GC

Grace Caughey

Answers (6)

GC

Answered

The grapevine,when managed properly,can be a reliable source of information.

On Jun 16, 2024

True

GC

Answered

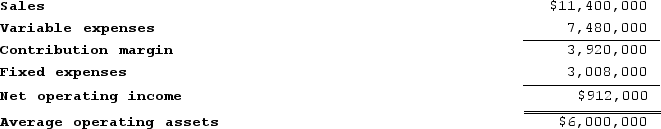

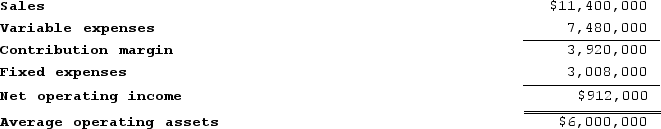

Ranallo Incorporated reported the following results from last year's operations:

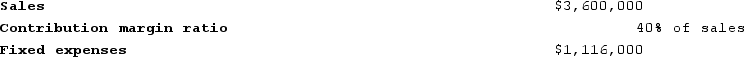

At the beginning of this year, the company has a $1,800,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,800,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.

Required:

1. What was last year's margin? (Round to the nearest 0.1%.)

2. What was last year's turnover? (Round to the nearest 0.01.)

3. What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4. What is the margin related to this year's investment opportunity? (Round to the nearest 0.1%.)

5. What is the turnover related to this year's investment opportunity? (Round to the nearest 0.01.)

6. What is the return on investment related to this year's investment opportunity? (Round to the nearest 0.1%.)

7. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall margin this year? (Round to the nearest 0.1%.)

8. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall turnover this year? (Round to the nearest 0.01.)

9. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall return on investment will this year? (Round to the nearest 0.1%.)

10. If Westerville's chief executive officer earns a bonus only if the return on investment for this year exceeds the return on investment for last year, would the chief executive officer pursue the investment opportunity? Would the owners of the company want the chief executive officer to pursue the investment opportunity?

11. What was last year's residual income?

12. What is the residual income of this year's investment opportunity?

13. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall residual income this year?

14. If Westerville's chief executive officer earns a bonus only if residual income for this year exceeds residual income for last year, would the chief executive officer pursue the investment opportunity?

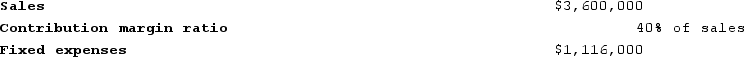

At the beginning of this year, the company has a $1,800,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,800,000 investment opportunity with the following characteristics: The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.Required:

1. What was last year's margin? (Round to the nearest 0.1%.)

2. What was last year's turnover? (Round to the nearest 0.01.)

3. What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4. What is the margin related to this year's investment opportunity? (Round to the nearest 0.1%.)

5. What is the turnover related to this year's investment opportunity? (Round to the nearest 0.01.)

6. What is the return on investment related to this year's investment opportunity? (Round to the nearest 0.1%.)

7. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall margin this year? (Round to the nearest 0.1%.)

8. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall turnover this year? (Round to the nearest 0.01.)

9. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall return on investment will this year? (Round to the nearest 0.1%.)

10. If Westerville's chief executive officer earns a bonus only if the return on investment for this year exceeds the return on investment for last year, would the chief executive officer pursue the investment opportunity? Would the owners of the company want the chief executive officer to pursue the investment opportunity?

11. What was last year's residual income?

12. What is the residual income of this year's investment opportunity?

13. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall residual income this year?

14. If Westerville's chief executive officer earns a bonus only if residual income for this year exceeds residual income for last year, would the chief executive officer pursue the investment opportunity?

