Asked by Ahmed El Shamlol on Jun 13, 2024

Verified

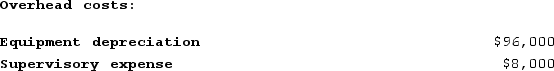

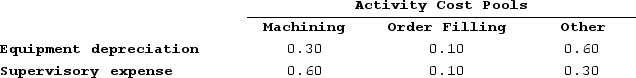

Meester Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools:

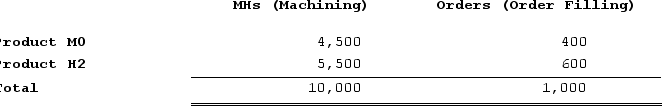

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

The activity rate for the Order Filling activity cost pool under activity-based costing is closest to:

The activity rate for the Order Filling activity cost pool under activity-based costing is closest to:

A) $8.00 per order

B) $13.33 per order

C) $10.40 per order

D) $104.00 per order

Activity-Based Costing

An accounting method that assigns costs to products or services based on the activities required to produce each product or service, aiming for more precise cost allocation.

Equipment Depreciation

The process of allocating the cost of tangible assets over its useful life, representing how much of the asset's value has been used up.

Supervisory Expense

Supervisory expense relates to the costs associated with the oversight and management of employees or production processes, often part of overhead costs.

- Ascertain activity rates within various cost pools under Activity-Based Costing.

Verified Answer

Activity rate = Total cost of activity pool / Total activity usage

Activity rate = $31,200 / 3,000 orders

Activity rate = $10.40 per order

Learning Objectives

- Ascertain activity rates within various cost pools under Activity-Based Costing.

Related questions

Deemer Corporation Has an Activity-Based Costing System with Three Activity ...

Wedd Corporation Uses Activity-Based Costing to Assign Overhead Costs to ...

Neas Corporation Has an Activity-Based Costing System with Three Activity ...

Zwahlen Corporation Has an Activity-Based Costing System with Three Activity ...

Moorman Corporation Has an Activity-Based Costing System with Three Activity ...