NP

Nirav Parmar

Answers (6)

NP

Answered

Potter owes George $500.Potter writes a check payable to George for that amount.Later,George loses the check.Potter is now discharged from his liability on the check.

On Jul 21, 2024

False

NP

Answered

The term chronemics reflects:

A) communication through the use of color

B) gender differences

C) status differences

D) the use of time in a culture

A) communication through the use of color

B) gender differences

C) status differences

D) the use of time in a culture

On Jul 18, 2024

D

NP

Answered

Investments in debt and equity securities that are held for current resale by banks and stockbrokerage firms are termed

A) available-for-sale securities

B) trading securities

C) held-to-maturity securities

D) marketable securities

A) available-for-sale securities

B) trading securities

C) held-to-maturity securities

D) marketable securities

On Jun 20, 2024

B

NP

Answered

A owns 80% of B and B owns 60% of C.If C pays a dividend and B distributes the amount received to its own shareholders,the allocation of the dividend will be:

A) parent 48%, NCI 52%.

B) parent 52%, NCI 48%.

C) parent 100%.

D) NCI 100%.

A) parent 48%, NCI 52%.

B) parent 52%, NCI 48%.

C) parent 100%.

D) NCI 100%.

On Jun 17, 2024

A

NP

Answered

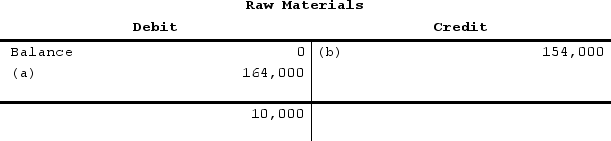

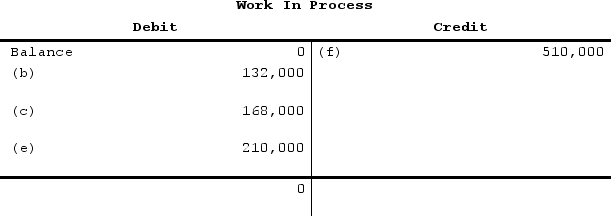

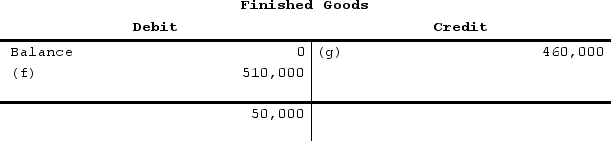

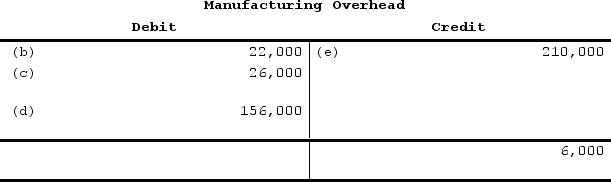

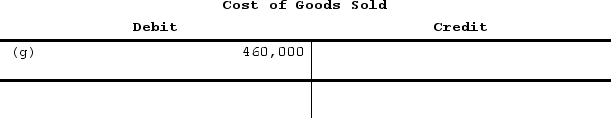

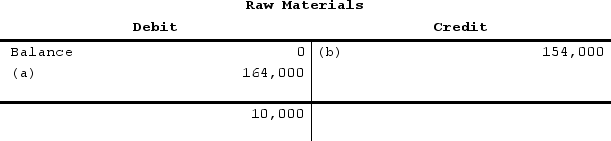

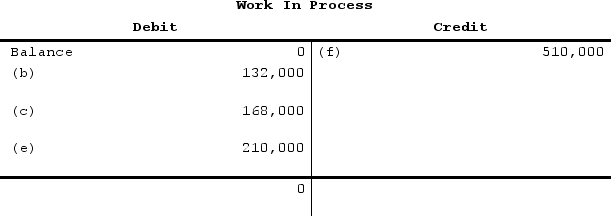

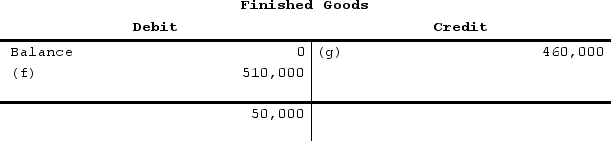

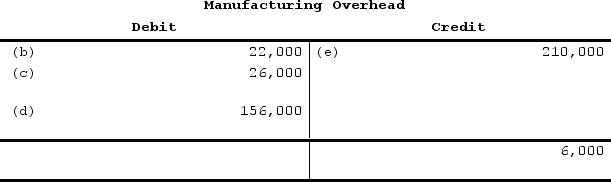

The following accounts are from last year's books at Sharp Manufacturing:

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. What is the manufacturing overhead overapplied or underapplied for the year?