On Jun 14, 2024

1. Last year's Margin = Net operating income ÷ Sales = $912,000 ÷ $11,400,000 = 8.0%

2. Last year's Turnover = Sales ÷ Average operating assets = $11,400,000 ÷ $6,000,000 = 1.90

3. Last year's Return on investment = Net operating income ÷ Average operating assets = $912,000 ÷ $6,000,000 = 15.2%

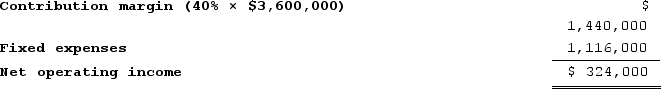

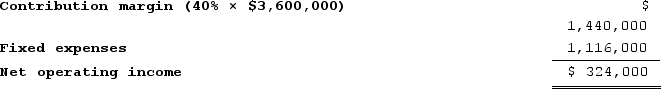

4. The margin for this year's investment opportunity is:

Margin = Net operating income ÷ Sales = $324,000 ÷ $3,600,000 = 9.0%

Margin = Net operating income ÷ Sales = $324,000 ÷ $3,600,000 = 9.0%

5. The turnover for this year's investment opportunity is:

Turnover = Sales ÷ Average operating assets = $3,600,000 ÷ $1,800,000 = 2.00

6. The return on investment for this year's investment opportunity is:

Return on investment = Net operating income ÷ Average operating assets = $324,000 ÷ $1,800,000 = 18.0%

7. If the company pursues the investment opportunity and otherwise performs the same as last year, the margin will be:

Net operating income = $912,000 + $324,000 = $1,236,000

Sales = $11,400,000 + $3,600,000 = $15,000,000

Margin = Net operating income ÷ Sales = $1,236,000 ÷ $15,000,000 = 8.2%

8. If the company pursues the investment opportunity and otherwise performs the same as last year, the turnover will be:

Sales = $11,400,000 + $3,600,000 = $15,000,000

Average operating assets = $6,000,000 + $1,800,000 = $7,800,000

Turnover = Sales ÷ Average operating assets = $15,000,000 ÷ $7,800,000 = 1.92

9. If the company pursues the investment opportunity and otherwise performs the same as last year, the return on investment will be:

return on investment = Net operating income ÷ Average operating assets = $1,236,000 ÷ $7,800,000 = 15.8%

10. The chief executive officer would pursue the investment opportunity because it increases the overall return on investment. The owners of the company would want the chief executive officer to pursue the investment opportunity because its return on investment is greater than the company's minimum required rate of return.

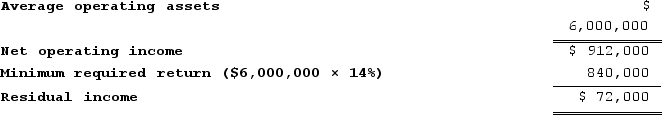

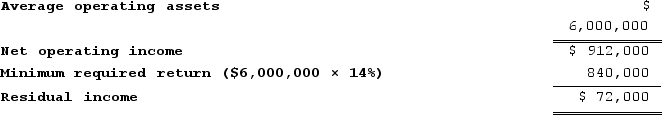

11. Last year's residual income was:

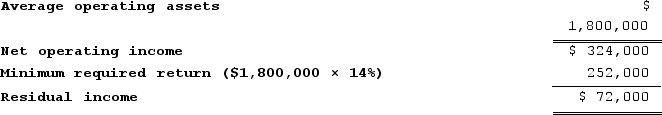

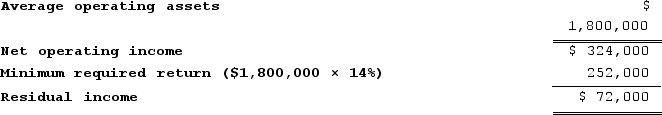

12. The residual income for this year's investment opportunity is:

12. The residual income for this year's investment opportunity is:

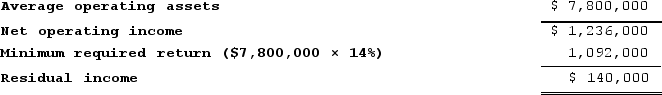

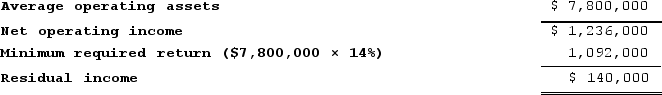

13. If the company pursues the investment opportunity, this year's residual income will be:

13. If the company pursues the investment opportunity, this year's residual income will be:

14. The chief executive officer would pursue the investment opportunity because residual income would increase by $72,000.

14. The chief executive officer would pursue the investment opportunity because residual income would increase by $72,000.

