Asked by Jennifer Robert on May 12, 2024

Verified

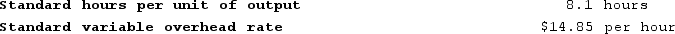

The following standards for variable manufacturing overhead have been established for a company that makes only one product:  The following data pertain to operations for the last month:

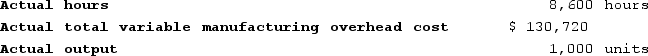

The following data pertain to operations for the last month:

What is the variable overhead rate variance for the month?

What is the variable overhead rate variance for the month?

A) $3,010 Favorable

B) $3,010 Unfavorable

C) $10,435 Unfavorable

D) $10,435 Favorable

Variable Overhead Rate Variance

The difference between the actual variable overhead incurred and the expected variable overhead based on standard cost.

Variable Manufacturing Overhead

Costs in the manufacturing process that change with the level of production output, such as utilities and materials used in production.

Last Month

Refers to the period of time from the first to the last day of the month immediately preceding the current month.

- Measure variances in variable overhead rates to determine the effectiveness of overhead cost management.

Verified Answer

Actual Hours Worked x (Actual Variable Overhead Rate - Standard Variable Overhead Rate)

Using the data given in the problem, we have:

Actual Hours Worked = 5,900

Actual Variable Overhead Rate = $1.90

Standard Variable Overhead Rate = $2.00

Therefore,

Variable Overhead Rate Variance = 5,900 x ($1.90 - $2.00) = $3,010 Unfavorable

Therefore, the correct choice is B.

Learning Objectives

- Measure variances in variable overhead rates to determine the effectiveness of overhead cost management.

Related questions

Descamps Incorporated Has Provided the Following Data Concerning One of ...

The Following Data Have Been Provided by Furr Corporation ...

Irving Corporation Makes a Product with the Following Standards for ...

Fluegge Incorporated Has Provided the Following Data Concerning One of ...

Kartman Corporation Makes a Product with the Following Standard Costs ...