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. What is the manufacturing overhead overapplied or underapplied for the year?

A) $6,000 underapplied

B) $6,000 overapplied

C) $26,000 underapplied

D) $26,000 overapplied

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. What is the manufacturing overhead overapplied or underapplied for the year?

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. What is the manufacturing overhead overapplied or underapplied for the year?A) $6,000 underapplied

B) $6,000 overapplied

C) $26,000 underapplied

D) $26,000 overapplied

On May 21, 2024

B

NP

Answered

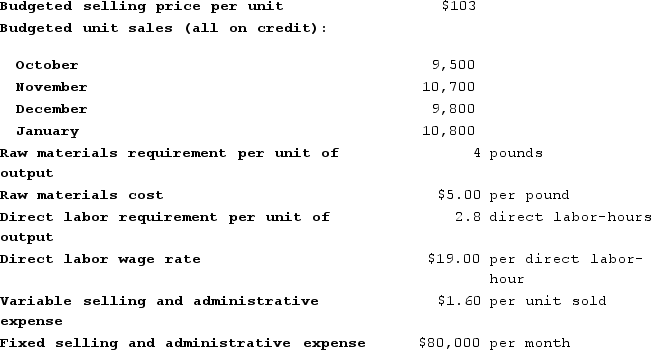

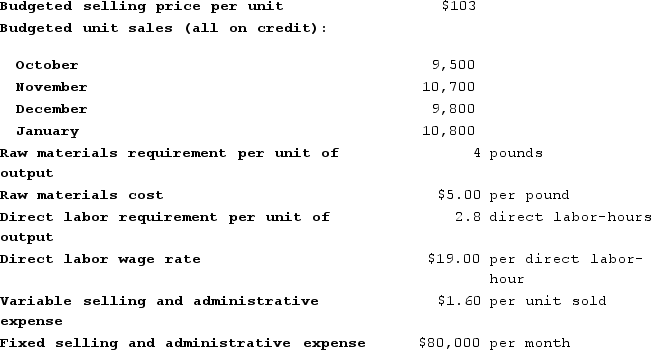

Mumbower Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations:

On May 18, 2024

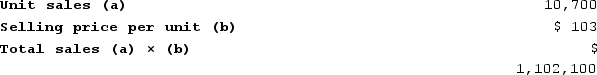

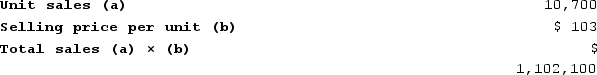

a. The budgeted sales for November are computed as follows:

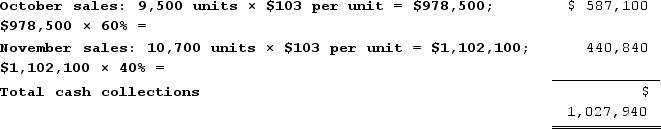

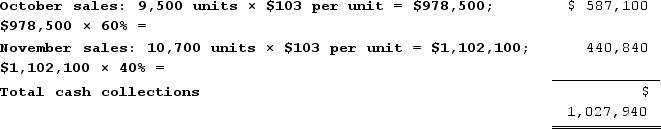

b. The expected cash collections for November are computed as follows:

b. The expected cash collections for November are computed as follows:

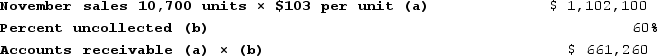

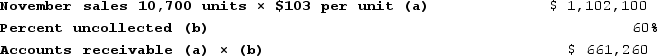

c. The budgeted accounts receivable balance at the end of November is:

c. The budgeted accounts receivable balance at the end of November is:

