Asked by Nefetiti Easter on Jun 13, 2024

Verified

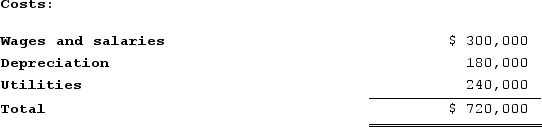

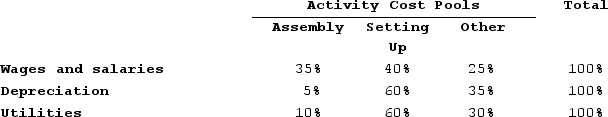

Gutknecht Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity-based costing system:  Distribution of resource consumption:

Distribution of resource consumption:

How much cost, in total, would be allocated in the first-stage allocation to the Other activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Other activity cost pool?

A) $138,000

B) $210,000

C) $180,000

D) $216,000

Resource Consumption

The amount of resources used during a process, such as raw materials, energy, or labor.

- Gain an understanding of primary and secondary allocations within Activity-Based Costing.

- Acknowledge the importance of cost pools in Activity-Based Costing and their effect on allocating costs.

Verified Answer

SC

Suléze CronjéJun 18, 2024

Final Answer :

B

Explanation :

To allocate costs in the first stage, we need to add up the total overhead costs and allocate them based on the activity cost drivers.

Total overhead costs = $1,470,000 + $600,000 + $330,000 = $2,400,000

Allocating costs to Other activity cost pool:

Other cost driver rate = $600,000 / 3,000 machine-hours = $200 per machine-hour

Activity consumption for Other = 900 machine-hours

Cost allocated to Other = $200 per machine-hour x 900 machine-hours = $180,000

Thus, the total cost allocated to the Other activity cost pool in the first-stage allocation is $180,000. Therefore, the best choice is B.

Total overhead costs = $1,470,000 + $600,000 + $330,000 = $2,400,000

Allocating costs to Other activity cost pool:

Other cost driver rate = $600,000 / 3,000 machine-hours = $200 per machine-hour

Activity consumption for Other = 900 machine-hours

Cost allocated to Other = $200 per machine-hour x 900 machine-hours = $180,000

Thus, the total cost allocated to the Other activity cost pool in the first-stage allocation is $180,000. Therefore, the best choice is B.

Learning Objectives

- Gain an understanding of primary and secondary allocations within Activity-Based Costing.

- Acknowledge the importance of cost pools in Activity-Based Costing and their effect on allocating costs.

Related questions

In the First-Stage Allocation in an ABC System, Some Costs ...

Mayeux Corporation Uses an Activity-Based Costing System with Three Activity ...

In the Second-Stage Allocation in Activity-Based Costing, Costs That Were ...

Eccles Corporation Uses an Activity-Based Costing System with Three Activity ...

In an ABC System, Departmental Managers Are Typically Interviewed to ...