HS

hector salinas

Answers (6)

HS

Answered

Courington Detailing's cost formula for its materials and supplies is $2,420 per month plus $9 per vehicle. For the month of August, the company planned for activity of 63 vehicles, but the actual level of activity was 33 vehicles. The actual materials and supplies for the month was $2,840.The spending variance for materials and supplies in August would be closest to:

A) $147 F

B) $123 F

C) $123 U

D) $147 U

A) $147 F

B) $123 F

C) $123 U

D) $147 U

On Jul 12, 2024

C

HS

Answered

Suppose Oklahoma decides to produce only two goods,oil and football helmets.If Oklahoma is producing on its production possibility frontier,as oil production increases,the production of football helmets will:

A) increase.

B) not change.

C) decrease at a necessarily decreasing rate.

D) decrease at some rate.

A) increase.

B) not change.

C) decrease at a necessarily decreasing rate.

D) decrease at some rate.

On Jul 09, 2024

D

HS

Answered

Gain or loss on the disposal of assets is determined by comparing the disposed asset's carrying amount to the value of any assets received.

On Jun 12, 2024

True

HS

Answered

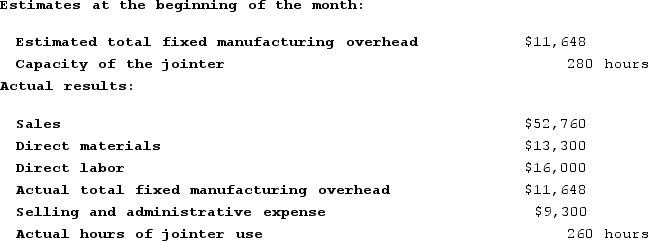

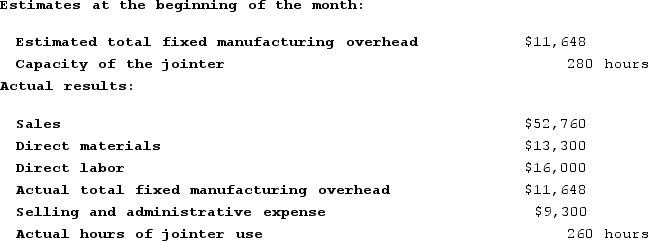

Mausser Woodworking Corporation produces fine cabinets. The company uses a job-order costing system in which its predetermined overhead rate is based on capacity. The capacity of the factory is determined by the capacity of its constraint, which is an automated jointer. Additional information is provided below for the most recent month:  The gross margin that would be reported on the income statement prepared for internal management purposes would be closest to:

The gross margin that would be reported on the income statement prepared for internal management purposes would be closest to:

A) $52,760

B) $3,344

C) $12,644

D) $11,812

The gross margin that would be reported on the income statement prepared for internal management purposes would be closest to:

The gross margin that would be reported on the income statement prepared for internal management purposes would be closest to:A) $52,760

B) $3,344

C) $12,644

D) $11,812

On Jun 09, 2024

C

HS

Answered

Explain the basic difference in a fixed (or pegged)exchange rate policy as opposed to a flexible exchange rate policy.

On May 13, 2024

With a fixed exchange rate policy, the government becomes the exchange market for their currency and pegs the exchange rate. Under a fixed exchange rate, the government stands ready to buy or sell as much of its own currency as is demanded or supplied at the constant fixed rate. A government that opts for a fixed exchange rate typically places its central bank in charge of the day-to-day operations. It is then the central bank's task to exchange as much local currency for foreign currency and as much foreign currency for local currency as is necessary each day to maintain the peg. When a flexible exchange rate is used, the government does not intervene, and the market determines the exchange rate.

HS

Answered

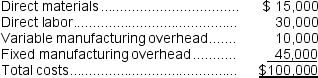

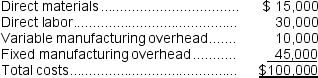

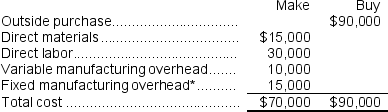

McGraw Company uses 5,000 units of Part X each year as a component in the assembly of one of its products.The company is presently producing Part X internally at a total cost of $100,000, computed as follows:  An outside supplier has offered to provide Part X at a price of $18 per unit.If McGraw Company stops producing the part internally, one-third of the fixed manufacturing overhead would be eliminated.Assume that direct labor is a variable cost.

An outside supplier has offered to provide Part X at a price of $18 per unit.If McGraw Company stops producing the part internally, one-third of the fixed manufacturing overhead would be eliminated.Assume that direct labor is a variable cost.

Required:

Prepare an analysis showing the annual financial advantage or disadvantage of accepting the outside supplier's offer.

An outside supplier has offered to provide Part X at a price of $18 per unit.If McGraw Company stops producing the part internally, one-third of the fixed manufacturing overhead would be eliminated.Assume that direct labor is a variable cost.

An outside supplier has offered to provide Part X at a price of $18 per unit.If McGraw Company stops producing the part internally, one-third of the fixed manufacturing overhead would be eliminated.Assume that direct labor is a variable cost.Required:

Prepare an analysis showing the annual financial advantage or disadvantage of accepting the outside supplier's offer.

On May 10, 2024

* 1/3 × $45,000 = $15,000

* 1/3 × $45,000 = $15,000The annual financial advantage of making the parts is $20,000.