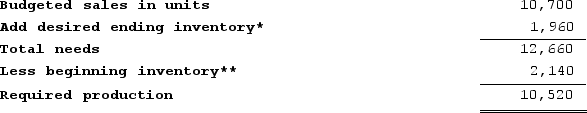

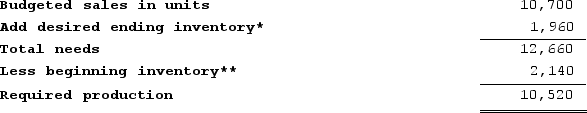

d. The budgeted required production for November is computed as follows:

d. The budgeted required production for November is computed as follows:

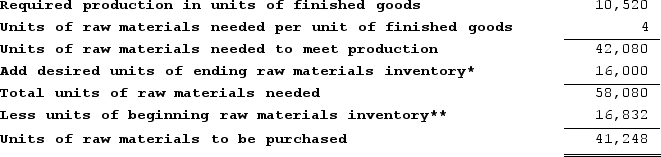

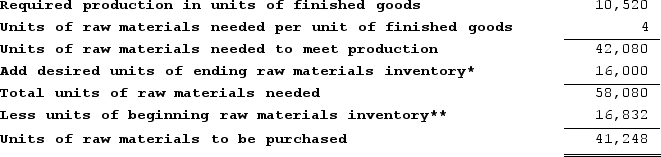

*December sales of 9,800 units × 20% = 1,960 units** November sales of 10,700 units × 20%= 2,140 unitse. The budgeted raw material purchases for November are computed as follows:

*December sales of 9,800 units × 20% = 1,960 units** November sales of 10,700 units × 20%= 2,140 unitse. The budgeted raw material purchases for November are computed as follows:

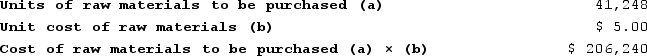

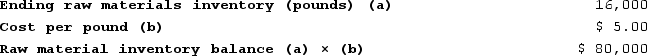

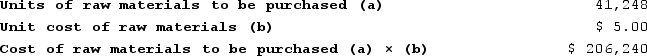

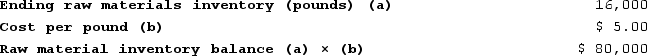

* 40,000 pounds × 40% = 16,000 pounds.** 42,080 pounds × 40% = 16,832 pounds.f. The budgeted cost of raw material purchases for November is computed as follows:

* 40,000 pounds × 40% = 16,000 pounds.** 42,080 pounds × 40% = 16,832 pounds.f. The budgeted cost of raw material purchases for November is computed as follows:

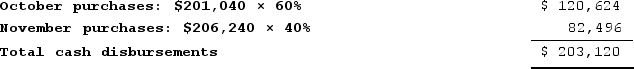

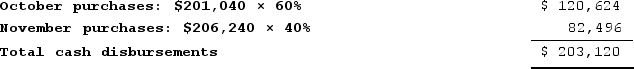

g. The estimated cash disbursements for materials purchases in November is computed as follows:

g. The estimated cash disbursements for materials purchases in November is computed as follows:

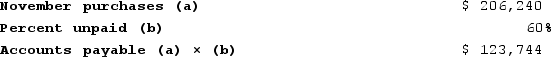

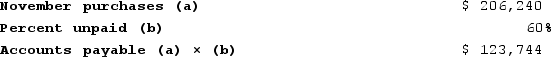

h. The budgeted accounts payable balance at the end of November is:

h. The budgeted accounts payable balance at the end of November is:

i. The estimated raw materials inventory balance at the end of November is computed as follows:

i. The estimated raw materials inventory balance at the end of November is computed as follows:

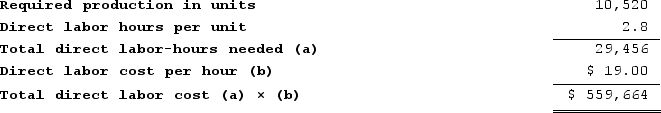

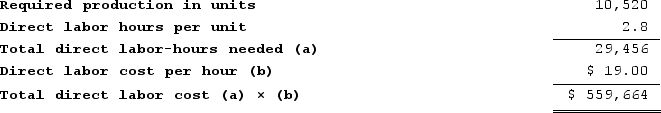

j. The estimated direct labor cost for November is computed as follows:

j. The estimated direct labor cost for November is computed as follows:

