Asked by Meena Roshnaye on Jun 05, 2024

Verified

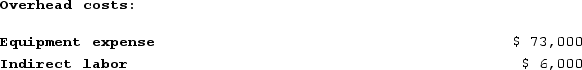

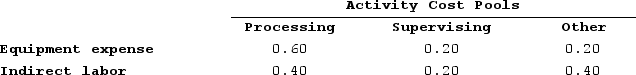

Deemer Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools:

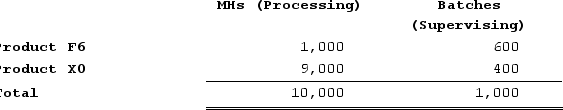

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

A) $15.00 per batch

B) $79.00 per batch

C) $15.80 per batch

D) $6.00 per batch

Activity-Based Costing

A costing method that assigns costs to products or services based on the activities they require, aiming to provide more accurate product cost information.

Machine-Hours

A unit of measure representing the operating time of a machine, used in allocating costs to products based on machine usage.

First Stage Allocations

In managerial accounting, it refers to the process of allocating overhead costs initially to various departments or cost pools.

- Calculate activity rates for different activity cost pools under ABC.

Verified Answer

For Product A:

Supervising cost = 150 batches x $15 per batch = $2,250

For Product B:

Supervising cost = 200 batches x $15 per batch = $3,000

Total Supervising cost = $5,250

Next, we need to determine the total number of batches across both products:

Total batches = 150 + 200 = 350

Finally, we can calculate the activity rate as:

Activity rate = Total Supervising cost / Total number of batches

Activity rate = $5,250 / 350 = $15.00 per batch

Therefore, the closest option to the calculated activity rate is C) $15.80 per batch.

Learning Objectives

- Calculate activity rates for different activity cost pools under ABC.

Related questions

Meester Corporation Has an Activity-Based Costing System with Three Activity ...

Wedd Corporation Uses Activity-Based Costing to Assign Overhead Costs to ...

Neas Corporation Has an Activity-Based Costing System with Three Activity ...

Zwahlen Corporation Has an Activity-Based Costing System with Three Activity ...

Moorman Corporation Has an Activity-Based Costing System with Three Activity ...