SD

SHRISHTY DAYAL

Answers (7)

SD

Answered

The costs of materials and labor that do not enter directly into the finished product are classified as factory overhead.

On Jul 06, 2024

True

SD

Answered

The term _____ is defined as the characteristic of an entity or object.

On Jun 29, 2024

attribute

SD

Answered

The performance of a contract cannot be rendered illegal by a statute after the parties have already entered into the contract.

On Jun 06, 2024

False

SD

Answered

Decisions about what types of training and development to provide are often influenced by current fads and vendor hype rather than by a systematic analysis of essential competencies that need to be enhanced.

On May 30, 2024

True

SD

Answered

A cost center

A) only incurs costs and does not directly generate revenues.

B) incurs costs and generates revenues.

C) is a responsibility center of a company which incurs losses.

D) is a responsibility center which generates profits and evaluates the investment cost of earning the profit.

A) only incurs costs and does not directly generate revenues.

B) incurs costs and generates revenues.

C) is a responsibility center of a company which incurs losses.

D) is a responsibility center which generates profits and evaluates the investment cost of earning the profit.

On May 04, 2024

A

SD

Answered

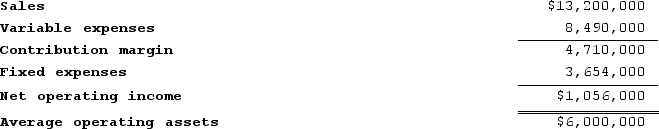

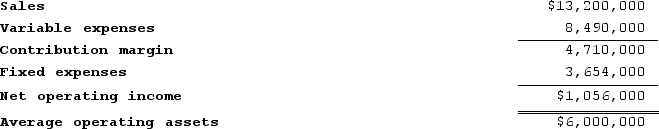

Worley Incorporated reported the following results from last year's operations:

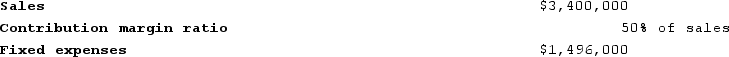

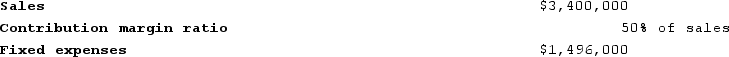

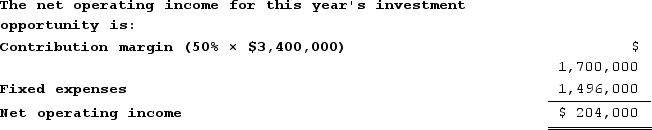

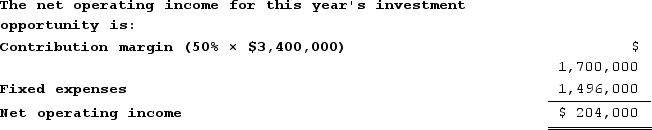

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 17%.

The company's minimum required rate of return is 17%.

Required:

1. What was last year's residual income?

2. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall residual income this year?

3. If Westerville's chief executive officer earns a bonus only if residual income for this year exceeds residual income for last year, would the chief executive officer pursue the investment opportunity?

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics: The company's minimum required rate of return is 17%.

The company's minimum required rate of return is 17%.Required:

1. What was last year's residual income?

2. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall residual income this year?

3. If Westerville's chief executive officer earns a bonus only if residual income for this year exceeds residual income for last year, would the chief executive officer pursue the investment opportunity?

On Apr 30, 2024

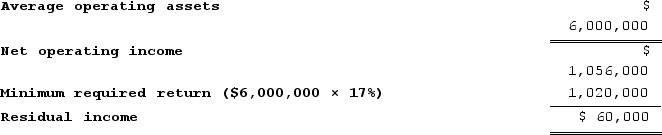

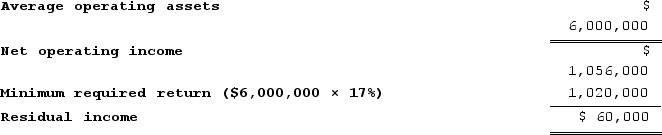

1. Last year's residual income was:

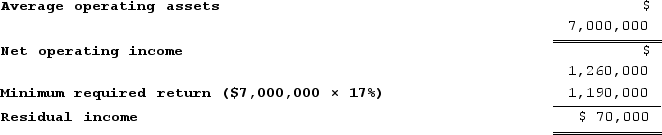

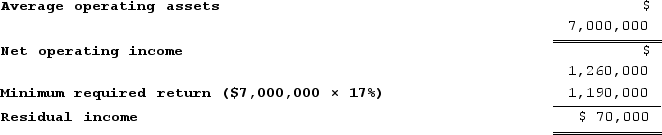

2. If the company pursues the investment opportunity, this year's residual income will be:

Average operating assets = $6,000,000 + $1,000,000 = $7,000,000

Net operating income = $1,056,000 + $204,000 = $1,260,000

3. The chief executive officer would pursue the investment opportunity because residual income would increase by $34,000.

2. If the company pursues the investment opportunity, this year's residual income will be:

Average operating assets = $6,000,000 + $1,000,000 = $7,000,000

Net operating income = $1,056,000 + $204,000 = $1,260,000

3. The chief executive officer would pursue the investment opportunity because residual income would increase by $34,000.

SD

Answered

Closing entries

A) need not be journalized if adjusting entries are prepared

B) need not be posted if the financial statements are prepared from the end-of-period spreadsheet

C) are not needed if adjusting entries are prepared

D) must be journalized and posted

A) need not be journalized if adjusting entries are prepared

B) need not be posted if the financial statements are prepared from the end-of-period spreadsheet

C) are not needed if adjusting entries are prepared

D) must be journalized and posted

On Apr 27, 2024

D