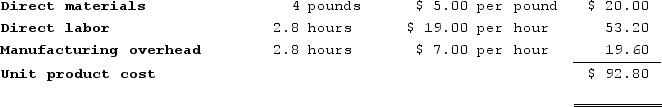

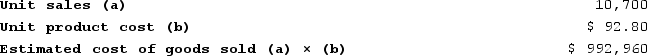

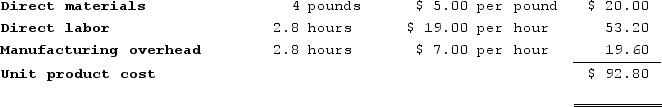

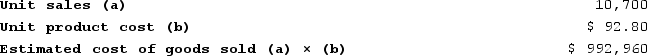

k. The estimated unit product cost is computed as follows:

k. The estimated unit product cost is computed as follows:

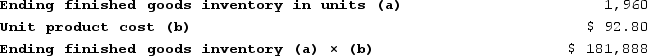

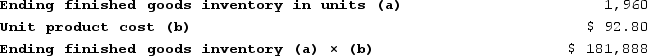

l. The estimated finished goods inventory balance at the end of November is computed as follows:

l. The estimated finished goods inventory balance at the end of November is computed as follows:

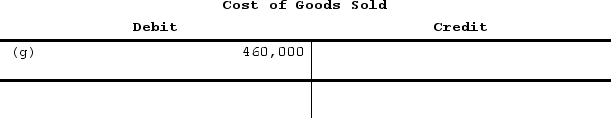

m. The estimated cost of goods sold for November is computed as follows:

m. The estimated cost of goods sold for November is computed as follows:

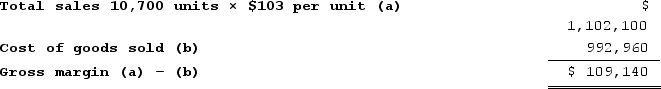

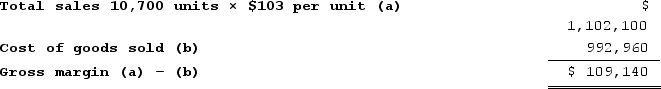

The estimated gross margin for November is computed as follows:

The estimated gross margin for November is computed as follows:

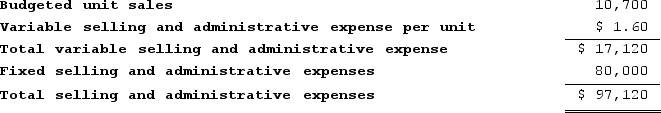

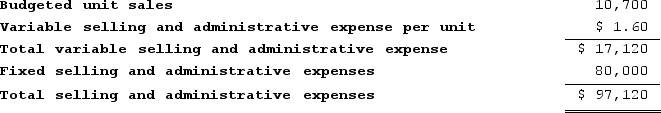

n. The estimated selling and administrative expense for November is computed as follows:

n. The estimated selling and administrative expense for November is computed as follows:

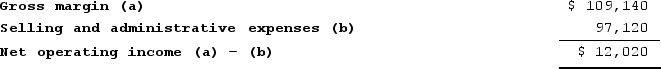

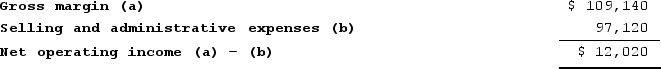

o. The estimated net operating income for November is computed as follows:

o. The estimated net operating income for November is computed as follows:

Credit sales are collected:

Credit sales are collected:

40% in the month of the sale

60% in the following monthRaw materials purchases are paid:

