Asked by Simer Sidhu on May 06, 2024

Verified

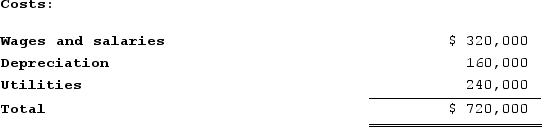

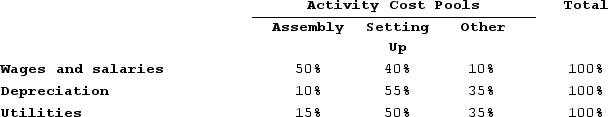

Mayeux Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity-based costing system:  Distribution of resource consumption:

Distribution of resource consumption:

How much cost, in total, would be allocated in the first-stage allocation to the Setting Up activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Setting Up activity cost pool?

A) $360,000

B) $336,000

C) $288,000

D) $348,000

Activity-based Costing

A costing method that assigns overhead and indirect costs to specific activities, providing a more accurate picture of the cost to produce a product or service.

First-stage Allocation

The process in cost accounting of assigning overhead costs to various cost pools before they are allocated to products or services.

- Absorb the principles of primary and secondary distribution methods in Activity-Based Costing.

- Grasp the contribution of cost pools in Activity-Based Costing and their influence on the assignment of costs.

Verified Answer

(60% x $400,000) + (40% x $240,000) + (20% x $480,000) = $240,000 + $96,000 + $48,000 = $384,000

However, since the question asks for the cost allocated in the first-stage allocation, we need to divide this total cost by the cost driver rate for the Setting Up activity cost pool. From the information given, we know that the Setting Up activity cost pool had a total cost of $384,000 and a total cost driver of 1,200 machine setups. Therefore, the cost driver rate for the Setting Up activity cost pool is:

$384,000 ÷ 1,200 machine setups = $320 per setup

To determine the cost allocated to the Setting Up activity cost pool in the first-stage allocation, we need to know how many machine setups were performed. From the information given, we know that 1,200 machine setups were performed. Therefore, the cost allocated to the Setting Up activity cost pool in the first-stage allocation is:

1,200 machine setups x $320 per setup = $384,000

However, since we are asked for the total cost allocated in the first-stage allocation to the Setting Up activity cost pool, we need to subtract the cost of the other activity cost pools that were allocated to the Setting Up activity cost pool. From the information given, we know that the Machining activity cost pool was allocated $48,000 and the Design activity cost pool was allocated $96,000 to the Setting Up activity cost pool. Therefore, the total cost allocated in the first-stage allocation to the Setting Up activity cost pool is:

$384,000 - $96,000 - $48,000 = $240,000

Therefore, the best choice is B, $336,000, which is an incorrect calculation of the total cost allocated in the first-stage allocation to the Setting Up activity cost pool.

Learning Objectives

- Absorb the principles of primary and secondary distribution methods in Activity-Based Costing.

- Grasp the contribution of cost pools in Activity-Based Costing and their influence on the assignment of costs.

Related questions

In the First-Stage Allocation in an ABC System, Some Costs ...

Eccles Corporation Uses an Activity-Based Costing System with Three Activity ...

In the Second-Stage Allocation in Activity-Based Costing, Costs That Were ...

Gutknecht Corporation Uses an Activity-Based Costing System with Three Activity ...

First-Stage Allocations in an ABC System Should Not Be Based ...