PJ

Punnapat Jirasarunpat

Answers (6)

PJ

Answered

If the wage rate in a purely competitive labor market increases, it will cause the

A) marginal resource cost curve for a single competitive firm in the industry to shift down.

B) marginal resource cost curve for a single competitive firm in the industry to shift up.

C) labor supply curve for a single competitive firm to shift downward.

D) labor supply curve for the industry to shift rightward.

A) marginal resource cost curve for a single competitive firm in the industry to shift down.

B) marginal resource cost curve for a single competitive firm in the industry to shift up.

C) labor supply curve for a single competitive firm to shift downward.

D) labor supply curve for the industry to shift rightward.

On Jul 20, 2024

B

PJ

Answered

The Fed can make loans to the general public at the discount rate.

On Jul 17, 2024

False

PJ

Answered

When employees have to change the way that they do work due to changes in reporting relationships and the organizational hierarchy, then they are responding to which force for change?

A) organizational restructuring

B) management changes

C) customers changing preferences

D) intrapreneurship

A) organizational restructuring

B) management changes

C) customers changing preferences

D) intrapreneurship

On Jun 20, 2024

A

PJ

Answered

Describe how conflict within a team can improve the performance of the team.

On Jun 17, 2024

Many teams experience conflict in the course of their work,but conflict isn't necessarily bad.Conflict can be constructive if it forces important issues into the open,increases the involvement of team members,and generates creative ideas for solving a problem.Even teams that have some friction can excel if they have effective leadership and members who are committed to positive outcomes.Conflict can stem from many areas including missed deadlines,hidden agendas,and groupthink.To counter potential areas of conflict,each team member must be allowed to develop their ideas without criticism,and have an opportunity to present those ideas.Technology can increase participation by using virtual meetings or collaborative writing sites.Teams must use the principles of participative management and all team members are held accountable for their actions,or inactions.The key to successful groups lies in strong communication skills by all members of the group.

PJ

Answered

Sweet Baking Company sells professional grade mixers for home use. The machines carry a 2-year warranty. Past experience indicates that 6% of the units sold will be returned during the warranty period for repairs. The average cost of repairs under warranty is $70 for labor and $90 for parts per unit. During 2017 2500 mixers were sold at an average price of $800. During the year 60 of the machines that were sold were repaired at the average price per unit.

Instructions

(a) Prepare the journal entry to record the repairs made under warranty.

(b) Prepare the journal entry to record the warranty expense for the year.

Instructions

(a) Prepare the journal entry to record the repairs made under warranty.

(b) Prepare the journal entry to record the warranty expense for the year.

On May 21, 2024

(a)

Labor on repaired units: $70×60=$4,200 Parts on repaired units: $90×60=$5,400 Warranty Liability 9,600 Repair Parts 5,400 Salaries and Wages Payable 4,200(To record honoring of 60 warranty contracts) \begin{array}{lrr} \text {Labor on repaired units: \( \$ 70 \times 60=\$ 4,200 \) } &\\ \text { Parts on repaired units: \( \$ 90 \times 60=\$ 5,400 \) } &\\\\ \text { Warranty Liability } &9,600\\ \text { Repair Parts } &&5,400\\ \text { Salaries and Wages Payable } &&4,200\\ \text {(To record honoring of 60 warranty contracts) } &\\\end{array}Labor on repaired units: $70×60=$4,200 Parts on repaired units: $90×60=$5,400 Warranty Liability Repair Parts Salaries and Wages Payable (To record honoring of 60 warranty contracts) 9,6005,4004,200

(b)

2,500 units ×6%=150 units 150 units ×$160=$24,000 Warranty Expense 24,000 Warranty Liability 24,000\begin{array}{llr} \text {2,500 units \( \times 6 \%=150 \) units } &\\ \text {150 units \( \times \$ 160=\$ 24,000 \) } &\\\\ \text { Warranty Expense } &24,000\\ \text { Warranty Liability } &&24,000\\\end{array}2,500 units ×6%=150 units 150 units ×$160=$24,000 Warranty Expense Warranty Liability 24,00024,000

(To record estimated cost of honoring 150 warranty contracts)

The balance in Warranty Liability at year end is $14400 ($24000 - $9600) which equals the expected cost of honoring the 90 remaining expected warranty contracts.

Labor on repaired units: $70×60=$4,200 Parts on repaired units: $90×60=$5,400 Warranty Liability 9,600 Repair Parts 5,400 Salaries and Wages Payable 4,200(To record honoring of 60 warranty contracts) \begin{array}{lrr} \text {Labor on repaired units: \( \$ 70 \times 60=\$ 4,200 \) } &\\ \text { Parts on repaired units: \( \$ 90 \times 60=\$ 5,400 \) } &\\\\ \text { Warranty Liability } &9,600\\ \text { Repair Parts } &&5,400\\ \text { Salaries and Wages Payable } &&4,200\\ \text {(To record honoring of 60 warranty contracts) } &\\\end{array}Labor on repaired units: $70×60=$4,200 Parts on repaired units: $90×60=$5,400 Warranty Liability Repair Parts Salaries and Wages Payable (To record honoring of 60 warranty contracts) 9,6005,4004,200

(b)

2,500 units ×6%=150 units 150 units ×$160=$24,000 Warranty Expense 24,000 Warranty Liability 24,000\begin{array}{llr} \text {2,500 units \( \times 6 \%=150 \) units } &\\ \text {150 units \( \times \$ 160=\$ 24,000 \) } &\\\\ \text { Warranty Expense } &24,000\\ \text { Warranty Liability } &&24,000\\\end{array}2,500 units ×6%=150 units 150 units ×$160=$24,000 Warranty Expense Warranty Liability 24,00024,000

(To record estimated cost of honoring 150 warranty contracts)

The balance in Warranty Liability at year end is $14400 ($24000 - $9600) which equals the expected cost of honoring the 90 remaining expected warranty contracts.

PJ

Answered

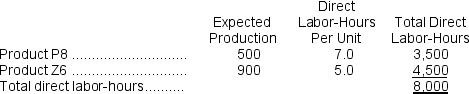

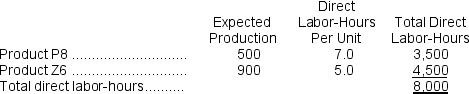

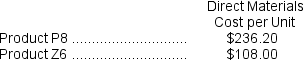

Busto, Inc., manufactures and sells two products: Product P8 and Product Z6.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $20.30 per DLH.The direct materials cost per unit for each product is given below:

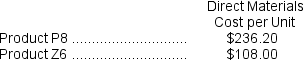

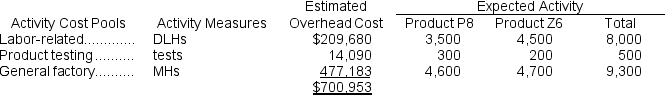

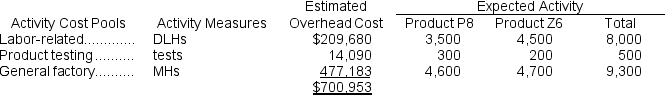

The direct labor rate is $20.30 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The unit product cost of Product Z6 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

The unit product cost of Product Z6 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

A) $340.55 per unit

B) $647.60 per unit

C) $466.05 per unit

D) $350.40 per unit

The direct labor rate is $20.30 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $20.30 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The unit product cost of Product Z6 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

The unit product cost of Product Z6 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:A) $340.55 per unit

B) $647.60 per unit

C) $466.05 per unit

D) $350.40 per unit

On May 18, 2024

B