2. Last year's Turnover = Sales ÷ Average operating assets = $11,400,000 ÷ $6,000,000 = 1.90

3. Last year's Return on investment = Net operating income ÷ Average operating assets = $912,000 ÷ $6,000,000 = 15.2%

4. The margin for this year's investment opportunity is:

Margin = Net operating income ÷ Sales = $324,000 ÷ $3,600,000 = 9.0%

Margin = Net operating income ÷ Sales = $324,000 ÷ $3,600,000 = 9.0%5. The turnover for this year's investment opportunity is:

Turnover = Sales ÷ Average operating assets = $3,600,000 ÷ $1,800,000 = 2.00

6. The return on investment for this year's investment opportunity is:

Return on investment = Net operating income ÷ Average operating assets = $324,000 ÷ $1,800,000 = 18.0%

7. If the company pursues the investment opportunity and otherwise performs the same as last year, the margin will be:

Net operating income = $912,000 + $324,000 = $1,236,000

Sales = $11,400,000 + $3,600,000 = $15,000,000

Margin = Net operating income ÷ Sales = $1,236,000 ÷ $15,000,000 = 8.2%

8. If the company pursues the investment opportunity and otherwise performs the same as last year, the turnover will be:

Sales = $11,400,000 + $3,600,000 = $15,000,000

Average operating assets = $6,000,000 + $1,800,000 = $7,800,000

Turnover = Sales ÷ Average operating assets = $15,000,000 ÷ $7,800,000 = 1.92

9. If the company pursues the investment opportunity and otherwise performs the same as last year, the return on investment will be:

return on investment = Net operating income ÷ Average operating assets = $1,236,000 ÷ $7,800,000 = 15.8%

10. The chief executive officer would pursue the investment opportunity because it increases the overall return on investment. The owners of the company would want the chief executive officer to pursue the investment opportunity because its return on investment is greater than the company's minimum required rate of return.

11. Last year's residual income was:

12. The residual income for this year's investment opportunity is:

12. The residual income for this year's investment opportunity is: 13. If the company pursues the investment opportunity, this year's residual income will be:

13. If the company pursues the investment opportunity, this year's residual income will be: 14. The chief executive officer would pursue the investment opportunity because residual income would increase by $72,000.

14. The chief executive officer would pursue the investment opportunity because residual income would increase by $72,000.GC

Answered

Historically,consumption spending in the United States has _____.

A) fluctuated greatly with changes in the level of income

B) remained approximately constant as a percentage of income

C) decreased as a percentage of income

D) varied inversely with the inflation rate

E) varied inversely with the interest rate

A) fluctuated greatly with changes in the level of income

B) remained approximately constant as a percentage of income

C) decreased as a percentage of income

D) varied inversely with the inflation rate

E) varied inversely with the interest rate

On Jun 12, 2024

B

GC

Answered

What is the jurisdiction of the highest court in Canada?

On May 15, 2024

The Supreme Court of Canada has unlimited jurisdiction to hear appeals from any court in the land, both criminal and civil. As well, they hear References from the federal government.

GC

Answered

Bacall, a building contractor, bid for and won the tender to construct Klegman's Shopping Centre. Due to rampant, unexpected inflation, she found she would not quite break even on the project and she asked Klegman to renegotiate the price. Klegman pointed out that there was no provision in the contract for that and said, "A deal's a deal."

A) Bacall can assert that this is a frustrated contract, and, since no work has been started, claim back the bid deposit of $50 000 and walk away from the whole thing.

B) Bacall is stuck with the contract and there is nothing she can do but take the loss.

C) Bacall can say that there has been a material alteration of the terms of the contract, and that this has discharged the contract's terms regarding payment, so she can renegotiate them without losing the contract.

D) Because Klegman will be unjustly enriched if the contract is not renegotiated, Bacall can insist on a substitute agreement, which will discharge the old one.

E) Any of the responses can be true.

A) Bacall can assert that this is a frustrated contract, and, since no work has been started, claim back the bid deposit of $50 000 and walk away from the whole thing.

B) Bacall is stuck with the contract and there is nothing she can do but take the loss.

C) Bacall can say that there has been a material alteration of the terms of the contract, and that this has discharged the contract's terms regarding payment, so she can renegotiate them without losing the contract.

D) Because Klegman will be unjustly enriched if the contract is not renegotiated, Bacall can insist on a substitute agreement, which will discharge the old one.

E) Any of the responses can be true.

On May 13, 2024

B

GC

Answered

The first step in the personal-selling process is ________ and qualifying.

On May 12, 2024

prospecting