40% in the month of purchase

60% in the following monthThe ending finished goods inventory should equal 20% of the following month's sales. The ending raw materials inventory should equal 40% of the following month's raw materials production needs.Required:a. What are the budgeted sales for November?b. What are the expected cash collections for November?c. What is the budgeted accounts receivable balance at the end of November?d. According to the production budget, how many units should be produced in November?e. If 40,000 pounds of raw materials are needed for production in December, how many pounds of raw materials should be purchased in November?f. What is the estimated cost of raw materials purchases for November?g. If the cost of raw material purchases in October is $201,040, then in November what are the total estimated cash disbursements for raw materials purchases?h. What is the estimated accounts payable balance at the end of November?i. What is the estimated raw materials inventory balance at the end of November?j. What is the total estimated direct labor cost for November assuming the direct labor workforce is adjusted to match the hours required to produce the forecasted number of units produced?k. For simplicity, we will assume that there is no fixed manufacturing overhead and that the variable manufacturing overhead is $7.00 per direct labor-hour. What is the estimated unit product cost?l. What is the estimated finished goods inventory balance at the end of November?m. What is the estimated cost of goods sold and gross margin for November?n. What is the estimated total selling and administrative expense for November?o. What is the estimated net operating income for November?

b. The expected cash collections for November are computed as follows:

b. The expected cash collections for November are computed as follows: c. The budgeted accounts receivable balance at the end of November is:

c. The budgeted accounts receivable balance at the end of November is: d. The budgeted required production for November is computed as follows:

d. The budgeted required production for November is computed as follows: *December sales of 9,800 units × 20% = 1,960 units** November sales of 10,700 units × 20%= 2,140 unitse. The budgeted raw material purchases for November are computed as follows:

*December sales of 9,800 units × 20% = 1,960 units** November sales of 10,700 units × 20%= 2,140 unitse. The budgeted raw material purchases for November are computed as follows: * 40,000 pounds × 40% = 16,000 pounds.** 42,080 pounds × 40% = 16,832 pounds.f. The budgeted cost of raw material purchases for November is computed as follows:

* 40,000 pounds × 40% = 16,000 pounds.** 42,080 pounds × 40% = 16,832 pounds.f. The budgeted cost of raw material purchases for November is computed as follows: g. The estimated cash disbursements for materials purchases in November is computed as follows:

g. The estimated cash disbursements for materials purchases in November is computed as follows: h. The budgeted accounts payable balance at the end of November is:

h. The budgeted accounts payable balance at the end of November is: i. The estimated raw materials inventory balance at the end of November is computed as follows:

i. The estimated raw materials inventory balance at the end of November is computed as follows: j. The estimated direct labor cost for November is computed as follows:

j. The estimated direct labor cost for November is computed as follows: k. The estimated unit product cost is computed as follows:

k. The estimated unit product cost is computed as follows: l. The estimated finished goods inventory balance at the end of November is computed as follows:

l. The estimated finished goods inventory balance at the end of November is computed as follows: m. The estimated cost of goods sold for November is computed as follows:

m. The estimated cost of goods sold for November is computed as follows: The estimated gross margin for November is computed as follows:

The estimated gross margin for November is computed as follows: n. The estimated selling and administrative expense for November is computed as follows:

n. The estimated selling and administrative expense for November is computed as follows: o. The estimated net operating income for November is computed as follows:

o. The estimated net operating income for November is computed as follows: Credit sales are collected:

Credit sales are collected:40% in the month of the sale

60% in the following monthRaw materials purchases are paid:

40% in the month of purchase

60% in the following monthThe ending finished goods inventory should equal 20% of the following month's sales. The ending raw materials inventory should equal 40% of the following month's raw materials production needs.Required:a. What are the budgeted sales for November?b. What are the expected cash collections for November?c. What is the budgeted accounts receivable balance at the end of November?d. According to the production budget, how many units should be produced in November?e. If 40,000 pounds of raw materials are needed for production in December, how many pounds of raw materials should be purchased in November?f. What is the estimated cost of raw materials purchases for November?g. If the cost of raw material purchases in October is $201,040, then in November what are the total estimated cash disbursements for raw materials purchases?h. What is the estimated accounts payable balance at the end of November?i. What is the estimated raw materials inventory balance at the end of November?j. What is the total estimated direct labor cost for November assuming the direct labor workforce is adjusted to match the hours required to produce the forecasted number of units produced?k. For simplicity, we will assume that there is no fixed manufacturing overhead and that the variable manufacturing overhead is $7.00 per direct labor-hour. What is the estimated unit product cost?l. What is the estimated finished goods inventory balance at the end of November?m. What is the estimated cost of goods sold and gross margin for November?n. What is the estimated total selling and administrative expense for November?o. What is the estimated net operating income for November?