AL

Adrianna Licka

Answers (3)

AL

Answered

Under The Family and Medical Leave Act of 1993, employers covered under the act do not have to maintain preexisting employee health insurance during the leave period.

On Sep 28, 2024

False

AL

Answered

According to the textbook,your communication style involves the choices you make to express yourself.Which one of the following will not have an effect on your communication style?

A) The words you select

B) The way you use words in sentences

C) The way you build paragraphs from individual sentences

D) None of the above.

A) The words you select

B) The way you use words in sentences

C) The way you build paragraphs from individual sentences

D) None of the above.

On Sep 24, 2024

D

AL

Answered

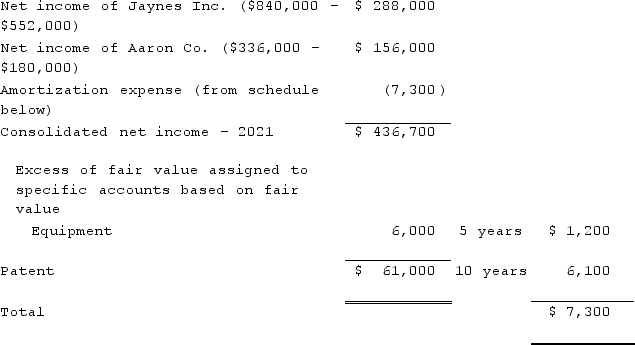

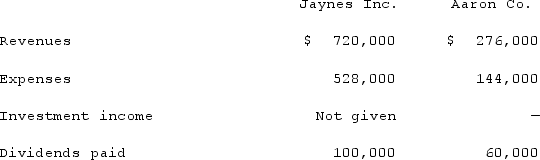

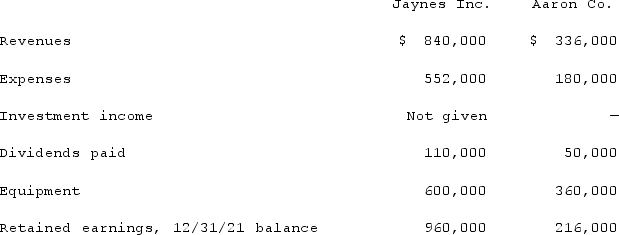

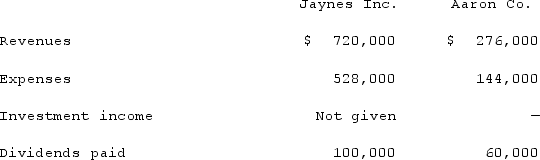

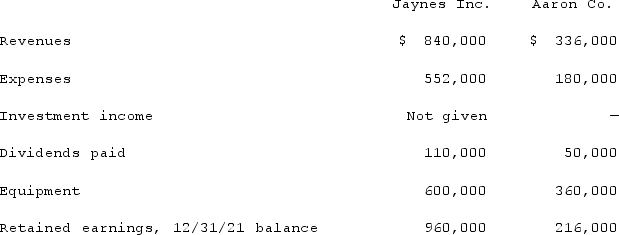

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2020, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities acquired is assigned to an unrecorded patent to be amortized over ten years.The following figures came from the individual accounting records of these two companies as of December 31, 2020:  The following figures came from the individual accounting records of these two companies as of December 31, 2021:

The following figures came from the individual accounting records of these two companies as of December 31, 2021:  What was consolidated net income for the year ended December 31, 2021?

What was consolidated net income for the year ended December 31, 2021?

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

The following figures came from the individual accounting records of these two companies as of December 31, 2021:  What was consolidated net income for the year ended December 31, 2021?

What was consolidated net income for the year ended December 31, 2021?On Sep 23, 2024