ZK

Zybrea Knight

Answers (8)

ZK

Answered

An insurance company's right to subrogation refers to their right to refuse to pay where the insured is responsible for his own loss.

On Aug 03, 2024

False

ZK

Answered

Which of the following is NOT a distributive negotiation tactic?

A) Threats

B) Concessions

C) Promises

D) Verbal persuasion

E) Cutting costs

A) Threats

B) Concessions

C) Promises

D) Verbal persuasion

E) Cutting costs

On Aug 02, 2024

E

ZK

Answered

Which of the following statements accurately describe planning time horizons?

A) Short-range plans cover one year or less into the future.

B) Intermediate-range plans cover a time frame of one to two years into the future.

C) Long-range plans cover a time frame of three or more years into the future.

D) all of the above

E) none of the above

A) Short-range plans cover one year or less into the future.

B) Intermediate-range plans cover a time frame of one to two years into the future.

C) Long-range plans cover a time frame of three or more years into the future.

D) all of the above

E) none of the above

On Jul 04, 2024

D

ZK

Answered

A company's post-closing trial balance has total debits of $40,560 and total credits of $40,650.Accordingly,the company should review for errors in the closing process.

On Jul 03, 2024

True

ZK

Answered

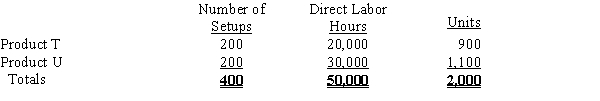

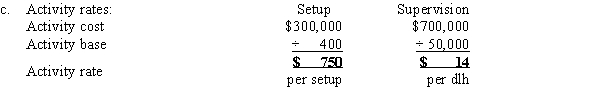

Tulip Company produces two products, T and U. The indirect labor costs include the following two items:  The following activity-base usage and unit production information is available for the two products:

The following activity-base usage and unit production information is available for the two products:

a.Determine the single plantwide factory overhead rate, using direct labor hours as the activity base.

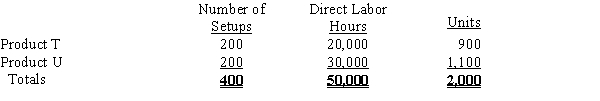

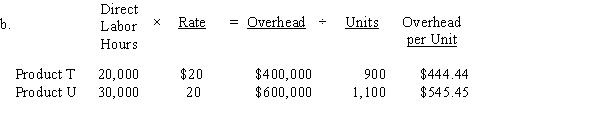

b.Determine the factory overhead allocated per unit for Products T and U, using the single plantwide factory overhead rate.

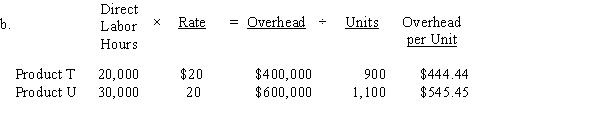

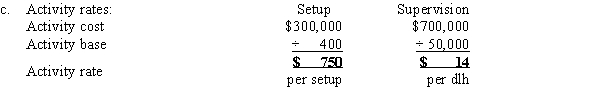

c.Determine the activity rate for plant supervision and setup labor, assuming that the activity base for supervision is direct labor hours and the activity base for setup labor is number of setups.

