KC

Kassu Chathu

Answers (6)

KC

Answered

Mark and his wife Jean had recently built a country home on a one-acre lot. Initially overwhelmed by the size of the lawn Mark arranged for Stanley, a neighbouring farmer, to cut their lawn with his riding mower. The first cut was difficult and time consuming as there were many tall grasses and weeds to cut through. On this occasion, Stanley charged $300. One week later, Stanley cut the lawn again and charged Mark $200. Reflecting on the substantial expense this represented, Mark thanked Stanley for his services and informed him that he planned to purchase his own lawn mower and take over the job himself. Mark also told Stanley that if he were stuck in the future, he would call Stanley to help him out. Shortly thereafter Mark and Jean took a two-week vacation and on arriving home discovered that Stanley had mowed their lawn in their absence. There was an invoice stuck to their door stating $200 for mowing services and $100 for weed spraying. When questioned about the bill Stanley explained that he understood Mark wanted him to mow the lawn if he were unable to.

What legal issues does this situation raise and what arguments would be used by the parties involved?

What legal issues does this situation raise and what arguments would be used by the parties involved?

On Jul 31, 2024

This case explores the principles of consideration and quantum meruit. Students should point out that the act of lawn mowing while the residents were on vacation was a gratuitous act although the argument may be raised by Stanley that a prior agreement existed to provide the services. This argument would be based on the notion that a unilateral agreement existed that Stanley interpreted as an invitation to perform his services when Mark was unable to, in return for payment on a quantum meruit basis. The appropriate amount to be assessed as reasonable would be $200, the amount previously paid by Mark for the same service. The facts here do not adequately support this notion. Furthermore, it is clear that the weed spraying service was entirely gratuitous, and Mark need not make any payment for this. Students should outline the principles of these issues in discussing the arguments of the parties.

KC

Answered

John, a new employee, is not sure of the effect the following unrelated situations would have on the accuracy of the financial statements. Identify the account(s) that are affected and if the trial balance would balance.

a. Equipment was purchased for $900 cash. The debit was recorded properly, but the credit was omitted.

b. A debit to Cash for $250 was posted as $2,500; the credit was posted correctly.

c. A purchase of supplies on account for $75 was posted as a debit to Supplies and a credit to Cash.

a. Equipment was purchased for $900 cash. The debit was recorded properly, but the credit was omitted.

b. A debit to Cash for $250 was posted as $2,500; the credit was posted correctly.

c. A purchase of supplies on account for $75 was posted as a debit to Supplies and a credit to Cash.

On Jul 28, 2024

a. Cash is overstated by $900; the debit side is $900 greater than the credit side on the trial balance. The trial balance would not balance.

b. Cash is overstated by $2,250; the debit side is $2,250 greater than the credit side on the trial balance. The trial balance would not balance.

c. Accounts Payable and Cash are both understated by $75. The trial balance would balance.

b. Cash is overstated by $2,250; the debit side is $2,250 greater than the credit side on the trial balance. The trial balance would not balance.

c. Accounts Payable and Cash are both understated by $75. The trial balance would balance.

KC

Answered

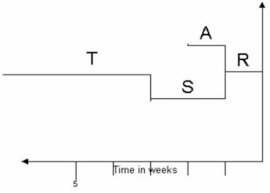

Each R requires 3 of component S and 3 of material A; each S requires 3 of part T. The lead time for assembly of R is 1 week. The lead time for the manufacture of S is 2 weeks. The lead time for material A is 1 week. The lead time for the procurement of T is 4 weeks.

a. Construct the time-phased product structure.

b. Construct the bill of material.

a. Construct the time-phased product structure.

b. Construct the bill of material.

On Jul 01, 2024

Bill of Material Item Quantity R1S(3)3T(3)9A(3)3\begin{array} { | c | c | c | c | } \hline { \text { Bill of Material } } \\\hline \text { Item } & & & \text { Quantity } \\\hline R & & & 1 \\\hline & \mathrm { S } ( 3 ) & & 3 \\\hline & & \mathrm { T } ( 3 ) & 9 \\\hline & \mathrm { A } ( 3 ) & & 3 \\\hline\end{array} Bill of Material Item RS(3)A(3)T(3) Quantity 1393

KC

Answered

Tyler has joined a start-up manufacturing company as its human resource manager. One of his first responsibilities is to make sure the company complies with the OSH Act. Under this law, what records must Tyler keep?

A) a list of violations of the general-duty clause

B) work-related injuries, plus an annual summary of employee illnesses

C) work-related injuries and illnesses, with an annual summary of these

D) schedule of employee-requested OSHA inspections

E) responses to questions in OSHA's Small Business Handbook

A) a list of violations of the general-duty clause

B) work-related injuries, plus an annual summary of employee illnesses

C) work-related injuries and illnesses, with an annual summary of these

D) schedule of employee-requested OSHA inspections

E) responses to questions in OSHA's Small Business Handbook

On Jun 28, 2024

C

KC

Answered

The current stock price of KMW is $27, the risk-free rate of return is 4%, and the standard deviation is 30%. What is the price of a 63-day call option with an exercise price of $25?

A) $2.50

B) $2.65

C) $2.89

D) $3.12

A) $2.50

B) $2.65

C) $2.89

D) $3.12

On Jun 01, 2024

B

KC

Answered

Because resources are scarce,the true cost of anything is its opportunity cost.

On May 29, 2024

True