OO

Oskarsson, Olivia

Answers (6)

OO

Answered

Opportunity cost of an activity

A) Is included in accounting costs

B) Does not include monetary costs

C) May include both monetary costs and foregone incomes

D) Is known with certainty

A) Is included in accounting costs

B) Does not include monetary costs

C) May include both monetary costs and foregone incomes

D) Is known with certainty

On Jul 19, 2024

C

OO

Answered

In law, negligence is the failure to honour established contracts.

On Jul 16, 2024

False

OO

Answered

Which account is not classified as a selling expense?

A) Sales Salaries

B) Delivery Expense

C) Cost of Goods Sold

D) Advertising Expense

A) Sales Salaries

B) Delivery Expense

C) Cost of Goods Sold

D) Advertising Expense

On Jun 18, 2024

C

OO

Answered

How do services differ from goods? Identify five ways.

On Jun 15, 2024

Pick from the following: a service is usually intangible; it is often produced and consumed simultaneously; often unique; it involves high customer interaction; product definition is inconsistent; often knowledge-based; and frequently dispersed.

OO

Answered

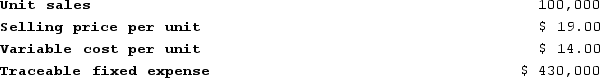

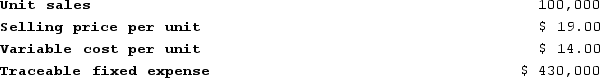

Algood Corporation manufactures numerous products, one of which is called Omicron09. The company has provided the following data about this product:

Required:a. What net operating income is the company earning now on its sales of Omicron09?

Required:a. What net operating income is the company earning now on its sales of Omicron09?

b. Management is considering decreasing the price of Omicron09 by 5%, from $19.00 to $18.05. The company's marketing managers estimate that this price reduction would increase unit sales by 15%, from 100,000 units to 115,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will Omicron09 earn at a price of $18.05 if this sales forecast is correct?

c. Assuming that the total traceable fixed expense does not change, how many units of Omicron09 would Algood need to sell at a price of $18.05 to earn the same net operating income that it currently earns at a price of $19.00? (Round your answer up to the nearest whole number.)

Required:a. What net operating income is the company earning now on its sales of Omicron09?

Required:a. What net operating income is the company earning now on its sales of Omicron09?b. Management is considering decreasing the price of Omicron09 by 5%, from $19.00 to $18.05. The company's marketing managers estimate that this price reduction would increase unit sales by 15%, from 100,000 units to 115,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will Omicron09 earn at a price of $18.05 if this sales forecast is correct?

c. Assuming that the total traceable fixed expense does not change, how many units of Omicron09 would Algood need to sell at a price of $18.05 to earn the same net operating income that it currently earns at a price of $19.00? (Round your answer up to the nearest whole number.)

On May 19, 2024

a.

b.The profit at the price of $18.05 per unit is computed as follows:Profit = (Selling price per unit − Variable cost per unit) × Quantity sold − Fixed expensesProfit = ($18.05 per unit − $14.00 per unit) × 115,000 units − $430,000Profit = ($4.05 per unit) × 115,000 units − $430,000Profit = $465,750 − $430,000 = $35,750c.Profit = (Selling price per unit − Variable cost per unit) × Quantity sold − Fixed expenses$70,000 = ($18.05 per unit − $14.00 per unit) × Quantity sold − $430,000$500,000 = ($18.05 per unit − $14.00 per unit) × Quantity sold$500,000 = ($4.05 per unit) × Quantity soldQuantity sold = $500,000 ÷ $4.05 per unit = 123,457 units (rounded up)

b.The profit at the price of $18.05 per unit is computed as follows:Profit = (Selling price per unit − Variable cost per unit) × Quantity sold − Fixed expensesProfit = ($18.05 per unit − $14.00 per unit) × 115,000 units − $430,000Profit = ($4.05 per unit) × 115,000 units − $430,000Profit = $465,750 − $430,000 = $35,750c.Profit = (Selling price per unit − Variable cost per unit) × Quantity sold − Fixed expenses$70,000 = ($18.05 per unit − $14.00 per unit) × Quantity sold − $430,000$500,000 = ($18.05 per unit − $14.00 per unit) × Quantity sold$500,000 = ($4.05 per unit) × Quantity soldQuantity sold = $500,000 ÷ $4.05 per unit = 123,457 units (rounded up)

b.The profit at the price of $18.05 per unit is computed as follows:Profit = (Selling price per unit − Variable cost per unit) × Quantity sold − Fixed expensesProfit = ($18.05 per unit − $14.00 per unit) × 115,000 units − $430,000Profit = ($4.05 per unit) × 115,000 units − $430,000Profit = $465,750 − $430,000 = $35,750c.Profit = (Selling price per unit − Variable cost per unit) × Quantity sold − Fixed expenses$70,000 = ($18.05 per unit − $14.00 per unit) × Quantity sold − $430,000$500,000 = ($18.05 per unit − $14.00 per unit) × Quantity sold$500,000 = ($4.05 per unit) × Quantity soldQuantity sold = $500,000 ÷ $4.05 per unit = 123,457 units (rounded up)

b.The profit at the price of $18.05 per unit is computed as follows:Profit = (Selling price per unit − Variable cost per unit) × Quantity sold − Fixed expensesProfit = ($18.05 per unit − $14.00 per unit) × 115,000 units − $430,000Profit = ($4.05 per unit) × 115,000 units − $430,000Profit = $465,750 − $430,000 = $35,750c.Profit = (Selling price per unit − Variable cost per unit) × Quantity sold − Fixed expenses$70,000 = ($18.05 per unit − $14.00 per unit) × Quantity sold − $430,000$500,000 = ($18.05 per unit − $14.00 per unit) × Quantity sold$500,000 = ($4.05 per unit) × Quantity soldQuantity sold = $500,000 ÷ $4.05 per unit = 123,457 units (rounded up)OO

Answered

Refer to Table 17-4. What is the socially efficient quantity of the product?

A) 35

B) 25

C) 50

D) 60

A) 35

B) 25

C) 50

D) 60

On May 16, 2024

C