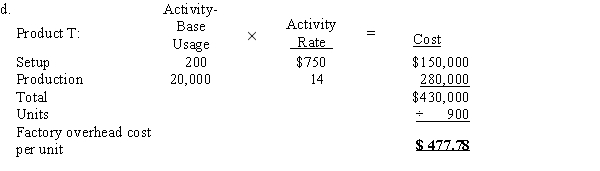

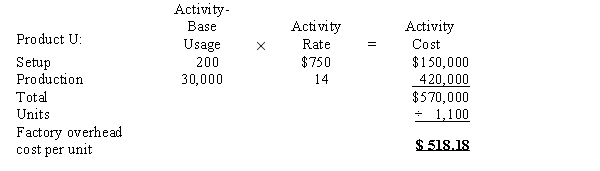

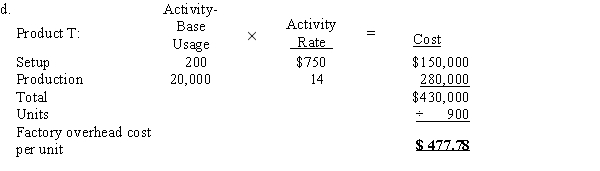

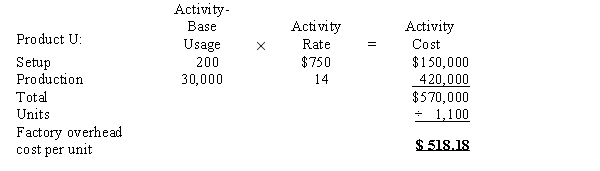

d.Determine the factory overhead allocated per unit for Products T and U, using the activity-based costing method.

e.Why is the factory overhead allocated per unit different for the two products under the two methods?

The following activity-base usage and unit production information is available for the two products:

The following activity-base usage and unit production information is available for the two products:

a.Determine the single plantwide factory overhead rate, using direct labor hours as the activity base.

b.Determine the factory overhead allocated per unit for Products T and U, using the single plantwide factory overhead rate.

c.Determine the activity rate for plant supervision and setup labor, assuming that the activity base for supervision is direct labor hours and the activity base for setup labor is number of setups.

d.Determine the factory overhead allocated per unit for Products T and U, using the activity-based costing method.

e.Why is the factory overhead allocated per unit different for the two products under the two methods?

On Jun 04, 2024

a.Single plantwide factory overhead rate

= $1,000,000 ÷ 50,000 dlh

= $20 per dlh

e.The factory overhead cost per unit under the single plantwide rate method is distorted because Product U consumes more setup-related activity relative to the amount of direct labor consumed than does Product T. Thus, the activity-based costing method, which separates setup according to its own activity base, provides a more accurate estimate of the factory overhead cost per unit.

e.The factory overhead cost per unit under the single plantwide rate method is distorted because Product U consumes more setup-related activity relative to the amount of direct labor consumed than does Product T. Thus, the activity-based costing method, which separates setup according to its own activity base, provides a more accurate estimate of the factory overhead cost per unit.

= $1,000,000 ÷ 50,000 dlh

= $20 per dlh

e.The factory overhead cost per unit under the single plantwide rate method is distorted because Product U consumes more setup-related activity relative to the amount of direct labor consumed than does Product T. Thus, the activity-based costing method, which separates setup according to its own activity base, provides a more accurate estimate of the factory overhead cost per unit.

e.The factory overhead cost per unit under the single plantwide rate method is distorted because Product U consumes more setup-related activity relative to the amount of direct labor consumed than does Product T. Thus, the activity-based costing method, which separates setup according to its own activity base, provides a more accurate estimate of the factory overhead cost per unit.ZK

Answered

The contribution margin per unit is calculated as the difference between

A) sales revenue per unit and fixed cost per unit.

B) sales revenue per unit and variable cost per unit.

C) sales revenue per unit and product cost per unit.

D) fixed cost per unit and variable cost per unit.

A) sales revenue per unit and fixed cost per unit.

B) sales revenue per unit and variable cost per unit.

C) sales revenue per unit and product cost per unit.

D) fixed cost per unit and variable cost per unit.

On Jun 03, 2024

B

ZK

Answered

Economic models of illegal immigration suggest that domestic-born workers avoid certain types of work more because the inflow of immigrants has reduced wages, rather than because the work is unpleasant.

On May 05, 2024

True

ZK

Answered

Possible result of using an inappropriate overhead allocation method

A)Opportunity cost

B)Sunk cost

C)Theory of constraints

D)Differential analysis

E)Product cost distortion

A)Opportunity cost

B)Sunk cost

C)Theory of constraints

D)Differential analysis

E)Product cost distortion

On May 04, 2024

e