rate for each activity by the amount of activity consumed by the pool.

For Assembly activity cost pool:

Cost driver rate = Total cost of Assembly activity / Total units of cost driver

= $558,000 / 1,500 machine-hours

= $372 per machine-hour

Activity consumption:

Assembly activity = 880 machine-hours

Cost allocated to Assembly activity cost pool = 372 x 880 = $328,900

Therefore, the correct answer is B.

For Assembly activity cost pool:

Cost driver rate = Total cost of Assembly activity / Total units of cost driver

= $558,000 / 1,500 machine-hours

= $372 per machine-hour

Activity consumption:

Assembly activity = 880 machine-hours

Cost allocated to Assembly activity cost pool = 372 x 880 = $328,900

Therefore, the correct answer is B.

Learning Objectives

- Comprehend the initial and subsequent allocations in Activity-Based Costing.

- Understand the significance of cost pools in Activity-Based Costing and their influence on the distribution of costs.

Related questions

In the First-Stage Allocation in an ABC System, Some Costs ...

Mayeux Corporation Uses an Activity-Based Costing System with Three Activity ...

Gutknecht Corporation Uses an Activity-Based Costing System with Three Activity ...

In the Second-Stage Allocation in Activity-Based Costing, Costs That Were ...

First-Stage Allocations in an ABC System Should Not Be Based ...